Private Limited Audit

Once you register your company as a Private Limited Company, the next step that follows is meeting the compliance requirements. The Ministry of Corporate Affairs (MCA) has eased the company incorporation process by introducing One-day Incorporation with SPICe.

The Companies Act, 2013 made audit mandatory for the companies irrespective of its turnover or nature of the company. All Private Limited Companies must maintain its books of accounts regardless of size, stature, or nature of the business. It is the responsibility of the directors of the company to get its books of accounts audited. Company for purpose Private Limited Audit must appoint a practicing Chartered Accountant for auditing.

The process of compliances also involves the appointment of an auditor. The auditor evaluates the accounts and also produces the Audit report. The Audited financial statements are filed with the Registrar of Companies (ROC) of the respective area.

The Private Limited Auditing process can be said to be an annual procedure that comes under the compliance requirements of the companies.

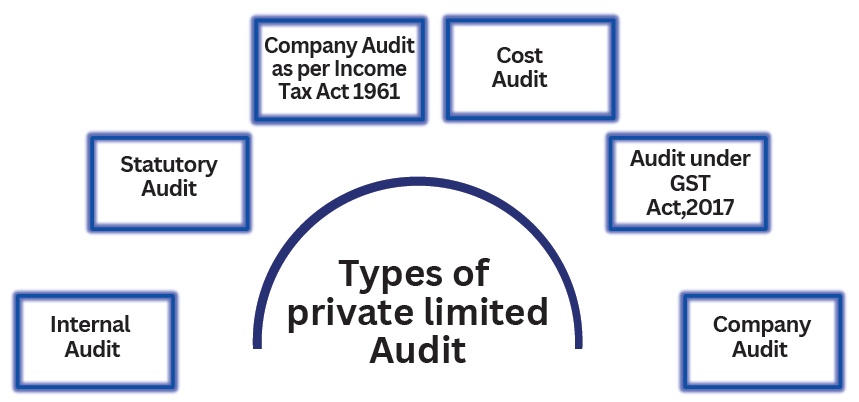

What are the Types of Private Limited Audit?

There are different types of Private Limited Audit. They are as follows:

Internal Audit

The internal private limited audits are conducted as per the suggestions of the internal management. It is done to check the health of the company finances and also analyzes the operational efficiency of the organization. Internal Audits can be performed by an independent party or by the company's internal staff. The internal audit helps the internal management to know about all the finances and also to make the required changes to increase the efficiency in operations.

The applicability of internal private limited audit in case of Private Limited Company is:

- Turnover of Rs. 200 crore or more during the preceding financial year or

- Outstanding loans or borrowings from Public financial institutions, Banks exceeding Rs. 100 crore or more.

If a private limited company fulfills the above criteria at any time during a preceding financial year must appoint an internal auditor to conduct an audit of books of accounts for the purpose of private Limited Audit.

Statutory Audit

The statutory audits for the purpose of a private limited audit are performed to understand the state of a company's finances and accounts to the Government. These type of audits are usually performed by the qualified auditors those who are working as external and independent parties. The audit report of a statutory private limited audit is made in the prescribed form by a Government agency. Hence, a statutory audit is mainly done to know the actual economic status of the concerned firm. The respective time period for statutory audit is a financial year from April 1st to March 31st.

The applicability of a statutory private limited audit is mandatory irrespective of the company's turnover and profit. Any company that is incurring loss must also compulsorily conduct a statutory audit.

Cost Audit

The private limited company will perform cost private limited audit as per the following criterion:

1) Companies with an annual turnover in the next financial year from all its products and services of Rs. 50 crore or more.

2) Companies having an aggregate turnover of the individual product or services of Rs. 25 crores or more.

- For companies under item B:

1) Companies having an annual turnover in the immediately preceding financial year of Rs. 100 crore or more from all its products and services.

2) Companies having an aggregate turnover of Rs. 35 crore or more.

Company Audit as per Income Tax Act 1961

Tax audit with regard to private limited audit is mandatory as per section 44AB of Income-tax Act, 1961 to the following person:

- For a Person carrying business: Total sales, Turnover or Gross receipts must exceed Rs. 1 crore.

- For Professionals: Turnover or gross receipts must exceed Rs. 50 lakhs.

- Businesses having annual turnover or gross receipt below Rs. 2 crores are covered under Section 44D of Presumptive Taxation Scheme.

Company Audit

In a private limited audit, the provisions of a company audit are explained in the Companies Act, 2013. The companies irrespective of their nature of business or turnover needs to get their annual accounts audited at the end of every financial year.

- For private limited audit purposes, the company and the directors of the company must first appoint an auditor at the outset.

- The shareholders of the company at each Annual General Meeting (AGM) must appoint an auditor.

- The appointed auditor will hold the position from one Annual General Meeting (AGM) to the conclusion of the next AGM.

- Therefore after the completion of the term, the auditor needs to be changed.

Who is Eligible to Conduct a Private Limited Audit?

- The auditor appointed by the company must conduct the private limited audit.

- The auditor shall be appointed within 30 days of the Incorporation of the company.

- The auditor shall be appointed by passing board resolution at the board meeting.

- In case the board fails to appoint the auditor the members shall appoint the auditor within 90 days of the extraordinary general meeting.

- The auditor shall hold the position from one AGM to the conclusion of the next AGM.

- The auditor is appointed by filing e-form ADT-1.

- The auditors of the company will be appointed at the first AGM for a maximum of 5 years' tenure.

- Any person who is a qualified Chartered Accountant (CA) within the meaning of the Chartered Accountant Act, 1949 can only be appointed as an auditor.

- LLP of Chartered Accountants can also be appointed as an auditor of the company.

The following are some other provisions with regard to the appointment of an auditor for private limited audit:

- As per Section 139(9) and (10) of the Companies Act, 2013-For private companies the auditor can be reappointed.

- As prescribed in Section 139-Rotation of the auditor will apply to private companies having a paid-up share capital of Rs. 20 crores or more.

- According to section 139 (8) -The casual vacancy of the auditor is to be filled by the board of directors within 30 days.

- According to section 140 of the Companies Act, a 2013-An auditor who has resigned from the company needs to file a statement in e-form ADT-3 to a company as well as to Registrar of Companies (ROC) within 30 days of the resignation.

- As per Section 140- The auditor can be removed before the expiry of his term by passing a special resolution and by getting prior approval of the Central Government. An application must be made in e-form ADT-2 within 30 days of passing the board resolution.

- Under Section 142 of the Companies Act, 2013-The remuneration of the auditor is fixed.

- The statutory auditor cannot act as an internal auditor.

- The internal auditor can be an employee of the company or can be appointed externally.

The following persons are disqualified from becoming an auditor according to the Companies Act, 2013:

- A Corporate Body.

- An officer or an Employee.

- Superior of the employees or partner with an employee of the company.

- Any person who has guaranteed to the company on behalf of another person a sum exceeding Rs. 1,000 or is indebted to a company for an amount exceeding Rs.1,000.

- Any person who has held any type of securities in the company.

Private Limited Audit Compliance Check List

ROC Compliances, GST, and income tax rules must be clear to the party to know the default status of the company. Some of the compliances are as follows:

|

S. No

|

Form-No

|

Compliances

|

|

1.

|

Form ADT-1

|

Appointment of Auditor.

|

|

2.

|

Form ADT-2

|

Removal of Auditor.

|

|

3.

|

Form ADT-3

|

Resignation of Auditor.

|

|

4.

|

Form AOC-4

|

Annual filing of financial statements (Balance sheet, Directors Report, Profit and Loss Account, accounting standards, Auditor's Report).

|

|

5.

|

Form MGT-7

|

Filing of Annual return with shareholders and debentures list.

|

|

6.

|

Form MGT-14

|

Filing of resolution and agreement to ROC.

|

|

7.

|

Form CRA-1

|

Maintaining cost records.

|

|

8.

|

Form CRA-2

|

Appointment of cost auditor.

|

|

9.

|

Form CRA-3

|

Submitting cost audit records to the board.

|

|

10.

|

Form CRA-4

|

Filing cost audit report, wherever applicable.

|

|

11.

|

Form ITR-6

|

Filing Income tax return of the company.

|

|

12.

|

GSTR-3B with GSTR-1 and GSTR-2A

|

Cross Verification.

|

|

13.

|

Form GSTR-9C

|

Filing GST Audit Form.

|

Who Signs the Private Limited Audit Report?

- Two directors of the company need to sign the financial statement of the company.

- One of the directors shall be the Managing Director, and in case there is no managing director then the Director can sign the financial statement.

- After the financial statement gets signed by the directors, the auditor's report is duly signed by the auditor appointed by the company.

- The audit report must be a duly certified copy.

- The qualifications, observations, or comments made on the financial statement, which has an adverse effect as specified in the audit report shall be read before the general meeting and is open to any inspection.

- The auditor must report fraud (if any) against the company done by employees or officers, in case he believes that an offense involving fraud is committed while conducting the audit.

What is the Due Date of Private Limited Audit?

The due dates of a private limited audit are as follows:

Internal Audit

There is no specified due date of internal audit. The internal auditor must report to the board before the Annual General Meeting (AGM).

Statutory Audit

- The statutory audit must be conducted before the Annual General Meeting (AGM)

- The audit report is required to be submitted to the board.

- The audit report is required to be read before the general meeting.

- The audit report must be attached to the financial statement of the company while filing the financial statement in e-form AOC-4 within 30 days of the Annual General Meeting.

- In form MGT-7 the Annual return must be filed within 60 days of the AGM.

- The due date for conducting Annual General Meeting (AGM) is on or before September 30th following the end of a financial year.

Cost Audit

The cost audit report must be submitted to the board. The company, after receiving the report, shall provide full information to the Central Government within 30 days of receipt of the cost audit report.

Tax Audit

The due date for filing of the income tax return after conducting the audit is September 30th.

GST Audit

The due date of the GST Audit is December 31st of the next financial year.

What is the Penalty for Non-Compliance of Private Limited Audit?

Penalty for Form AOC-4

- A penalty of Rs. 100 per day will be charged on the delay of filing Form AOC-4.

- Also a penalty of Rs. 1000 per day of default will be charged on the company which can go maximum up to Rs. 100000.

Penalty for Form MGT-7

- A penalty of Rs. 100 per day will be charged by the companies.

- Each member of the defaulter company shall be deemed for paying the penalty of Rs. 50,000 and also a late fee of Rs. 100 per day till the default continues.

- The maximum amount of penalty that can be charged is Rs. 5, 00,000/-.

Penalty for non- filing of ITR-6

- Late filing fees up to Rs. 10, 000 are applicable for non-filing of the income tax return.

- According to section 273B, an approx fine of Rs. 1, 50,000 or 0.5% of the total sales, gross receipts or turnover for the current financial year.

What are the Documents Needed in Private Limited Audit Report?

The documents required in a private limited audit report are as follows:

- Before the auditor's report, the documents that are attached are Notice, Director's report, and Form MGT-9.

- The auditor's report, when prepared, is attached below the form MGT-9 that contains the contents with all the information that is gained after conducting the company audit.

- An annexure to the report is presented in Form 3CD.

- Profit and Loss Account, Balance Sheet, and notes to accounts are attached.

- If the tax audit is conducted, the observations made during a tax audit are also attached.

- Notes related to financial statements are also attached at the end of the Audit Report.

What are the Contents in the Auditor's Report for Private Limited Audit?

The contents in the Auditor report for Private Limited Audit are as follows:

- Title of the Audit.

- Auditor's opinion.

- Basis of the opinion of the auditor.

- Essential matters related to the audit.

- Any information is other than financial statements and auditor's reports.

- Responsibility of the management for financial statements.

- Auditor's responsibility with regard to the audit of the financial statements.

- Other reporting responsibilities.

- Signature of the auditor.

- Place of signature and date of the audit report.

What is the Process for Conducting a Private Limited Audit?

Our team at TAP GLOBAL includes experienced professionals and qualified for conducting a private limited audit.

- Preparing an efficient and effective private limited audit approach by defining the objectives and scope, scheduling the resources, and making the programs.

- Obtain evidence that the audit area is controlled adequately. The operations that are conducted are efficient by using appropriate techniques.

- By evaluating the strengths and weaknesses of audit areas and also reporting their efficiency by analyzing audit evidence.

- By presenting a report of the findings, recommendations, and conclusions to inform the management with regard to the adequacy of controls and effectiveness of operations.

- Assessing all the actions taken by the management with regard to reporting techniques and follow-ups.

- Adhering to the norms of ethics and professional standards to ensure the quality and consistency of audit work.

How can TAP GLOBAL Help you?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables