International Tax Planning

International tax planning, which is also termed as international tax structures or expanded worldwide planning (EWP), is a foreign taxation element created to implement directives for several tax authorities. The art of arrangement of cross-border transactions with the knowledge of international tax principles for achieving a tax-effective and lawful routing of business activities and capital flows are covered under international tax planning.

The planning process comes along with the money flows in the cross-border transactions as it gets passed from the host country where they move towards the home country where it can end eventually.

Tax planning helps in reducing the cumulative impact of taxation compared to separate tax incidence in countries through which the transaction flows. The prime objective here is to receive the after-tax flows of overseas income lawfully at a minimal cost and risk.

Domestic tax planning is basically concerned with the national rules of tax deductions, allowances and exemptions and the different tax rates that are levied on various sources of income in a single jurisdiction.

International tax planning checks the interrelationship of two or more tax systems, the impact of juridical and economic double taxation, and also the tax compliance rules in more than one country. It also involves some other concerns such as tax incentives and exemptions for the foreign income, availability of the foreign tax credits, use of tax treaties, and anti-avoidance measures.

What is Meant by International Tax Planning?

International tax planning is defined as a tax-driven proactive arrangement of a person's affairs to minimize his tax results. It can generally be optimized when the after-tax profit is maximized.

Besides reducing the overall effective tax rate, it can also lead to tax deferral and reduction in tax compliance costs. It looks at both the tax-saving opportunities and even tax risks such as double taxation and prospects tax legislation.

What is the Need for International Tax Planning?

Tax is not a primary or overriding factor in the decisions to engage in overseas business activities or invest abroad. These decisions are usually made on factors such as business viability, availability of resources, market access, and market potential. Some other factors include political and economic stability, government grants and incentives, business infrastructure, geographical location, availability of skilled and low-cost workforce, stable currency, etc. The decisions are based on economic, commercial, even social and political considerations.

However, after making the decision, the tax becomes a critical business consideration. Many multinationals consider the tax rate on business profits as a decisive factor in deciding the country to start their business. Other primary concerns are the availability of treaties and the quality of tax administration. These factors influence the long-term financial viability of the company and the ultimate return on the investment.

Usually, cross-border activities suffer a higher tax liability worldwide than just domestic or single country transactions. They need to pay tax in more than one jurisdiction. Moreover, the taxpayers need to cope with inconsistent tax laws, unpredictable tax authorities, and high taxes in various jurisdictions.

Hence, proper tax planning is essential in international business for reducing the misrepresentation that arises due to a lack of harmonization in domestic tax systems. Without adequate international tax planning, it will suffer from excess tax payments and additional tax compliance costs.

Impact on Cross-Border Transactions in International Tax Planning.

Some of the levels of tax impact on cross border transactions are as follows:

In a source or host country, the taxes are payable on the income earned by way of overseas subsidiaries or branches, and the withholding tax on the payments made by them.

In an intermediary country, the taxes are payable on the overseas income and the withholding taxes on the recovery of profits or capital to the home country.

-

Residence or Home Country

In a residence or home country, the taxes are payable on the profits and the capital received at home, and sometimes even if it is not received from the organizations in the other countries.

What are the Opportunities for International Tax Planning?

The opportunity for international tax planning exists at each level. For instance:

The Taxation in the Source Country can be reduced by way of:

- Local tax planning optimizes tax deductions, tax losses, incentives, and individual tax concessions that are available under the domestic law and tax treaties.

- Tax exemptions from the break of the connecting tax factors with either the source or the Residence state (or both).

- The use of several tax planning methods to ensure that the taxable profits arise outside the country.

- The use of tax treaties and new planning techniques to reduce withheld taxes or obtain tax exemption.

- Choosing the appropriate legal entity and the form of financing (debt or equity).

The Intermediary Country Taxation on the remitted Income Flows can be Reduced Through:

- Using the tax treaties to reduce the withholding taxes in the host country.

- Selection of proper offshore financial organizations to minimize or avoid corporate and withholding taxes.

- Tax arbitrage by way of change in the nature or character of the payments that are made to the home country.

- Using the various tax concessions such as participation exemption and the European Community Directives.

- Retaining of funds offshore for reinvestment abroad or achieving tax deferral on remittances that are made to the home country.

The Taxation on Profits that are Repatriated to the Home Country may be Reduced Through:

- The appropriate use of global corporate structures that avoids, reduces or defer the tax liability.

- The best use of available foreign tax credits and exemptions for reducing the domestic tax liabilities.

- The opportunities for international tax planning are limitless. They are based on several techniques to eliminate, minimize, or defer the tax burden after considering the transaction costs, the management structures, and the business risks. They aim to reduce the foreign tax liabilities and increase the total income after tax over the complete transaction flow from the source to the ultimate destination.

What are the methods of International Tax Planning?

The amount of tax liability is determined by the taxable income that is multiplied by the tax rate the reduction in either of the two factors that leads to a reduction in the tax payable.

Most of the international tax planning methods that are used in current date rely on the following principles:

-

The Review of the Tax Provisions and Compliance Rules under the Domestic Law

The beginning of any international tax planning is the knowledge of tax rules and practices in different jurisdictions. The domestic law and practices alone decide who must be taxed and how to tax. Tax treaties cannot expand the tax base or generally determine how to compute it.

-

The Reduction of Pre-tax Profits through Deductible Expenses

Several countries provide additional tax deductions and allowances under the domestic law to encourage investment, look at savings, and other social and political considerations. The effective use of tax breaks can reduce tax liability.

-

The use of Special Tax Concessions for Foreign Capital technology

Many countries grant special tax concessions for foreign capital and technology. The host countries can give incentives to attract them, such as tax holidays or the use of tax-free zones for export purposes. Many of these tax concessions can be given only to non-residents.

-

The optimal use of the Tax Loss Carry-Overs

Tax losses represent deferred tax benefits and tax planning can help in optimizing their use. Many countries allow carry-forward losses for specified periods for setting off against future profits. Some of them permit carry back losses. Several jurisdictions enable companies to net their taxable gains and losses under the tax consolidation rules.

-

The Provision of Special Deductions or Exemptions to Qualifying Dividends

Many countries provide relief under the dividend-deduction or participation exemption rules to partly or wholly exempt foreign dividends. Relief can also be given through indirect credit for the underlying foreign taxes paid by the subsidiaries or for domestic dividends.

-

The Tax Deferral of Foreign Profits

Tax deferral provides a tax saving in terms of time and cost of money. The deferral may be achieved through the intermediary companies' setup, use of different legal organizations, and accounting periods.

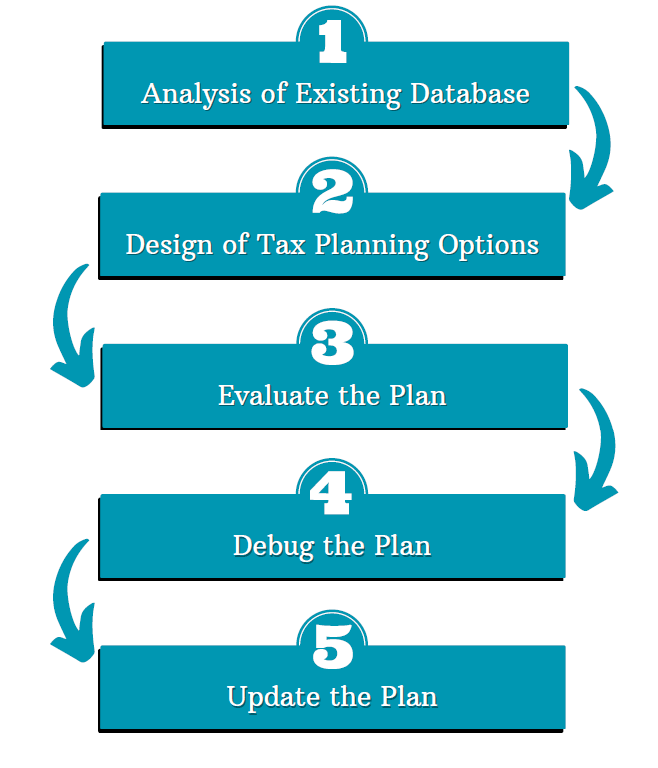

Checklist of International Tax Planning

Analysis of Existing Database

- Determining the facts and applicable tax and non-tax factors.

- Analyze the transaction thoroughly with the host country.

- Reviewing the domestic law and the tax treaties in every jurisdiction.

- Compute the tax liability and the other costs.

- Perform a cost-benefit analysis.

Design of Tax Planning Options

- Introduce multilateral or global tax planning.

- Identifying suitable foreign intermediary countries.

- Select the form of transaction, relationship or operation,

- Examine relevant non-tax factors.

- Checking the availability of advance rulings

- Prepare a list of all the tax planning options

Evaluate the Plan

- Determine the non-tax costs and tax savings if:

- The plan has not been adopted.

- The plan is adopted and succeeds.

- The failure of the adopted plan.

- Computing the total costs both as host to home.

- Selecting the best tax option

Debug the Plan

- Getting local advice on tax laws and practice.

- Obtaining advance rulings, wherever it is possible.

- Check the applicability of treaties and protocols.

- Determine the validity of organizations in the jurisdictions.

- Look at the compliance with anti-avoidance rules.

- Evaluation of significant risks or disadvantages.

- Review of long term benefits and costs.

Update the Plan

- Regular review of changes in the tax laws, treaties, and tax practices.

- Change the plan accordingly.

How to Reach TAP GLOBAL?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables