Internal Control Audit Services

Internal controls are said to be mechanisms, procedures, and rules that are implemented by a company. The internal control mechanism is implemented to ensure the integrity of financial and accounting information to prevent fraud and promote accountability. The internal controls can help in improving the operational efficiency by improving the accuracy and timeliness of financial reporting.

Internal control audits have become an essential business function for every company. Effective internal control over financial reporting provides reasonable assurance with regard to the reliability of financial reporting and also the preparation of financial statements for external purposes. In case of the existence of one or more material weaknesses, the company's internal control over financial reporting cannot be considered effective.

What are Internal Controls?

Internal control consists of five interrelated components. This is derived from the process specified by the management to run an operation or function and also integrated with other management functions. Although the components apply to companies from small to mid-size to large companies, they may implement them differently at all stages.

Internal controls are designed in a way to provide reasonable assurance regarding the achievement of objectives in the following categories:

- Effectiveness and efficiency of the operations.

- Reliability of financial reporting.

- Compliance with the applicable laws and regulations.

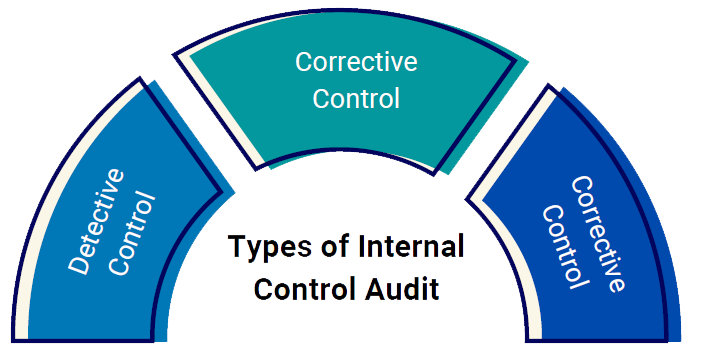

Types of Internal Control Audit

This type of control is designed to detect the errors that might have occurred. This will help in analyzing the discrepancies in financial reports. Detective control identifies existing problems. When an audit is performed, it is considered as an example of detective control.

In this type of internal control audit, if you find a discrepancy, it will take measures to prevent the recurrence of this error. For example, if there is a typing error in the payroll that results in employees being paid and also an incorrect amount. For the correction of payroll, the associate needs to address this problem and perhaps provide additional training for the prevention of future discrepancies. This means that you have performed a corrective control.

After performing the internal control audit and correcting the discrepancies, the controls can be put in place to prevent future errors. With the preventive controls, you can now design controls to help in preventing errors from occurring in the future. To keep proper check-in errors and to prevent any type of mistakes, the duties must be segregated to different employees to authorize and record transactions.

Objectives of the Internal Control Audit

The objectives of each audit are different. An objective is a desired goal or condition prescribed for the specific event.

Below is the list of common internal audit control objectives:

- Authorization: Authorization ensures that all the transactions done are authorized and are approved by a responsible associate before completion of the recorded transaction.

- Completeness: By way of completeness, you can ensure that there are no missing entries in your records.

- Accuracy: Accuracy ensures that transactions are entered in a correct and timely manner.

- Validity: Through validity, you can assure that your transactions are lawful in nature and do not contain any misrepresentation.

- Physical Safeguards & Security: Physical safeguards and security ensure that the physical assets are guarded safely, and only authorized personnel may access them.

- Error Handling: By way of error handlings, it can be ensured that when errors are discovered, the management is notified as well as the errors are corrected in a timely manner.

- Segregation of Duties: It also ensures that there are different persons to report, collect, and process a single transaction.

Components of the Internal Control Audit

The control environment stands at the top. It refers to attitudes, awareness, and actions of management and those charged with the governance towards internal controls. It is extremely important because it filters down to other employees and to all other components of control and hence can have a huge impact on the company. For example, with a less committed and more relaxed tone, there is a very less chance that the lower-level employees will follow the internal controls in place.

The risk assessment of the entity relates to how the client will identify and respond to the risks of the business, such as new personnel and new accounting pronouncements

-

Information Systems & Communication

The information systems component usually refers to how the company captures, processes, reports, and also communicates the information of the transaction.

The control activities refer to the particular detailed policies and procedures. Control Activities such as the company performance via variance analysis, physical and logical controls, and also segregation of duties. This is an essential internal control audit that helps in preventing a lot of problems, one of which is a fraud. By getting different employees to count inventory and have access to the ledger records, helps prevent employees from stealing the inventory and writing it off on the sub-ledger.

Finally, the monitoring controls deal with the management's assessment for the quality of internal controls for the purpose of determining which controls need modification. An example of this in larger companies is the work performed by internal auditors.

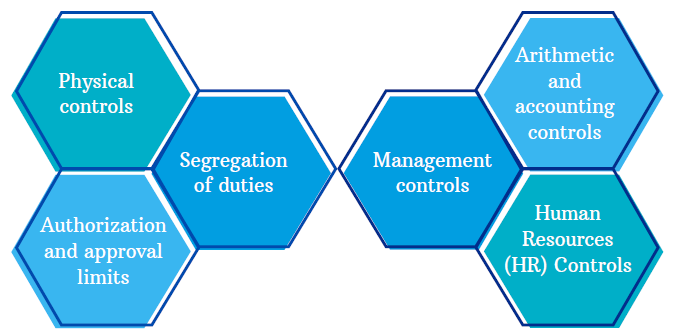

Procedure to Conduct Internal Control Audit

These controls include restrictions on access to buildings or any specified office or factory areas or equipment, such as turnstiles at the entrance to the premises, swipe cards, and passwords. This also includes physical restraints, such as fixing non-current assets to prevent removal.

-

Authorization and approval limits

Many employees need to adhere to the authorization limits, and these are usually specified in terms of employment.

To limit the risk of fraud and errors, the duties related to cash handling are generally segregated. For instance, in the post room of an organization that receives money by post, the employee recording the cash will be a different person from the receiver of money. Segregation is likewise pertinent to different capacities. At the official level, it is presently best practice to segregate the jobs of administrator and CEO, and as an independent assurance function, internal audit must be completely segregated from the finance department, with a reporting line directly to the board of directors or the audit committee.

Manager controls are operated by the managers. Performance management of the subordinates is also an integral part of many managerial positions. Further down the chain of command, supervision controls are exercised with respect to day-to-day transactions. Organization controls operate according to the configuration of the organization chart and line/staff responsibilities.

-

Arithmetic and accounting controls

These controls ensure accurate recording and processing of transactions. The procedures here include reconciliations and trial balances.

-

Human Resources (HR) Controls

HR controls are implemented for all aspects of HR management. Some of the examples are qualifications verification, references, and criminal record checks on new employees, checks on staff for competence, and effective training.

Auditor's Role in the Internal Control Audit Process

- Once the auditor collects the information on the client's system of internal control audit, the auditor should check the control risk.

- Control risk is basically the risk that the client's system will fail to detect or prevent and correct an error or mistake.

- The ratings range from low to high till maximum. Low specifies that the client's internal control system is strong, and maximum specifies that the controls are virtually useless.

- In case a client's system of internal control is assessed below the maximum level, the auditor needs to test the internal controls to ensure that it is functioning as per the understanding of the auditor.

- The testing of internal controls involves making inquiries to the management as well as its employees, inspecting the source documents, observing all inventory counts, and actually re-performing the client's procedures. Finally, the auditor needs to perform more substantive procedures to assess the level of overall risk according to the audit strategy.

Limitations of the Internal Control Audit

Some of the limitations of internal control are explained below:

- Judgment: The effectiveness of an internal control audit will be limited by decisions made by using human judgment under pressure for conducting business based on the information.

- Breakdowns: Even the well designed internal controls have the possibility to break down. Sometimes, employees misunderstand instructions or simply make small mistakes. Some errors may also result from new technology and the complexity of computerized information systems.

- Management Override: The personnel at a high level may be able to override given policies and procedures for personal profit or benefit. This must not be confused with management intervention, which represents management actions to depart from given policies and procedures.

- Collusion: The control systems can be circumvented by employee collusion. Individuals acting collectively can alter financial data or other management information in a manner that cannot be identified by control systems.

What can be the Consequence of Weak Internal Control?

When we recommend improving controls within a department, we often hear three basic arguments for not implementing our recommendations:

- There is not enough staff to have adequate segregation of duties.

- It is too expensive.

- The employees are trusted, and the controls are not necessary.

These arguments represent pitfalls to unsuspecting management. Each argument is in itself, a problem that needs to be resolved.

- The problem of not having enough staff or other resources should be discussed with your supervisor. In most cases, compensating controls can be implemented in situations where one person has to do all of the business-related transactions for a department.

- If implementing a recommended control seems too expensive, be sure to consider the full cost of a fraud that could occur because of the missing control. In addition to any funds that may be lost, consider the cost of time that would have been spent by the department during the time of an investigation of the matter, and the cost of hiring a new employee. Fraud is always expensive, and the prevention of fraud is worth the cost.

- Finally, consider the issue of trust. Most employees are trustworthy and responsible, which is an important factor in employee relations and departmental operations. However, it is also the responsibility of administrators to remain objective.

A department that conducts research is a good example of areas where internal sound controls are needed. Research departments that have grants and contracts with the outside sponsors are at risk that inadequate charges will be posted to the project account, perhaps affecting current or future funding. Each department not only has the responsibility to ensure that all of its transactions are have been processed properly but also to ensure that other researchers are not hiding any type of improper transactions in the department's accounts.

How can TAP GLOBAL Help you?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables