Tax Optimization - An Overview

Tax Optimization is one of the essential aspects of personal finance. For tax optimization, we need proper tax planning. Most of India's individuals fail to assess their tax liability and do not plan tax savings until the last minute. Many individuals often encounter problems in assessing their actual tax liability. Due to these factors, the taxpayer ends up paying unnecessary taxes or opt for unnecessary tax savings.

In India, income tax planning strategies often concentrate more on deduction under Section 80C of the Income-tax Act, 1961. Tax planning helps individuals in optimizing tax planning strategies.

These days experts focus on the following general peculiarities for proper tax management:

- Classical method showing that all actions of the taxpayer are in accordance with the existing legislation.

- Minimal optimization involves tax optimization on possible occasions.

- Intentional loopholes are forming the taxation, and fiscal payments decrease.

What are the Types of Tax Optimization?

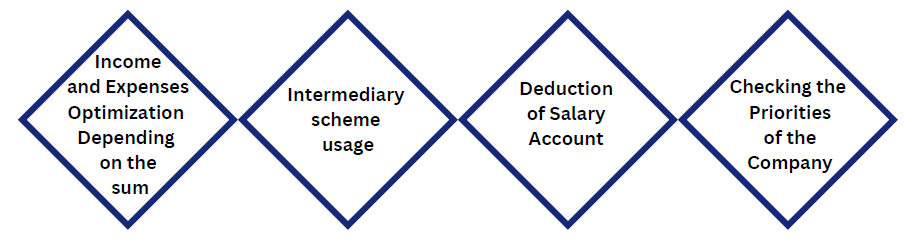

-

Income and Expenses Optimization Depending on the sum

In this type, you can use the sum of income tax to influence the object of taxation. The trade flows, time, and shipment volumes must also be considered.

-

Intermediary scheme usage

This is originally for companies working on sales, services, direct contracts, or delivery. This solution is very effective for influencing the formation of taxation object. However, it is also important to remember the illegal fraud, sanctions, or penalties.

-

Deduction of Salary Account

This type of procedure works for premium and business trips payments and also for any other expenses to be classified as dual-use costs.

-

Checking the Priorities of the Company

The company must check its priorities in various taxation forms. Competent structuring of some companies' taxation scheme allows lowering the burden of tax significantly.

What are the Ways and Tools of Tax Optimization?

Some of the legal methods for the purpose of tax optimization are as follows:

- Specialties' of ownership for sold goods change.

- Revaluation and decrease in expenses on extra items.

- Applying the possibilities of regional rate reduction.

- Simplified business division.

- Transferring the taxation object to the part- income-expenses.

- The merged procedure of simplified taxation with assumed tax profit.

- In case, as per the Income Tax Act, there is a positive rate of difference that taxpayers need not pay the income tax.

- As per the modernization procedure, you must involve all the assets and amortize them.

- Creation of preferential taxation.

- Redistribution of per cent inside the holding to deduct the interest on credits and loans.

- Purchasing the property in portions.

- Control and regulate tax payments.

- Contribution on the economy and compensations at dismissals and staff reduction.

What is the Main Difference Between Tax Planning and Tax Optimization?

Tax Optimization involves searching and identifying the legal and organizational framework that provides the lowest possible level of tax in a company.

Tax planning includes analysis of a company's financial situation and plans to incorporate taxation in an efficient way.

Tax optimization is a broader concept than tax planning; it is also said as the next step. In the beginning, a businessman looks at what kind of taxes and where he will need to pay. Hence, he/she plans them accordingly, and afterwards, he/she optimizes them. When we talk about taxes, optimization is considered as minimization.

In the previous few years, the meaning of the term tax optimization has shifted towards a less honest behavior pattern. In the meanwhile, tax planning is generally seen as a part of the financial planning of the company. However, in case one looks at the history of the meaning of both the terms, he will find that there is no such big difference between the two.

Why is Tax Optimization Important?

Tax optimization is important because of the following reasons:

- Finding capital from sources outside can be a challenge for small-sized companies or individuals. That is why saving tax is often the first line of defense for them.

- Tax optimization can also lead to additional sources of cash. The lower the overall tax rate, the more cash is left at the end of each financial year or to reinvest or to consider as profit.

- Private businesses should consider the positions of both the company as well as owner when investigating strategies to lower their overall tax rates. This also means that it is utilizing techniques that lower both corporate and personal tax.

How TAP GLOBAL Helps in Tax Optimization?

Our tax optimization services help companies in enhancing their performance and productivity. Our professionals deliver innovative solutions for delivering meaningful results for our clients, including:

- Improved quality, timeliness, and accuracy of financial reporting.

- Efficient and effective processes that incorporate best practices and quality controls.

- Opportunity for cost reduction, co-sourcing, and outsourcing and streamlining.

- Shifting of focus from compliance to value-adding or strategic activities.

- Achieving efficient and high-quality tax compliance.

- Providing insights into data in an automated process.

How Can Private Companies save Tax by way of Tax Optimization?

By way of tax optimization, private companies can save tax in the following ways:

Take Advantage of R&D Tax Credits

Taking benefit of the tax incentive program for conducting R & D to encourage businesses in all the sectors will lead to new, improved, or technologically advanced products or processes. Many companies are eligible to get this type of credit, but they are not aware of it.

Implement Effective Compensation Strategies

Usually, at the year-end, an owner of a private company tallies profits and distributes an appropriate amount to him and key staff through bonuses. Bonuses generally attract income taxes. This is where innovative compensation strategies come in.

Effective compensation strategies permit for both the deferral and the reduction in the tax rate on compensation. Employing these types of techniques not only results in lowering the overall tax rate for the private business owner, but it can motivate its employees by increasing their salary amount.

Consider worldwide tax planning

Some countries have proposed methods to reduce corporate tax rates. Private business owners cannot be ignorant of that because it always brings out a new way to keep more cash for their businesses.

- Companies can use this strategy by restructuring the way they finance their capital, through an intermediary financial company, and also by the way they hold their assets. It is convenient for a company to get tangled in the web of tax regulations associated with international tax planning.

- These specified financial strategies require consultation with the tax advisor.

Effective Tax Optimization Takes long-Term Planning

- The three techniques for reducing tax rates are available for all private companies. Any of these strategies can be used in conjunction with the strategies that allow for the deferral of taxes. Deferral strategies can take many forms that can range from deferrals of when income is reported to accelerating deductions. In the end, deferred taxes still need to be paid, but deferrals that last for a long time can just be as valuable as some tax-saving strategies.

- Effective tax rate management needs long-term planning and breadth of knowledge. Navigating through the tax system can make the most of the opportunities to be tricky, and it is easy to miss out on strategies that can lead to major savings.

- Many private companies lack the in-house technical expertise for identifying and implementing the tax-saving strategies. Finding capital to reinvest in your business may be worth the long-term investment.

What are the Objectives of Tax Optimization?

Some of the fundamental objectives of tax optimization are as follows:

Tax planning or tax optimization primarily revolves around reducing the tax liability. Every taxpayer wants to reduce the burden of paying taxes while saving their money for future purposes. Luckily, the Government provides many different investment schemes by way of which the liabilities can be reduced significantly. Still, it is important not to leave tax planning for the last moment. An individual must plan to invest in tax-savings instruments from the beginning of each financial year and also avail all the benefits for reducing tax payments.

Minimizing of legal litigations is important while planning taxes. If you do not have one, you must instantly avail the services of a legal advisor. You must consult your legal advisor and adopt adequate provisions related to income tax laws so that you can minimize the chances of litigation. Minimizing litigation will save you from getting legally harassed.

-

To stabilize the economy of the country

The taxes paid by an individual are devoted to the development of the country. By paying all the taxes that are legally due, an individual can contribute towards creating a productive economy. Hence, planning your taxes is beneficial for both the individual as well as the economy of the nation

-

To leverage productivity and financial growth

By planning your taxes in a prudent manner can facilitate economic growth. Specifying clear and precise financial objectives from your mentioned investments, over the specific time frames and then investing in the right tax-saving instruments can help a person to create a good corpus, thereby contributing to your economic growth.

What are the Different Methods for Tax Optimization?

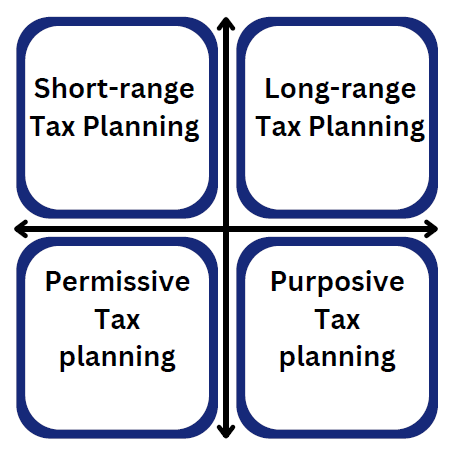

While many people think of tax optimization as a process that helps in reducing the tax liabilities, it can also be said that investing in the right instruments at the right time so that it can help you in achieving your short, medium, and long-term financial goals. There are four methods of tax planning. Some of the methods for tax optimization are as follows:

This term is used in reference to tax planning that is the execution of the process at the end of the financial year. Investors depend on this planning at the end of the fiscal year, trying to find ways to reduce their tax liabilities in a legal manner. For example, if, at the end of the financial year, the taxpayer finds that their taxes are high compared to the previous year, they may try to reduce it. Taxpayers may be able to do that by arranging it adequately to get tax rebates as per Section 88. Short-range tax planning does not involve long-term commitments, while it can still promote substantial tax savings.

The long-range tax plan is one followed when the financial year begins, and which the taxpayer follows throughout the year. Such an arrangement does not provide immediate tax-relief benefits as short-range plans do. However, it can prove to be beneficial in the long run. You usually have to start investing when the new financial year begins and hold on to the investment for a period exceeding one year.

Permissive tax planning means planning investments under the various specified provisions of the taxation laws of India. In India, there are many provisions of law, offering exemptions, deductions, incentives, and contributions. Section 80C of the Income Tax Act of 1961, for instance, offers several different types of exemptions (on the amount invested, interest earned, and the amount at maturity) on tax-savings investments.

Purposive tax planning is referred to the act of planning investments with specific purposes in mind, thereby ensuring that you can avail maximum benefits from your investments. It involves the accurate selection of investment instruments, creating a suitable agenda to replace assets (if necessary), and diversification of income and business assets based on your residential status.

How to reach us?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables