What do you mean by Money Changer?

An authorized money exchanger can purchase foreign currency from non-residents who visit India and sell foreign currency for private and business travel purposes are called full fledge money changers.

Under section 10 of the (FEMA) Foreign Exchange Management Act 1999, Reserve Bank of India authorizes Authorized Money Changer who can undertake the money changing business. Without having a valid money changer's license issued by the Reserve Bank, no one can carry on the business of money changing.

Mandatory Money Changer Compliance for Dealer: Records and Registers

These are the mandatory money changer compliances:

- Daily Summary and Balance Book (Foreign currency notes / coins) in form FLM 1;

- Daily Summary and Balance Book (Travelers' cheques) in form FLM 2;

- Register of purchases of foreign currencies from the public in form FLM 3;

- Register of purchases of foreign currency notes / coins from authorized dealers and authorized money changers in form FLM 4;

- Register of sales of foreign currency notes / coins and foreign currency travelers' cheques to the public in form FLM 5;

- Register of sales of foreign currency notes / coins to authorized dealers / Full Fledged Money Changers / overseas banks in form FLM 6;

- Register of travelers' cheques surrendered to authorized dealers / authorized money changers / exported in form FLM 7;

- The Cash Transaction Report (CTR) (for each month should be submitted to the FIU-IND by 15th of the succeeding month. However, while filing CTR, details of individual transactions below Rupees 50,000 need not be furnished) and

- The Suspicious Transaction Report (STR) (should be furnished within 7 days of arriving at a conclusion that any transaction, including an attempted transaction).

Activities of Full Fledge Money Changer

The following are the activities:

- An FFMC can enter into franchise agreement at their convenience to carry on the Restricted Money Changing business which involves converting the foreign currency notes, coins or travelers' cheques into Indian Rupees (INR).

- An FFMC or its franchisees can freely purchase foreign currency notes, coins or traveler's cheques from residents and from the non-residents of India.

- An FFMC can sell Indian Rupees (INR) to foreign tourists or visitors against International Debit Cards/International Credit Cards and take prompt actions to get reimbursements via normal banking channels.

- FFMCs can sell foreign exchange for the following purposes:

- Business Visits

- Private Visits

- Forex Pre-Paid Cards.

What is the eligibility to obtain FFMC License?

The following eligibility criteria should be fulfilled to operate as a Full Fledged Money Changer (FFMC):

- The entity that seeks to apply for a Full Fledged Money Changer License must be registered under the Companies Act of 2013.

- The entity should be having a minimum net-owned fund of 25 Lakhs rupees to apply for a single-branch license and 50 Lakh rupees for a multiple-branch license.

- The object clause of the Memorandum should reflect the money changing activity that would be undertaken by the Entity.

- There should not be any civil or criminal cases pending against the entity with the enforcement of the Department of Revenue Intelligence.

- Once the License is obtained, the Entity should carry out the business activity within 6 months from the date of issuing the Forex License and should, without fail, intimate the Reserve Bank.

Post Approval Requirements by FFMCs

The following conditions should be fulfilled by the Full Fledged Money Changer after obtaining the license:

- The registration copy under the Shops & Establishment Act or any other documentary evidence like the rent receipt or the copy of the lease agreement should be submitted to the Regional Office directed by the Reserve Bank of India before starting any business activity.

- New Full Fledged Money Changers should carry out their activities as per the instructions provided by the Reserve Bank.

- FFMCs is required to, at each of its business places, display a copy of the money changing license issued by the Reserve Bank of India.

- FFMCs should have a system of Concurrent Audit of all transactions undertaken by them.

- It is necessary that all FFMCs should submit their annual audited balance sheets to the respective RBI Regional Office.

Annual Money Changer Compliances in India

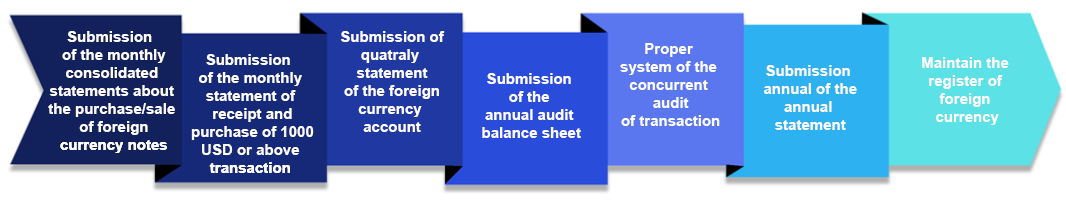

When a person obtains the FFMC license and has commenced the company's operation, he/she should consider the following mandatory money changer compliances. Some of them are discussed below:

- The person is required to maintain the register of purchase of foreign currency, balance book of foreign currency coins, register of daily summary, travellers' cheque, etc.

- Further, submission of the monthly consolidated statements should be made about the purchase or sale of foreign currency notes to Reserve Bank of India by the 10th of the following month.

- Submission of the monthly statement of receipt and the purchase of 10,000 US Dollars or above transactions should be made to the concerned Regional Office of the Foreign Exchange Department, RBI by the 10th of the following month.

- Submission of quarterly statement of the foreign currency account(s) which is maintained in India.

- Moreover, submission of the annual audited balance sheet is required including the certificate from the statutory auditors associated with the NOFs (Net-Owned Funds). Additionally, the submission should be made as on the date of the balance sheet to the concerned Regional Office of the Reserve Bank of India.

- A proper system of the concurrent audit of transactions should be done by the FFMC.

- Moreover, the annual statement should be submitted to the respective Regional Office of the Foreign Exchange Department of the RBI.

Renewal of FFMC License

An application for renewal of the Full Fledged Money Changer License should be made before 1 month from the date of expiry of the license. No request for the restoration of the money changer license will be accepted once the FFMC license has expired.

How TAP GLOBAL will help you

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables