Asset Reconstruction Company- An Overview

In 1997 in Government of India recognized the problems with recovery of Non-Performing Assets (NPAs). In the Narasimhan Committee Report it was mentioned about the important aspect of a continuous reform process reduce the high level of NPAs as a means of banking sector reform. It was expected that new NPAs in the future could afford to be lower with the combination of policy and institutional development.

Accordingly, Asset Reconstruction Company is a company registered under Section 3 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SRFAESI) Act, 2002. It is regulated by Reserve Bank of India as a Non Banking Financial Company (u/s 45I (f) (iii) of RBI Act, 1934). They operate their functions according to the guidelines issued by the RBI. RBI has exempted ARCs from the compliances under section 45-IA, 45-IB and 45-IC of the Reserve Bank Act, 1934.

An Asset Reconstruction Company known as an ARC is a special form of entity which is registered under the provisions of the Companies Act, 2013. This company is established for the sole purpose of securitization of financial assets. All entities that want to carry out the activities of an ARC have to register with the RBI as per requirements of the SARFAESI Act.

Hence in order to establish and have clear liquidity, these companies ensure that bad debts, non-performing assets and loans are purchased from banks and financial institutions. When the loans are legally purchased by the ARC, then the ARC would take the necessary steps for recovery of loans as if the ARC is the original lender.

In other words, we can say that ARCs are in the business of buying bad loans from banks. ARCs help to clean up the balance sheets of banks when the latter sells these to the ARCs. It helps banks to concentrate in normal banking activities. Banks rather than wasting their time and effort by going after the defaulters can sell the NPA's to the ARCs at a mutually agreed value. Its primary goal is to manage and make profitable those assets which are underperforming or have formally classified as Non Performing Assets belonging to those companies which are unable to generate sufficient revenue to complete their outstanding obligations.

Under this, the main disadvantage is the potential loss of income which can be suffered in trying to resolve crises in distressed debt where companies are in danger of bankruptcy/insolvency. When ARC's are managed properly they have a significant possibility of profit if they can relieve the company under financial stress and manage to pass over the acquisition of the assets to other worthy candidates. For their services, they charge a management fee or commission from the distressed company/individual.

Under the SARFESI Act, the responsibility of the Asset management companies is to function as intermediaries between the promoter and the trust. Their main role is to see that the trust is able to take over the assets or loans at a nominal fee according to the revalue amount, which is consequently paid to the promoter for the acquisition.

In India the first ARC was a company named ARCIL which has been a leader in this field, having established industry standards for the rest of the market to follow.

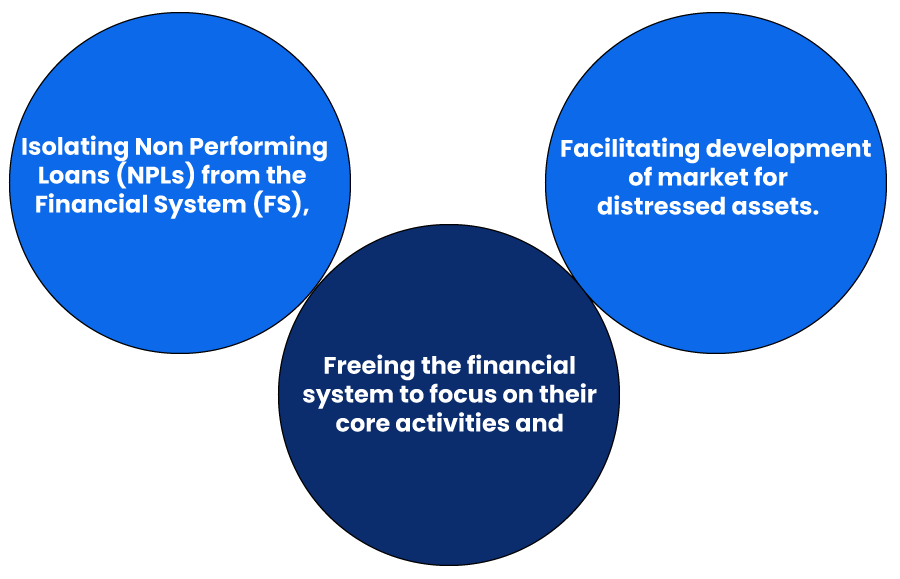

What are the approaches related to NPA by an Asset Reconstruction Company?

