Small Finance Bank License- An Overview

There are particular banks which are regulated by the Reserve Bank of India (RBI). These banks are started with the main motive to serve particular sectors of the society. Though large based banks would also carry out activities, however small banks such as the above would only cater needs to small sections of the society.

These institutions cater to the needs of different forms of customers. Apart from this, the primary activities offered by these types of institutions include providing loans, accepting of deposits and work related to insurance activities. Hence these institutions are formed to provide banking services to the semi-urban and rural sectors of the society.

Regulatory Authority/Body for Small Finance Bank License

The primary regulatory authority or body for a small finance bank license is the Reserve Bank of India. Apart from this, the main legislation that governs the establishment of a small finance bank is the Companies Act, 2013 and the Banking Regulation Act, 1949. The Reserve Bank of India Act, 1934 is another banking regulation that governs the activities of this form of institution.

Main Objectives of a Small Finance Bank License

- Forming this type of entity has the main purpose related to cater the needs of semi urban and rural sectors of the society.

- These banks would provide loans to Small Scale Industries and House Holds with low source of income.

- Usually micro farmers and other forms of individuals would rely on the provisions which are provided by this form of institution.

- When these institutions are formed, they are registered as a Public Limited Company under the Companies Act, 2013. Apart from this section 22 of the Banking Regulation Act, 1949 governs the requirements related to grant of license for a small finance bank in India.

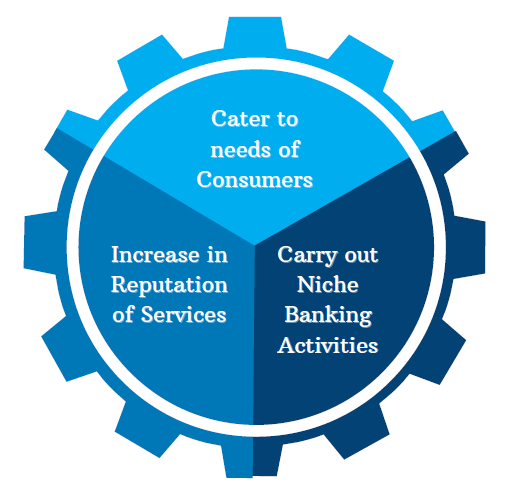

Benefits of Securing a Small Finance Bank License

The following are the benefits of securing a small finance bank license in India:

- Cater to needs of Consumers

This bank is formed with the main purpose to cater to the needs of consumers of rural and semi urban sectors of the society. Such customers would not get services from large financial institutions in India. Hence they would have to utilize the service provided by these small types of banks.

- Carry out Niche Banking Activities

By securing the small finance bank license, the bank can specialize in carrying out Niche Banking activities in particular areas. These areas include providing loans to small scale industries and other form of household, insurance based services and accepting of deposits from the public.

- Increase in Reputation of Services

These banks would cater to the needs of small customers. These customers would not get any form of financing facilities from other large banks and public institutions. Hence customers can utilize the services of a small bank providing above services.

Salient Features of a Small Finance Business License

The following are the features of securing this license:

- The applicant would secure the benefits of carrying out loans and lending activities to specific sectors of the society. These sectors would include rural sectors and semi-rural sectors.

- Usually the form of loans provided by these institutions would be around the range of Rs. 50,000 to Rs. 125000. However, loans of more amounts can be provided by this institution.

- An applicant choosing this type of license would find it easy to carry out the process of registration. It is quite straightforward and simple to form this type of entity.

- Usually this type of institution provides predominantly unsecured loans. However, secured loans would also be provided by this form of institution.

- Housing loans can also be provided by this form of institution. Usually small loans to the amount of Rs. 1, 25,000/- is provided by this form of institution.

- These institutions do not provide any form of public deposits.

- Either this type of entity can be formed as a section 8 company or it can be formed as a company established for the sole purpose of making some form of profit. Usually the type of structure utilised for forming this type of entity would either be a private limited company or a public limited company.

- When it comes to interest rates for this form of entity, then the respective guidelines related to RBI must be followed.

- Interest rates charged by this form of entity must be exceed more than 25%.

- Funds of any amount can be easily raised by this form of institution, and there is no form of ceiling on the amount of funds which are raised.

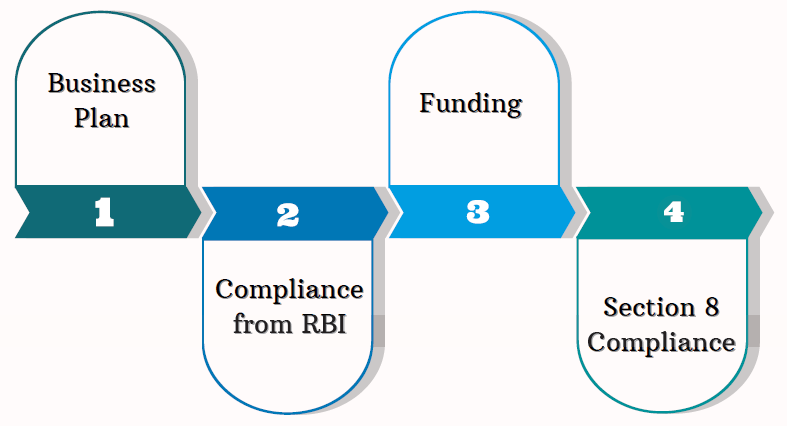

Eligibility Criteria for Starting a Small Finance Bank

The following criterion is required for starting this form of institution:

- Business Plan

In order to form this form of entity it would be crucial for the applicant to have a basic business plan. In the business plan the type of products and services offered must be mentioned. This must meet the requirements of the small business bank business model. Some of the objectives would include providing services to rural and semi urban areas.

- Compliance from RBI

Compliance from the RBI must be maintained by this entity. Not only compliance from the RBI, but other forms of compliance must be carried out as per the requirements of the Companies Act, 2013 and Reserve Bank of India Act, 1934. Usually this form of bank is exempted from the requirement of securing an approval from the RBI. However compliance must be maintained by this form of entity.

- Funding

Usually the promoters and directors have to meet the requirements related to funding of the small business bank. Small business banks would usually provide small time loans between the ranges of Rs. 50,000 to Rs. 1, 25,000.

- Section 8 Compliance

An entity which is formed under the provision of section 8 of the Companies Act, 2013 is a not for profit company. Such company is usually formed for not for profit activities which are carried out by different forms of societies. The applicant can either form the company as a public limited company with the purpose of making some form of profit or a company which is established for not carrying out any profit driven activities.

Forming a Small Finance Bank License as a Section 8 Company

If the company wants to be formed as a section 8 company, then the following process or procedure must be followed:

- First and Foremost the applicant has to obtain the digital signature certificates as well as the director identification number. There is a minimum requirement of two directors for carrying out the activities of this form of entity.

- After this is carried out the process of name approval is required.

- Once the approval for the name is carried out the applicant to register with the Central Government for carrying out the activities as permitted by the license. With this all the documents must be submitted by the applicant for starting this form of entity.

- The company would only be formed after securing the approval from the Central Government. Once the approval is got the applicant would receive the certificate of incorporation from the Registrar of Companies.

- The permanent account number and the TAN number would be provided after this.

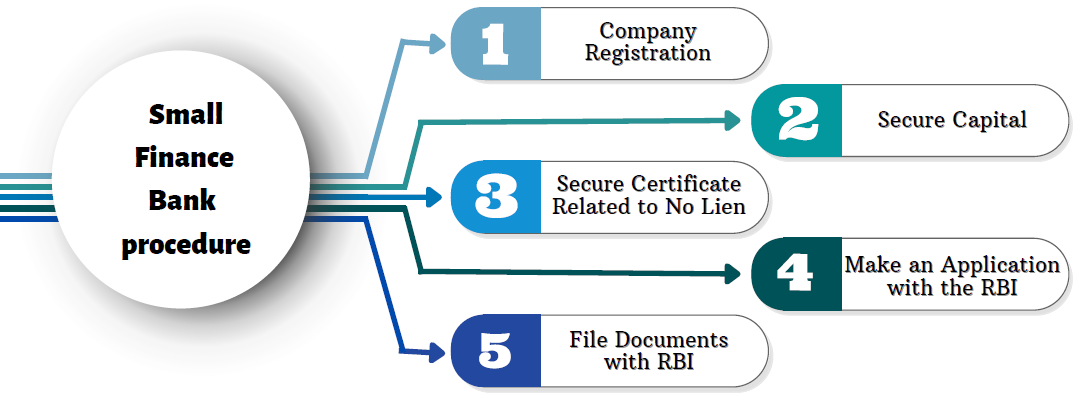

How to Start a Small Finance Bank?

The following procedure must be carried out to start a Small Finance Bank. This process would be if the entity is registered as a private limited company or a public limited company in India:

- Company Registration

An applicant wanting to form this form of entity must register the entity as a private limited company or a public limited company. For this requisite process must be carried out by filing documents with the MCA and the ROC.

- Secure Capital

In the next step, the applicant would have to secure minimum amount of capital for carrying out the operations of this form of entity. The minimum capital that is required for forming this type of entity is Rs. 5 Crore. Such is mandatory to carry out the requirements related to NBFC registration.

- Secure Certificate Related to No Lien

In the next step, the applicant has to receive a certificate from the Bank related to no form of lien on the amount of money which is present as the paid up capital for the small finance bank license. The amount of money should be in the form of a fixed deposit and no lien or any hold on the amount which is utilised as the capital for this form of entity.

- Make an Application with the RBI

In the next step, the applicant has to make or file an application with the Reserve Bank of India. The process of making this application is completely online. After this the NBFC would be started as a Small Finance Bank. After this is carried out the company or the entity would receive the CARN (Company Application Reference Number). This number has to be quoted by the applicant for carrying out any form of correspondence with the regulatory authority.

- File Documents with RBI

Though the above registration process to form this type of entity is completely online, the applicant also has to file a hard copy of the application for forming this type of entity. Hard copy of the documents as well as all the documents must be filed with the Regional Office of the Reserve Bank of India.

How do these entities operate?

Usually an applicant securing the small finance bank license would operate through the interest rates which are collected on different forms of accounts of customers.

Interest rates which are offered in savings accounts would be around 6 to 8 %.

Interest rates offered in fixed deposit accounts are usually higher which goes to about 9% Different forms of loans are provided by the Small Finance Bank. Through this the company can ensure that all the working capital expenses are recovered.

These banks are classified under the category of non-scheduled banks. Hence they cannot borrow from the RBI (Central Bank). Only scheduled banks are allowed to borrow from the RBI.

Documents Required

- Copy of the Certificate of Incorporation of the Company

- Information on the Directors and Shareholders related to the income earned by the respective individuals

- Total income and net income earned by the directors and shareholders of the entity

- Copy of the Memorandum of Association and Articles of Association (MOA and AOA) of the company

- Certificate from the Banker related to No-Lien on the amount of funds (5 crore)

- Respective Credit Report on the Directors and Shareholders

- Professional and Educational Qualifications of the Directors

- Bankers Report of the Status of the Company

- Structure Plan of the Organization

- Information on the Services and Products which would be offered by the Bank.

How to reach TAP GLOBAL for Small Finance Bank License

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables