Internal Control and Organisation SOPs (Standard Operating Procedure)

Governance is required for every organization to maintain proper standards of transparency. Corporate governance can be understood as the relationship that exists between the shareholders, stakeholders, and the employees of an organization. The framework should ensure that there is transparency between the stakeholders in the organization. This is the main priority of an organization having an effective corporate governance framework.

The Insurance Regulatory and Development Authority of India (IRDAI) issued guidelines related to corporate governance for insurance companies in 2009. For recruitment, appointment, and remuneration of key management executives such as Managing Director, CEO, and Whole Time Director separate guidelines were issued. With developments of the Companies Act 2013, the corporate governance norms of all companies have improved. The revised guidelines related to corporate governance for insurance companies have been issued in 2016-17.

Internal Control and Organisation Sops would come under the governance procedure on how an insurance company operates. Internal control and organizational sops would apply to all insurance companies, insurance intermediaries, insurance brokerage firms, corporate agency firms. The guidelines related to internal control and organizational SOP would not apply to the following:

- Reinsurance companies may not be required to have the Policyholders' Protection Committee; and

- Branches of foreign reinsurers in India may not be required to constitute the Board and its mandatory committees.

Objectives of the Guidelines related to Internal Control and Organisation SOPs

- To ensure that the governance structure is followed by an insurance company.

- To ensure that the board and the management executives fulfill their responsibilities.

- To follow compliance under the Insurance Act 1938 and the Companies Act 2013.

- These guidelines ensure that compliances are met by insurance firms.

Who Regulates Internal Control and Organisation SOPs

The primary regulatory authority for the Internal Control and Organisation Sops is the Insurance Regulatory and Development Authority of India (IRDAI). The Insurance Act 1938 and the Insurance Regulatory and Development Act 1999 are the regulations behind Insurance law. The Companies Act 2013 also applies to corporate governance regulations for an organization.

The Securities Exchange Board of India (SEBI) regulates the disclosure patterns for insurance firms. Apart from this, insurance companies that have internal control and organization sops have to comply with the relevant insurance regulations.

For Disclosure requirements the IRDAI (Preparation of Financial Statements and Auditors' Report of Insurance Companies) Regulations, 2002 provides mandatory disclosures for insurance companies.

Eligibility Criteria for Internal Control and Organisation SOPs

- To start an insurance company a company has to be a public company that is registered under the Companies Act 2013 or previous company law.

- Insurance Intermediaries, Corporate Agencies, Insurance Brokers, Insurance Marketing Firms can be the following:

1) Company registered under the Companies Act 2013;

2) Partnership Firm which is registered under the Limited Liability Partnership Act 2008;

3) Co-operative society which is registered under the Cooperative Society Act 1912; and

4) Any other entity which is recognized by the authority.

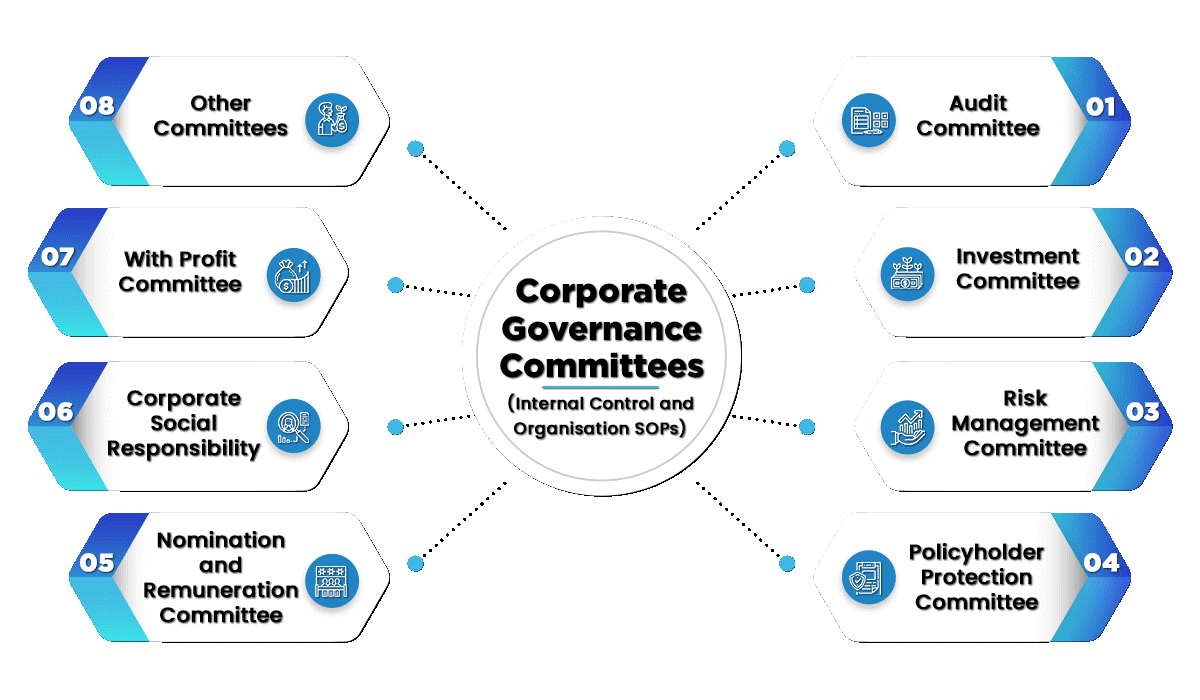

Corporate Governance Committees (Internal Control and Organisation SOPs)

Requirements for Internal Control and Organisation SOPs

Significant Control/ Role of Board

- The minimum lock-in period for the transfer of shares is 5 years for shareholders and members of the insurance company.

- Foreign investment is only allowed to 49%. The company has to have the majority of Indian Control.

- Control is through the amount of shares held by the Indian Company - through the Memorandum of Association and Articles of Association.

- Prior approval is required from the IRDA for registration and transfer of shares exceeding 1%.

Conflict of Interest

There must be no conflict of interest when entering into a contract or agreement with the company. There must be adequate systems in place to ensure there is no conflict of interest. Related Party Transactions (RPT) would come under the purview of conflict of interest. Before dealing with related party transactions, the following have to be taken into consideration:

- Definition of the transaction;

- Determining the Arms length Price;

- Items requiring prior approval from audit and board committee; and

- Other matters to RPT.

Actuaries, directors, key management persons, and auditors shall not simultaneously hold two positions in the insurance company.

The Board must consider the requirements of the capital structure of the company.

Board Structure- Internal Control and Organisation SOPs

- Chairman- Insurance Companies should have an executive or non-executive chairman to manage the board.

- All the group of insurance companies and conglomerates should have similar governance policies.

Board of Directors (BOD)

- Board of directors must not be disqualified under any law.

- The BOD should have requisite qualifications related to the management of the group.

- BOD should ensure that they have thorough knowledge related to the working of the company- organizational structure of the insurance company, key lines of work related to insurance products

- BOD should address the material risk related to insurance.

- 3 Minimum BOD are required to manage the insurance company. However, this has been relaxed to 2 directors.

- There must be an optimum mix of executive as well as non-executive directors in the insurance company.

- Independent directors must be recruited as per the requirements of the Companies Act 2013.

- One woman director is required to be appointed by the company.

- Chairman is a non-executive director; the Chief Executive Officer has to be a whole-time director.

Fit and Proper Criteria

Directors have to satisfy the fit and proper criteria as per the requirement of Internal Control and Organisation SOPs.

The following are not allowed to be directors:

- An insurance intermediary/ agent to be the Director of an insurance company (except with prior approval of the Authority); and

- The common directorship among life insurance companies.

Disclosures under Internal Control and Organisation SOPs

Disclosures have to be made according to the Companies Act, 2013, and the Secretarial Standards. An insurance company has to also disclose the following in the director report:

- Number of meetings of the Board of Directors and Committees;

- Details of the composition of the Board of Directors and Committees mandated, setting out the name, qualification, field of specialization, status of directorship held etc;

- Number of meetings attended by the Directors and members of the Committee; and

- Details of the remuneration paid to all directors (including Independent Directors).

Delegation of Functions under Internal Control and Organisation SOPs

Governance norms require insurance companies to delegate roles and responsibilities to different committees.

Audit Committee- Internal Control and Organisation SOPs

- This committee is mandatory for an organization according to the Companies act 2013.

- The audit committee will oversee financial statements, financial reporting, statements of cash flow and disclosure processes both on an annual and quarterly basis.

- Chairman - must be an independent director with a Chartered Accountant Qualification and experience in the field of insurance, finance management.

The audit committee will have the following functions:

- Overlook the accounts of the company;

- Manage cash flows related to the company;

- Conduct internal audit and statutory audit review;

- Maintain books of accounts related to the company; and

- Report compliances related to accounting related to the company.

Investment Committee- Internal Control and Organisation SOPs

Investment Committee will comprise of two non-executive directors, the Chief Executive Officer, Chief of Finance, Chief of Investment, Chief Risk Officer and, the Appointed Actuary.

The following responsibilities have to be carried out by the investment committee:

- Investment committee would be responsible for the financial policy related to the insurance firm;

- The committee is also responsible for the asset-liability management (ALM) of the company;

- The committee must have knowledge related to the laws laid down by the authority;

- The committee must formulate an effective system of reporting; and

- The committee must review the investment proposal at least once a quarter.

Risk Management Committee- Internal Control and Organisation SOPs

For managing internal control and organization SOPs it is mandatory to have a risk management committee.

The following are the functions of the risk management committee:

- To implement the risk management strategy;

- To appoint a Chief Risk Officer (CRO)to formulate the risk;

- To ensure effective coordination between the risk management function and the financial management function;

- Review solvency position of the company regularly;

- Implement anti-fraud and money laundering procedures for the company;

- Report to the board on the amount of risk. Assist the board with the proper risk management strategy; and

- Review compliance with fraud monitoring regularly.

Policy Holder Protection ( Committee)- Internal Control and Organisation SOPs

Insurance companies must act in the interest of policyholders. A committee to protect the interests of the policyholders is mandatory. The following functions are carried out by the committee:

- Ensure that the insurance company acts in the best interests of the policyholders;

- Handle the grievances related to insurance;

- Provide support to the policyholders;

- Ensure that there is compliance with the statutory framework related to policies;

- Review methods and take various steps to reduce the number of complaints made by policyholders;

- Ensure the details of the insurance ombudsman is provided to the policyholder; and

- Standard operating procedures to treat the customer fairly including time-frames for policy and claims servicing.

Nomination and Remuneration Committee- Internal Control and Organisation SOPs

- Insurance companies have to have a nomination and remuneration committee;

- The nomination and remuneration committee can be merged with prior approval of the authority within 180 days;

- This Committee has to scrutinize applications related to the appointment of key managerial persons;

- They have to get an annual declaration from the directors during the appointment that there is no form of change;

- Directors have to enter into a deed of covenant with the insurance company;

- Remuneration of the CEO and the Whole Time Director must be following the provisions related to the authority;

- The nomination committee and remuneration committee will decide the salaries and remuneration of the key managerial persons; and

- The committee also appoints the key managerial persons.

Corporate Social Responsibility Committee (CSR Committee)- Internal Control and Organisation SOPs

- This committee is mandatory for an insurance company being a public company;

- A company that has net profits of more than 5 crores has to mandatory have a CSR Committee;

- The CSR Committee will comprise of independent director;

- The committee has to mandatorily spend at least 2% of the net profits on CSR activities; and

- The expenses incurred on CSR activities should not be charged to the Policyholders' Account.

With-Profits Committee ( Internal Control and Organisation SOPs)

Every insurer handling life insurance business has to have a with-profits committee, with an independent director, CEO, appointed actuary.

The With-Profits Committee has the following functions to carry out:

- The share of assets attributable to the policyholders;

- The investment income attributable to the participating fund of policyholders; and

- the expenses allocated to the policyholders;

Other committees- Internal Control and Organisation SOPs

The other committees are Ethics Committee and ALM Committee. If an insurance firm is not having either of these committees then the board would have to take roles in handling such responsibilities.

Other Compliances for Insurance Companies

Whistle Blower Policy- Internal Control and Organisation SOPs

An insurance company must have a whistleblower policy in place. This policy would address weaknesses in the governance framework, financial problems, and other issues faced by the insurance company.

Reporting with IRDAI- Internal Control and Organisation SOPs

- The company secretary must be appointed as a compliance officer to report with the status of compliance with corporate governance norms related to the insurance company.

- Annual Report of Compliance would have a separate certification by the Company Secretary (CS) regarding the compliance carried out.

- Annual corporate governance compliance must be submitted by the insurers every year. This must be done 3 months from the end of the financial year.

Reporting Requirements

- Insurance company's financial and operating ratios incurred claims;

- Solvency Margin of the Insurance Company;

- Life Insurance business has records of the persistency ratio;

- Financial Performance;

- Risk Management Architecture;

- Details of number of claims intimated, disposed of and pending with details of duration;

- All pecuniary relationships and transactions of the Non-Executive Directors;

- Elements of remuneration package(including incentives) of MD & CEO and all other directors and Key Management Persons; and

- Payments made to policyholders.

How can TAP GLOBAL help

- We will help your company in securing all corporate governance compliances.

- We value your time and money.

- We also offer post compliance services for your organization.