ARC has been set up to provide a focused approach to Non-Performing Loans resolution issue by:

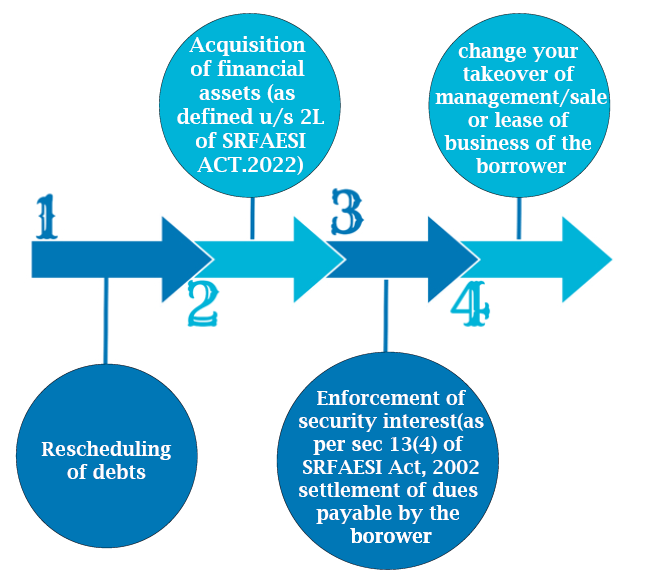

Functions of Asset Reconstruction Company (ARC)

Following functions are performed by ARC as per RBI Notification:

Registration Criteria for an Asset Reconstruction Company

No asset reconstruction company shall commence or carry on the business of asset reconstruction without:

- Obtaining a certificate of registration.

- Having net owned fund (NOF)of not less than two crore rupees or such other amount not exceeding fifteen per cent of total financial assets acquired or to be acquired by the securitization company or reconstruction company, as the Reserve Bank may, by notification, specify.

However, the RBI may come out with specific criteria of owned fund for different class or classes of securitization companies or reconstruction companies.

All companies that are formed for the sole purpose of carrying out securitization activities have to make an application for the same within 6 months or the expiry of 6 months of this legislation.

- Every securitization company or reconstruction company shall make an application for registration to the Reserve Bank in such form and manner as it may specify.

- Reserve Bank of India may for the purpose of considering the application for registration of asset Reconstruction Company requires to be satisfied by inspection of records or books of such company.

Conditions for Registering an Asset Reconstruction Company

There are specific conditions or eligibility criteria for registering an ARC. The following criteria have to be sufficed for this:

- The company must be registered as a company under the Companies Act, 2013.

- After the company is formed, it must be eligible for registration under the RBI under the respective statutory legislation.

- There should not be any losses incurred by the company in the previous or preceding three financial years.

- If there is a process for the realization of assets, then sufficient arrangement must be carried out for the purpose of securitization and asset reconstruction.

- The ARC must be able to pay all the periodical returns.

- The company must be capable of redeeming the amount of investment which is made by qualified buyers and other investors in the company.

- Directors must have sufficient experience and exposure in matters related to financial affairs which include reconstruction, insolvency, financial assets and other areas related to regulation.

- There must be no criminal convictions against the directors. The directors and shareholders should not have committed any acts which affect their moral turpitude. Any acts which would lead to prosecution would also be covered.

- All the key management executives or individuals should pass the requirements related to the fit and proper person test in order to comply with the requirements of the act. The requirements related to the fit and proper test would be notified by the RBI from time to time. This criteria and requirement would also be applicable to the sponsors of the company.

- The entity is responsible for complying with the financial and prudential norms as set by the RBI.

- There are specific guidelines which have to be followed by the RBI for registration of Asset Reconstruction Company in India.

As long as the above criteria or requirements have been met by the asset reconstruction company, the applicant could go ahead with the process of registration.

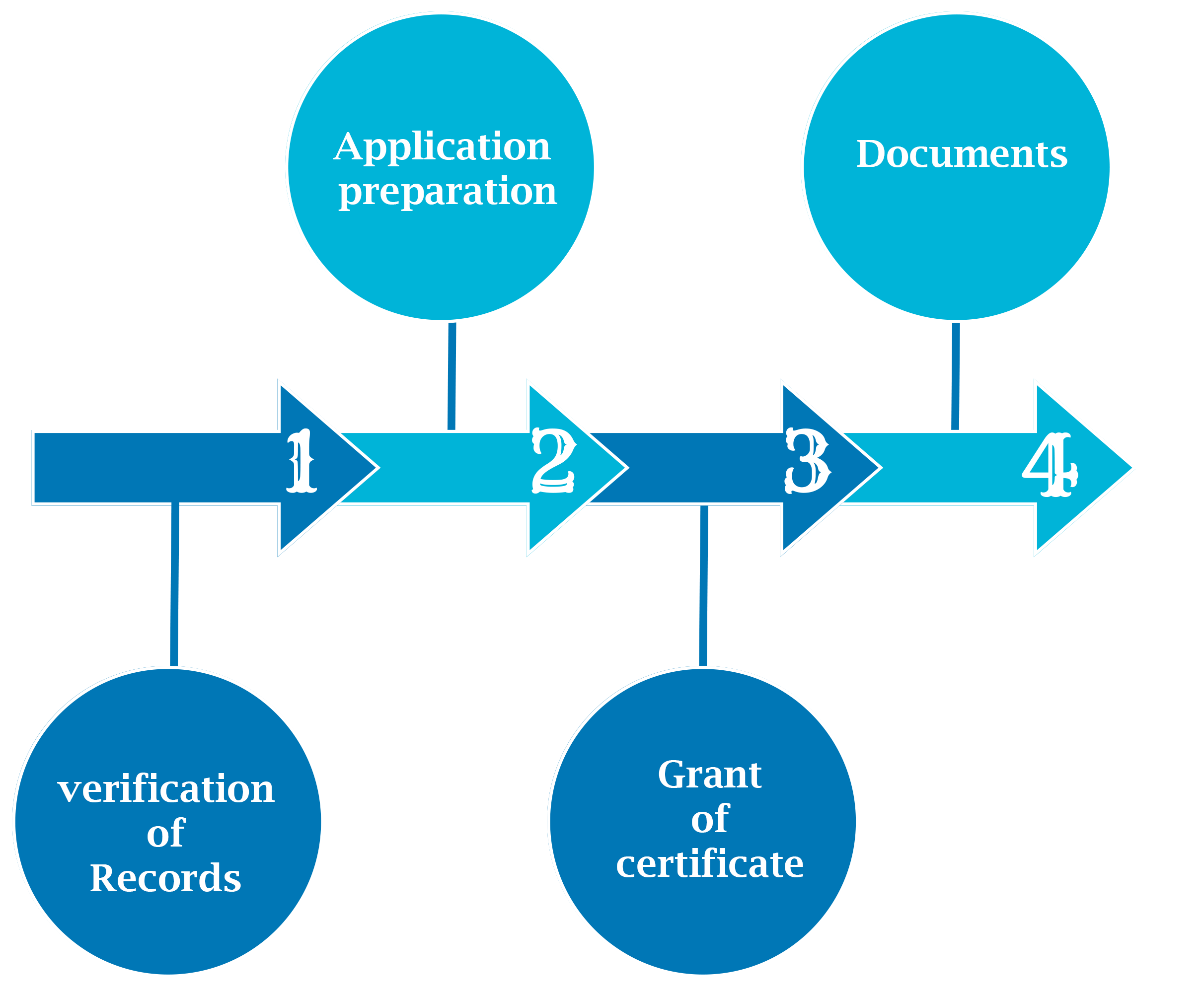

Procedure for Registration of an Asset Reconstruction Company

- Application Preparation

For the registration of an Asset Reconstruction Company, the applicant has to fulfil the provisions related to ARC registration process. All the application forms related to ARC registration has to be filled as per the requirements of the above act. The application can be carried out as per the requirement of the following form Image/COR07092016A4556D0

B919D4863B08C47AA33AD9EFF.PDF .

- Documents

In the next step, the applicant would have to prepare the documents for submission to the requisite authority for ARC registration. The concerned regulatory authority would be the Reserve Bank of India (RBI).

- Verification of Records

After submission of documents, the RBI would verify the records. The RBI would carry out all the work related to inspection of books of records of the company in order to find out if the company is financially sound to carry out the activities as required by the ARC.

- Grant of Certificate

If there are no issues with the application, then the RBI would grant the certificate of registration for the asset reconstruction company. If the conditions related to the ARC registration are not fulfilled, then the RBI would reject the application by stating reasons for rejecting the application.

Documents Required for Registration of an Asset Reconstruction Company

The following documents are required for registering an ARC:

- Certificate of Incorporation of the Company.

- Memorandum of Association and Articles of Association of the Company.

- Resolutions stating that the company has not taken or accepted any form of deposits. These resolutions would be applicable by the board of the company.

- Information that the directors are not disqualified as per the provisions of the Companies Act.

- Information and profiles related to the sponsors of the company.

- Information related to the management of the company. The management of the company would include the shareholders and directors of the company.

- Certified Copy related to the certificate of audit by the auditor of the company.

- Copy of the audited balance sheet of the company.

- Copy of the directors and auditor's report of the company.

- Net Owned Funds of the Company.

- Detailed Information on Related Party Transactions (RPT).

How to reach TAP GLOBAL for Asset Reconstruction Company Registration

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables