NGO Audit

Non-Governmental Organizations (NGOs) play a vital role in the process of social and economic development of the economy. With passing time, there can be said to be a substantial increase in the activities of the Indian NGOs. The Ministry of Corporate Affairs brought a uniform accounting and reporting framework for NGOs

NGOs are established as public trusts as per Trust Laws, or as per Societies Registration Act or as Companies under the Companies Act, 2013. All these acts apply to entities as per their choice of the constitution. Further, this act requires the NGO to receive a foreign contribution for getting its books of accounts audited by the Chartered Accountants.

The NGO must get its accounts audited as per the Incorporation Law depending on their mode or form of Registration. NGO Audit must be done as per the Societies Act, Trust Act, or Companies Act, 2013. NGO Audit must also be done as per the Income Tax Act, 1961. As prescribed in Section 12A (b), the Income-tax law audit becomes compulsory for NGOs where the total income of an entity exceeds the maximum amount which is not chargeable to Income Tax in any previous year. The receivables of an organization should be compulsorily audited as per Section 12 A (b) of the Income Tax Act, 1961.

What is an NGO or Non-Governmental Organization?

NGOs are not owned by any particular person. They cannot distribute profits by way of dividends. Whatever profits are earned by NGOs from the economic activities are reinvested or spent on appropriate non-profit activities.

The general source of revenue for non-governmental organizations is donations, funding of grants from unilateral and multilateral agencies, or through membership fees, or interest and dividends on investments or through any miscellaneous sources.

The following forms of associations may act as NGO:

- A trust registered under the Indian Trusts Act, 1982 having two or more persons as Trustees therein.

- A company registered under s. 25 of Companies Act, 2013. Generally, clubs, associations of professionals get registered as per the provisions specified in Companies Act, 2013.

- A society of persons that are registered under the provisions of the Societies Registration Act, 1860 with the Registrar of the Societies.

- A statutory body that consists of a membership of persons constituted by or under a statute, having a structure as laid down in the statute by which it is formed.

- A charitable trust constituted under the Charitable Endowments Act, 1920.

- Any other organization that is akin to society.

- Thus an organization NGO in India can either be registered as a trust, society or as a company under sec 25.

What is the Benefit of NGO Audit?

An audit is an independent investigation of the activities done in an NGO which concludes whether they are in good order or not.

Though NGO Audits are time-consuming to some entities, they have two significant benefits:

- Firstly, by performing NGO audits, an NGO can provide evidence that transparency is present in the financial statements.

- Secondly, NGO audits provide valuable learning opportunities. Auditors can provide advice on financial controls or systems or investigate specific issues.

What are the Formats of Financial Statements for the Purpose of NGO Audit?

The financial statements of NGOs at present have varied contents and formats with limited liability. These must be reviewed with reference to shareholder's requirement. The financial statements should form part of General Purpose Financial statements of an NGO:

- Balance Sheet;

- Income and Expenditure Account; and

- Cash Flow Statement.

The fund-based accounting is considered relevant for an NGO. The Income and Expenditure Account must have three columns, to present income and expenses with respect to the restricted funds as differentiated from unrestricted funds. The columns which have to be considered by the company are:

- Unrestricted Funds further classified into Designated Funds and General Funds.

- Restricted Funds.

- Total Column that will reflect the total income and expenses of unrestricted funds and restricted funds.

NGOs must separate designated funds from other unrestricted funds in its internal accounting records. The NGOs musty take utmost care while publishing the accounts, so as not to provide a distinction between the two. The NGOs at the time of auditing must provide an integrated balance sheet.

The financial statements must be prepared after confirming relevant statutory requirements and accounting standards.

What is the Task to be performed by an Auditor while Conducting NGO Audit?

The Auditor needs to conduct the following tasks while conducting an NGO Audit:

- Since the NGO has its own memorandum the Auditor while conducting NGO Audit must have few insights about the company.

- The Auditor, while conducting NGO Audit, must investigate about the amount received as subscription ratifying with counterfoils of the receipts.

- The Auditor during an NGO Audit must evaluate the decisions taken by the executives.

- The Auditor must make physical verification of assets ratifying with store ledger.

- The Auditor shall check the liabilities and also that its assets during NGO Audit and whether its transfer is proper or not.

- NGOs receives grant from foreign institutions as well. So it is the duty of the Auditor to check whether it is accepted as per the provision of financial rules and regulations of the nation or not.

- The Auditor during the NGO Audit should check the use of Government grants. It should also look if the accounts are adequately maintained or not for recording the grants.

- In case such an institution has received the donation from any individual or organization, an auditor should check accounting of such amount and its use.

What are the Types of Financial Statements for Conducting NGO Audit?

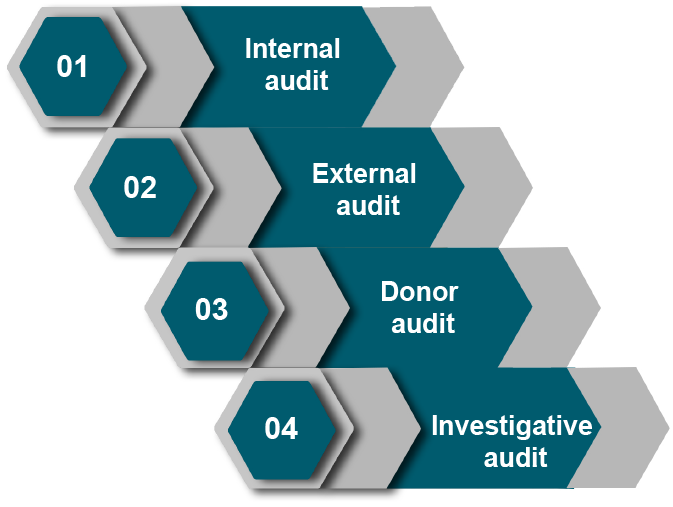

There are four types of NGO Audit done for financial statements:

External audit- checks whether Financial Statements are accurate and fair

An external audit is generally carried out by independent auditors. They give a professional opinion as to whether financial statements are true and fair, based on carefully checking a sample of the records. Their opinion is important because it provides evidence that financial reports are reliable - which means a lot to stakeholders like trustees and donors.

Internal Audit- Checks policies and procedures

An internal audit can be carried out by the employees of the organization's own staff or by experts especially hired for the job. It includes checking whether the organization's policies and procedures are being followed in practice. These give trustees relevant and up to date information about how risks are being managed adequately in practice.

Donor Audit- checks whether grant terms and conditions have been followed.

A donor audit can be carried out by the organization's normal external auditors (on a separate or additional engagement to the standard year-end Audit) or sometimes the donors themselves carry out this Audit. This brings confidence in donors that their funds have been properly used and the grant conditions are being complied with. A successful NGO audit is often a requirement for further funding.

Investigative Audit- for evidence relating to a specific suspected wrong-doing

An investigative audit is carried out when an organization suspects a specific problem generally fraud and auditors are brought in to establish the facts. The auditors may provide evidence for further action that the organization may decide to take.

What must an Auditor's Report Include in an NGO Audit?

The Auditor's report in must have included the Balance Sheet of Society Name, with the address as on 31st March of the financial year. They must also attach the Income & Expenditure Account, and Receipts & Payments Account for the year ended on that date. The format of the report must be as follows:

- The Auditor has received all the explanations and information which as per his knowledge is necessary for the purpose of Audit.

- The books of accounts have been appropriately maintained as required by the law.

- The Balance Sheet and Income & Expenditure account dealt with this report are in agreement with the books of accounts.

- According to his opinion and the best of his information, the accounts give a true and fair view:

a) In the case of the Balance Sheet, the state of affairs of the particular NGO as of 31st March of the particular year.

b) In the case of Income & Expenditure Account, the surplus amount for the year ended on that date.

c) For receipts and payments account, payments of the society during the year ending date.

What is the List of Documents to be Included in Annual Accounts of NGO Audit?

The list of documents to be included in audited annual accounts for NGO Audits is as follows:

- Auditor's report (typically on the letterhead of the CA/auditor).

- Balance Sheet (Signed and stamped by the CA/auditor), signed by your Chief Functionary & Board Members

- Income and Expenditure Account (Signed and stamped by the CA/auditor), signed by your Chief Functionary & Board Members

- Receipts and Payment Account. These are mandatory if you have an FCRA registration. (Signed and stamped by the CA/auditor), signed by your Chief Functionary & Board Members. However, it is an excellent practice to prepare consolidated Receipts and Payments accounts (both foreign and domestic transactions) irrespective of whether you have an FCRA account or not.

- Notes to Accounts (including significant accounting policies). Also, you can include your organization's registration details, date of filing income tax return, and FCRA return and details of 12A, 80G, 35AC, and FCRA registration.

- Fixed Assets Schedule.

- Complete Schedules if your balance sheet, income, and expenditure account mention the same. Each page should be stamped along with the initials of the CA.

- Ensure that the year is correctly mentioned in all schedules and annexures.

- Check that there are no errors or rounding off errors across all pages.

- Ideally, figures for the previous year should be provided in all statements and schedules.

- The pages must be numbered. The original copy of the required documentation must be provided.

- Payment of fees or salary or remuneration or reimbursements to Trustees or Governing Body members or Directors should be tracked and reported separately.

- If your CA/auditor makes any comment/ qualification in their draft audit report, discuss the issues with them. You must also provide your response in a management report so that the CA/auditor can incorporate the same in their final report.

- Share the action report with the Auditor on issues raised on the previous years report.

- In case the accountant has made separate project wise or location wise accounts and also separately for FCRA and domestic transactions, it is better to ensure that the accountant has also prepared consolidated statements for the organization as a whole.

What are the Services Provided in TAP GLOBAL for NGO Audit?

In TAP GLOBAL, we cover issues related to NGO audit, covering:

- The designing and implementation of accounting methodologies, procedures, and policies.

- To establish and monitor union and linkage of program activities and financial management of the NGO's

- Guiding the NGO in Planning and also in budgeting the proposal of any developmental activity.

- To monitor and audit the financial records of the NGO.

- Project evaluation with the experts in the particular field including financial evaluation, of an NGO

- Cost analysis of the socio-economic project based on the financial data for an NGO

- Guidance on legal compliances for NGO in areas of:

- Foreign Contribution Regulation Act – Registration and Returns.

- Income-tax Registration & Returns.

- 80G Registration under the Income-tax Act.

- Compliance under the Societies Act, the Indian Trust Act, etc.

How can TAP GLOBAL Help you?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables