Corporate Agency License

A corporate agent is usually an organization or a company that represents the interest of an insurance company. Therefore, a corporate agent acts in the best interest of the insurance company. There are several guidelines required to be adhered to and followed by a corporate agent. The corporate agent not only represents the interest of the insurance company but also sells the policies of the insurance company. To operate on behalf of the insurance company, a corporate agent would require obtaining a corporate agency License. A corporate agency License is required for an organization to act as a corporate agent. When a company sells vehicle insurance on behalf of an insurance organization, the company is a corporate agent for the insurance organization.

Companies, as well as banks, can obtain a Corporate Agency License. Therefore when a bank gets this License, such a bank would be representing the interest of the insurance organization. This agreement is referred to as a bancassurance or partnership. Financial institutions offer insurance packages to the customers based on their requirements. A corporate agent can represent one life insurer, one non-life insurer, and a health insurer.

Categories of Corporate Agents

Scope of Corporate Agent

Corporate Agents are companies that solicit, procure, and provide service to different forms of insurance businesses. Once a corporate agent obtains the License, they can serve life insurance business, non-life insurance business, and health insurance business.

- A Corporate Agent for a life insurance business can have arrangements with only three life insurers to advertise, solicit, and procure different insurance products.

- A Corporate Agent for a general insurance business can have arrangements with only three general insurers to solicit, advertise, and procure different types of insurance products on behalf of the business. The corporate agent for this type of business would only solicit, service, and procure retail and commercial insurance products for insurers whose risk does not exceed Rs. 5 Crore. This amount is the sum of individual insurance amounts.

- Corporate agent for health insurance can have arrangements only with three health insurers to advertise, procure, and service their products.

- Corporate agent for a composite insurance can have arrangements with a composite insurance provider for three years.

If there is any change in the arrangement related to the insurance policies, then prior permission is required from the Insurance Regulatory and Development Authority of India.

Why Corporate Agent License is required

- To ensure that the corporate agent acts on behalf of the insurance business.

- To solicit products on behalf of the insurance business.

- To act in the best interests of life insurance, non-life insurance, and general insurance business.

- This License is required so that sufficient regulation is present in the insurance business.

Who Regulates Corporate Agent License

The primary regulatory Authority for the Corporate Agency License is the Insurance Regulatory and Development Authority of India (IRDAI). The Insurance Act 1938 and the Insurance Regulatory and Development Act 1999 are the regulations related to insurance. The law regulating corporate agents is the Insurance Regulatory and Development Authority of India (Registration of Corporate Agents) Regulations, 2015.

Eligibility Criteria

The following criteria would apply to secure a Corporate Agent License:

Minimum Capital Requirements

- An applicant with an insurance distribution business must have an equity capital or contribution and net worth of Rs. 50 Lakhs. The net worth requirement has to be maintained by the company at all times.

- For an applicant in the area of insurance distribution, the aggregate holding of equity shares or contributions made by the foreign investor will be prescribed by the central government.

Applicant

For being registered as a Corporate Agent, the applicant must be the following:

- A company formed under the Companies Act, 2013 or the company law; or

- A Limited Liability Partnership under the LLP Act, 2008; or

- A Co-operative Society registered under Co-operative Societies Act; or

- A banking company; or

- A corresponding new bank under the Banking Companies Act, 1949; or

- A regional rural bank established under the Regional Rural Banks Act, 1976; or

- A Non-Governmental organization or a micro-lending finance organization covered under the Co-operative Societies Act, 1912 or a Non-Banking Financial Company registered with the Bank of India; or

- Any other person as may be recognized by the Authority to act as a corporate agent.

Other Criteria

For the Corporate Agency License, the applicant must also satisfy other criteria prescribed as per the regulations:

- The applicant should not be disqualified under any law in force.

- The applicant requires possessing adequate office space, equipment, and trained workforce on their rolls to discharge its activities effectively.

- According to the requirements of the Authority, the Principal Office must be a graduate and receive a minimum of 50 hours of practical training according to the syllabus and preparation.

- The principal officer and the employees must not have violated the code of conduct which is prescribed by the Authority for securing the corporate agency License. This must be during the last three years.

- If the applicant has a business that is not related to insurance, then it must maintain an arm’s length relationship between the financial matters of the other business and the corporate agency business.

- The key management personnel must satisfy the FIT and PROPER criteria.

Process / Procedure for Applying for a Corporate Agency License

Application for Grant of Certificate of Registration:

- The applicant should make an application for a Corporate Agency License.

1) The corporate agent can act as an entity whose principal business does not deal with the distribution of insurance products, and insurance distribution is a subsidiary activity of the company.

2) A business that wants to carry out insurance intermediation exclusively.

- The application for a Corporate Agency License must be made in Form A of Schedule -I.

- A fee of Rs. 10,000/- plus taxes must be paid through an Account Payee draft in favor of ‘The Insurance Regulatory and Development Authority of India’ payable at Hyderabad. The fees can also be made through electronic transfer.

- If the applicant is an institution in the financial sector, then a No Objection Certificate (NOC) must be obtained by the applicant regarding the same. The NOC is to conduct transactions in the corporate agency business. However, corporate agents who are licensed under the 2002 regulations would not be required to get a NOC.

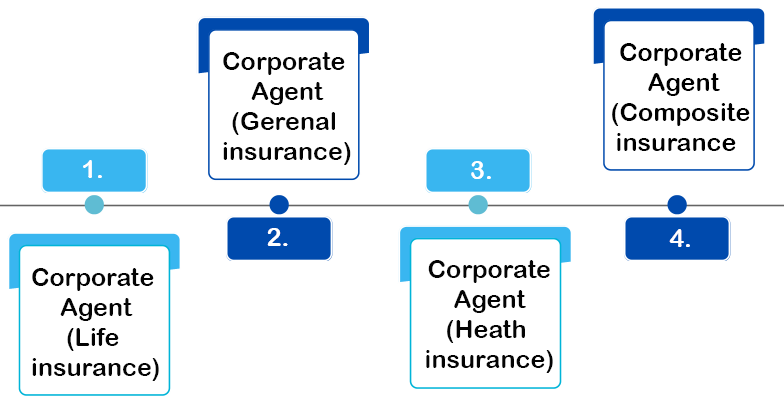

- The application must be made under one of the categories :

1) Corporate Agent (Life Insurance)

2) Corporate Agent (General Insurance)

3) Corporate Agent (Health Insurance)

4) Corporate Agent (Composite Insurance)

- The applicant along with the group entities of the applicant would be granted the certificate for registration. However, the applicant or any other entity must not be doing another business such as a Corporate Agent, insurance marketing firm, insurance brokering, or corporate agency firm. If an entity is already in the business of insurance intermediation, then the application would be considered on the merits and there must not be any form of conflict of interest between the businesses.

- The application for granting the corporate agent License will be rejected if it does not confirm the requirements.

- The Authority may request from the applicant further information and documents.

Procedure of Registration for Corporate Agency License

- Upon receipt of communication for grant of registration from the Authority, the applicant shall pay a fee of Rs.25, 000/-, plus applicable taxes, within 15 days of receipt of such communication.

- If the Authority is satisfied with the application, then the certificate would be granted in Form- B.

- The Authority would also have to send intimation to the applicant regarding the category in which the applicant has been granted registration.

- An applicant can apply for another category if specific requirements related to the regulation are satisfied. This application must be made only after completion of 1 year of the corporate agency License.

Conditions required for a Corporate Agency License

There are specific conditions for granting corporate agency License:

- Corporate agents have to follow the code of conduct for insurance regulation business.

- Corporate agents must only solicit and service the insurance business.

- Corporate agents must be compliant with the Act, Regulations, and Rules provided by the Authority.

- The applicant should inform the Authority of any material change or false/ misleading information, for previously provided documents.

- Corporate Agents should take adequate steps for redressal of grievances within 14 days.

- The Corporate Agent shall solicit and procure a reasonable number of insurance policies commensurate with the resources.

- The corporate agent has to maintain records of the business. These include policy details and person wise details of the different policies. The corporate agency will have adequate systems in place to ensure that records are maintained.

- The corporate agent cannot carry out multi-level marketing for solicitation of insurance-related products.

- The corporate agent has to maintain specific books of accounts for their business.

- The corporate agent has to ensure that during the solicitation process, there is no conflict of interest.

Rejection of Registration for a corporate agency License

- If the requirements with the application are not met, then the Authority would cancel the application. The application must conform to the eligibility criteria and the conditions.

- The applicant would have a reasonable opportunity to be heard on the application.

- The Authority must communicate refusal or rejection of the application to the applicant within 30 days of the date of denial.

- The applicant can appeal the rejection of the application to the securities application tribunal (SAT) within 45 days of the order of rejection from the Authority.

- If the application has been refused, the business of the corporate agent must be ceased. However, the corporate agent can still act for previous clients which contracts have already been entered into with. These contracts would have an expiry on the contract's termination or six months, whichever is earlier. The applicant has to make an application to the insurer after this period.

Documents required for Corporate Agent License

- Submission of relevant information as required in the FORM A.

- Remittance of requisite fee by electronic mode as prescribed under Regulation 17 of IRDAI (Registration of Corporate Agent) Regulations, 2015.

- Submission of charter documents of the applicant (Memorandum and Articles of Association/Byelaws as the case.

- Declaration of Fit & Proper criteria from Principal Officer, Directors and Managing Partners (separately for each person) to be provided in the 'Fit and Proper Form as per annexure .

- Details of infrastructure, supporting evidence thereof like ownership/lease agreement papers about office space/ equipment/ trained workforce, etc. for the registered office and the branch offices at various locations.

- Projections of administrative expenses, salaries and wages, and other expenses, draw the revenue account, the profit and loss account and the balance sheet for the projected three years.

- Organization chart giving a complete picture of the company's activities like IT, underwriting, risk assessment, claims settlement, marketing, accounts, back office, etc.

- Board approved policy on open architecture.

- Any other record of information relevant to the nature of services rendered by the applicant for the growth and promotion of insurance business.

- Any other requirements as deemed necessary by the Authority.

Validity for Certificate of Registration for Corporate Agency License

- Once the corporate agency License is given, it can be renewed after three years.

Corporate Agency License Renewal in India

- Applications for renewing a corporate agency License must be made to the relevant Authority 30 days before the License expiry. The application must be made in FORM A along with the requisite fee.

- The applicant has to pay Rs. 25,000/- for granting the renewal of application. Applicable taxes also have to be paid with the above fee.

- If an application is made after the expiry of the above period, but before the actual expiry of the certificate, then a payment of Rs. 100/- must be made with the application.

- If there is a delay in making an application for renewal of registration, then the same must be mentioned by the applicant. If the Authority feels that the delay is reasonable, then it will accept the application. However, the applicant has to pay a fee of Rs. 750/- plus applicable taxes.

- A corporate agent can submit a renewal 90 days before the expiry of the License.

- Principal Officer and specified persons before seeking a renewal of registration shall have completed, at least twenty-five hours of theoretical and practical training, imparted by an approved institution.

- If the Authority is satisfied with the relevant information, then the renewal would be granted in Form -C. The renewed application would be valid for three years.

How can Tap Global help in securing Insurance Broker License

- We file the application form on your behalf to get the Corporate Agency License for your business.

- We will also help you securing approval for the License from the Authority.

- We monitor and track the status of the application on behalf of the client.

- We value your time and money.

- We also offer post compliance services for your Corporate Agency business.