Foreign Exchange Regulations

The Central Government developed the Foreign Exchange Management Act to encourage external payments and cross border trades. Foreign Exchange Management Act or FEMA was introduced in the year 1999, replacing FERA (Foreign Exchange Regulation Act).FEMA was introduced to fill all the drawbacks and loopholes of FERA. Hence FEMA Act added various significant reforms.

The Foreign Management Act (FEMA) is an official act which consolidated and amended the laws governing the foreign exchange in India. The FEMA Act main objective was to facilitate the orderly development, external payments, and maintenance of foreign exchange market in India.

When a Foreign Investor invests in India or an Indian investor invests outside India, that person must comply with the Foreign Exchange Regulations. The Foreign Exchange Regulations are framed by the Directorate of Foreign Trade and the Reserve Bank of India (RBI). Foreign Exchange Regulations introduced compliances in Foreign Exchange to keep a check on the increased flow of both the inbound and outbound funds.

Applicability of FEMA Act

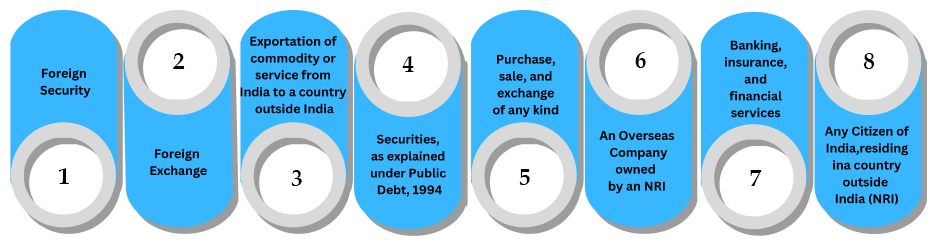

FEMA is applicable in India and is equally applicable to the agencies and offices located outside India that are owned or managed by an Indian Citizen. The Head Office for foreign exchange is situated in New Delhi and is known as Enforcement Directorate. FEMA applies to the following:

- Foreign Security.

- Foreign Exchange.

- Exportation of commodity or service from India to a country outside India.

- Securities, as explained under Public Debt, 1994.

- Purchase, sale, and exchange of any kind.

- Banking, insurance, and financial services.

- An Overseas Company owned by an NRI.

- Any Citizen of India, residing in a country outside India (NRI).

What are the Rules and Regulations framed under FEMA?

The Rules and Regulations specified by FEMA are as follows:

- Foreign Exchange Management (Current Account Transactions) Rule, 2000.

- Foreign Exchange Management (Permissible Capital Account Transactions) Regulations, 2000.

- Foreign Exchange Management (Transfer or Issue of any Foreign Security) Regulations, 2004.

- Foreign Exchange Management (Foreign currency accounts by a person resident in India) Regulations, 2000.

- Foreign Exchange Management (Acquisition and transfer of immovable property in India) regulations, 2000.

- Foreign Exchange Management (Establishment in India of branch or office or other places of business) regulations, 2000.

- Foreign Exchange Management (Manner of Receipt and Payment) Regulations, 2000.

- Foreign Exchange Management (Export of Goods and Services) regulations, 2000.

- Foreign Exchange Management (Realization, repatriation, and surrender of Foreign Exchange) Regulations, 2000.

- Foreign Exchange Management (Possession and Retention of Foreign Currency) Regulations, 2000.

- Foreign Exchange (proceedings) Rules, 2000.

Which Foreign Exchange Transactions are Permitted as per Foreign Exchange Regulations?

The procedures and formalities for dealing with all the foreign exchange transactions in India are streamlined by FEMA. Foreign Exchange transactions are classified into two categories:

According to the FEMA Act, the actual balance payments must record the business assets of the goods and services. Moreover, these transactions take place between the citizens of other countries with India.

Current Account Transactions

The Current Account Transactions include the inflow and outflow of money during any year to and fro from different countries outside India. This transaction takes place because of trading or rendering services, commodities, and income between the countries. The Current Account Transactions are further categorized into three parts, according to Foreign exchange Regulations. They are:

- Transactions that are prohibited by FEMA.

- Transaction requiring prior approval from the Central Government.

- Transaction requiring RBI's prior approval.

Capital Account Transactions

The Capital Account checks domestic investments within foreign assets and vice versa. According to FEMA, the Capital Account Transactions are transactions that alter the assets or liabilities of a person resident in India outside of India or assets or liabilities in India of the resident individual outside India.

Foreign Exchange Regulations for Direct Investments Outside India

As per Foreign Exchange Regulations specified by FEMA direct investments outside India is permitted in following:

- An Indian party can make direct Investment in a Joint Venture (JV) or Wholly Owned Subsidiary (WOS) outside India.

- The financial commitment of an Indian party in a Joint Ventures or Wholly Owned Subsidiary shall not exceed 100% of the net worth of the concerned Indian Party as on the date of the last audited balance sheet.

- Investment prescribed under the Foreign Exchange Regulation may be funded by:

1) Balance held in the Exchange Earners' Foreign Currency Account of the Indian party that is maintained with an Authorized Dealer (AD).

2) Drawn on foreign exchange from an authorized dealer in India not exceeding 100 % of the Indian Party's net worth as on the date of the last audited balance sheet.

- A person resident in India, can be an individual or a listed company or a mutual fund registered in India can invest in:

- A Company incorporated in India or a Partnership firm that is registered under the Indian Partnership Act, 1932, can undertake Agricultural Operations. Agricultural Operations will include the purchase of land that is incidental to such activity either done directly or through the overseas offices.

- To make investment as per the Foreign Exchange Regulations through Remittance from India in an existing Company outside India shall be made.

- An Indian Party can make direct Investment in any foreign security without any specified limit. This can be done out of the proceeds of the international offering of shares through the mechanism of ADR or GDR.

- An Indian Party can extend the loan or guarantee to or on behalf of the WOS/JV aboard within the permissible financial commitment. This is possible if the Indian Party has made Investment by contributing to the joint venture's equity capital.

1) Shares of overseas Company that is listed on a recognized stock exchange. It must also have a shareholding of at least 10% in any listed company as on 1st January of the year of Investment.

2) Rated Bonds or Fixed Income Securities that are issued by Companies.

- The Indian Party can also invest as per Foreign Exchange Regulations to an entity outside India that is engaged in financial services activities. Provided that the Indian Party:

1) Has earned a net profit from the financial services during the preceding three fiscal years.

2) For conducting financial services activities if registered with the regulatory authority.

3) Has also obtained approval from the concerned regulatory authority in India and a foreign country for making ventures in the financial sector.

4) It has fulfilled all the prudential norms relating to capital adequacy as per the concerned regulatory authority in India, as specified by the Foreign Exchange Regulations.

How Investment can be Made by Way of Capitalization as per Foreign Exchange Regulations?

An Indian party can make direct Investment outside India through capitalization as per Foreign Exchange Regulations in full or part of the amount due to the Indian party from the foreign organization towards:

- Payment made for Export of Plant and Machinery or Equipment and other goods and software.

- Fees, Commissions, Royalties, or other entitlements due to the Indian Party from any foreign entity with regard to the supply of technical know-how, managerial, consultancy, or other services.

- The royalties, commissions, fees, or other entitlements if remained unrealized from the date of such payment beyond a period of six months shall not be capitalized without obtaining prior permission of the Reserve Bank.

- An Indian Software exporter can receive up to 25% of the value of exports in the form of shares to an overseas software startup company by applying with the Reserve Bank through an Authorized Dealer.

How to Acquire a Foreign Company without Tender or Bidding Procedure as per Foreign Exchange Regulations?

The Foreign Exchange Regulations specifies specific procedures for acquiring a foreign company without a tender or bidding procedure. They are listed below:

- The Indian party that is eligible under the Regulations can make Investment outside India to an Authorized Dealer may allow remittance. The remittance can be made towards earnest money deposit or issue a bid bond guarantee on its behalf for the purpose of participation in bidding or tender procedure for the acquisition of a company incorporated outside India.

- In cases where the Indian Party wins the bid:

1) The Authorized dealer may permit further remittances for the foreign company's acquisition as specified in Regulation 6 of Foreign Exchange Regulations.

2) The Indian Party must submit a report to the RBI in Form ODA through an authorized dealer within 30 days of effecting final remittance.

- For the purpose of participation in bidding tender procedure, the Reserve Bank in Form ODI may allow remittance of foreign exchange towards earnest money deposit or allow the Authorized dealer to issue a bond guarantee, subject to the terms and conditions as per the requirement of Reserve Bank.

How can Individuals Invest Abroad as per Foreign Exchange Regulations?

According to the Foreign Exchange Regulations individuals can make Investment abroad in the following ways:

- A Resident individual can apply to the Reserve Bank with regard to permission to acquire shares in a foreign entity offered as consideration for the rendered professional services to the foreign entity.

- The RBI after considering all the points may grant permission to such terms and conditions as required:

1) Credentials and net worth of the individual and also the nature of his profession.

2) The extent of the individuals' forex earnings or balances in his EEFC or RFC Account.

3) The business track record, as well as the financial history of the foreign entity.

4) Potentials with regard to forex inflow of the country.

5) Other benefits to the country.

Foreign Currency Convertible Bonds (FCCBs) as per the Foreign Exchange Regulations

The Foreign Exchange Regulations has suggested some automatic route for Foreign Currency Convertible Bonds (FCCBs):

- The FCCBS that will be issued needs to conform to the Foreign Direct Investment Policy of the Government as announced from time to time and the Reserve Bank's Regulations or directions released.

- The FCCBs shall be issued to a ceiling of USD 500 million in any financial year.

- The public issue of FCCBs shall be done by the lead managers in the international capital market.

- The FCCBs maturity time shall not be less than five years.

- The FCCB bonds shall not be used as an investment in the stock market.

- The Banks, NBFCs, or Financial Institutions shall not provide guarantee or LOC for the FCCB issue.

What are the Key Services Offered by Us?

The Key Services offered by us for Foreign Exchange Regulations are:

- Providing assistance to the Foreign Companies for setting up a branch office or liaison office and project office.

- Regulatory Due Diligence.

- Advice on Foreign Exchange Transactions

- Carry out Compliance with regard to the regulatory risk analysis of the past and present.

- Representation before the authorities such as RBI and Revenue Departments.

- Obtaining approvals for External Commercial Borrowing.

How can TAP GLOBAL Help You?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables