Conversion of NBFC into Bank - An Overview

Firms are governed by different provisions. If a particular entity is formed as a private or a public company and the main objects of the company is to carry out banking and financial services, then the company is known as a Non Banking Financial Company. To understand the process of conversion of NBFC into Bank, it is important to analyse the meaning of the terms NBFC and Bank.

NBFC- As defined under the Reserve Bank of India, an NBFC is a company which is formed under the provisions of the Companies Act, 2013 or previous company law. The entity formed as an NBFC can carry out activities such as the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature. However, there are certain activities which are not allowed to be carried out by an NBFC. As per the RBI definition, under section 45 (1) (c) - a banking company which carries out the business of a financial company would be understood as an NBFC. Hence the provisions related to the NBFC are regulated by the RBI as well as the MCA.

Bank- The meaning of bank is present under section 5 of the Banking Regulation Act, 1949. Any entity which is formed for the purpose of lending or carrying out any form of investments in the form of money, deposits of money and repayable when asked by the public or on demand. An entity which carries out all the above activities is known as a banking company.

When an NBFC is converted into a bank, there would be lower costing deposits. However, once they are converted to a Bank, there would definitely be more funding.

Main Regulatory Authority for Conversion of NBFC into Bank

The primary regulatory authority for conversion of NBFC into bank is the Reserve Bank of India. Banks are classified under the Banking Regulation Act, 1949. However a NBFC is authorised by the provisions of the RBI and the MCA.

Benefits of Conversion of NBFC into Bank

Benefits of Conversion of NBFC into Bank

- More Amount of Liquidity

When an NBFC is converted into a bank, there would be more amounts of liquid funds available to consumers. More consumers would consider investing in the activities which are carried out by a bank. More investment the entity would mean more liquidity for the bank.

- Accepting of Deposits

More amount of low cost deposits can be accepted by a Bank when compared to that of an NBFC. Banks service all types of customers and not just only a specific group of customers. Hence low cost and interest bearing deposits would be available to all forms of consumers.

- Entity can draw cheques

An NBFC cannot draw cheques and demand drafts. Customers would usually go to bank to credit money in their accounts through the form of cheques drawn in the favour of the payee. Such facilities are not allowed in a NBFC. Hence conversion of NBFC into a Bank would allow cheques to be drawn.

- Insurance Based Services

Once the NBFC gets converted to a bank they can carry out other forms of activities. Some of the services which can be offered would be insurance based services. However, the bank has to ensure to take prior permission and necessary compliance from the IRDAI regarding this.

- More Reputation

An NBFC converted into a bank would secure more reputation from the public. All types of digital products can be advertised directly to the consumer utilising this process. Apart from this, there can be direct marketing of products to consumers who come and utilise the services of the bank. Through this the overall reputation and goodwill of the bank would improve.

- Initial Public Offering

After conversion of NBFC into bank, the bank can start with the process of going for an Initial Public Offering. The bank would have to comply with the requirements of the SEBI (LODR) Regulations for carrying out such process. Reaching out to the public as a bank is faster when compared to that of an NBFC.

Eligibility Criteria for Conversion of NBFC into Bank

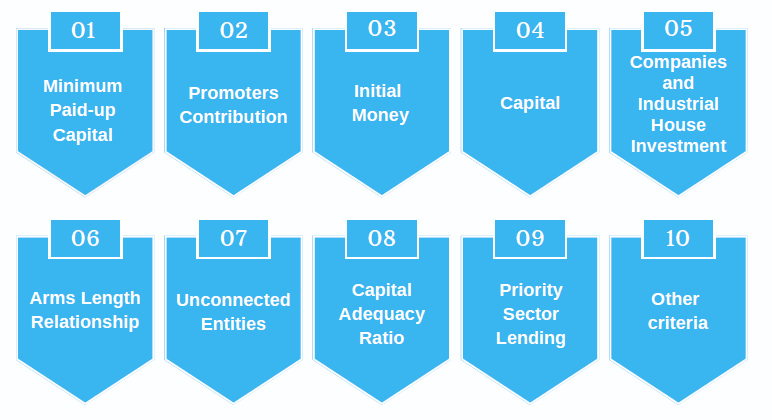

The following criterion has to be sufficed by the NBFC to convert into the Bank:

- Minimum Paid-up Capital

First and foremost, for conversion of NBFC into Bank, there has to be minimum paid up capital requirement for the bank. For a bank the minimum paid up capital must be Rs. 200 crore. This capital requirement must be increased to Rs. 300 crores within three years of commencement of operations of the business of the bank.

- Promoters Contribution

There has to be some form of contribution from the promoters of the company. The contribution must be 40% of the paid up money or the bank money.

- Initial Money

The money which is provided initially for liquidity purposes can be taken through some form of private placements or public placements.

- Capital

The capital has to be initially Rs. 200 crores, and has to grow to Rs.300 crores within three years of the commencement of the business. However apart from this, promoters have to collect additional money which would amount to 40 percent of the fresh money generated. Such capital which is secured must be locked in the bank for a period of 5 years.

- Companies and Industrial House Investment

When it comes to companies and other forms of industrial houses investment, then such are not allowed to invest in a bank. However, large form of companies would usually have good connections with large industrial houses. Such form of large companies would be allowed to invest in the bank. However, when it comes to the percentage of investment then about 10% of the equity capital is considered.

- Arms Length Relationship

There must be constant support between the entities. Apart from this the bank must maintain some form of commercial and arms length relationship with the promoter's entities and other branches.

- Unconnected Entities

The relationship if any between the promoters and the bank would be independent from each other. This means that they would be unconnected entities in ways. This is carried out to ensure that the principles related to corporate governance are followed.

- Capital Adequacy Ratio

The Capital Adequacy Ratio (CAR) is a percentage which has to be maintained by the bank when it comes to the liquidity. Hence the capital adequacy ratio must be around 8 to 10%.

- Priority Sector Lending

The activities carried out by the bank should ensure that lending is carried out as per the requirements of the RBI. The target should be around 40% of the net bank credit. This must be related to private banks.

- Other criteria

Apart from the above, the following criteria has to be sufficed for conversion of NBFC into Bank:

-The bank can consider opening the registered office or the head office in any place located in India.

- At least 25 to 30% operations must be started in rural and semi-rural areas.

- If the bank wants to open a branch office or a business related to mutual fund, then the same cannot be allowed for a period of three years since the beginning of operations or the commencement of the business.

- If the bank wants to carry out usual operations then the provisions related to the Banking Regulation Act, 1949 would be applicable. Apart from this above, the Reserve Bank of India Act 1934 would be applicable to the bank when it comes to compliance. If the bank wants to offer securities to the public by way of listing, then compliance related to relevant SEBI guidelines must be followed.

Procedure for Conversion of NBFC into Bank

For Conversion of NBFC into a bank, the following procedure must be utilised:

1. A report related to the feasibility study has to be provided by the entity. Once the report is made it must be filed with the relevant regulatory authorities in the correct manner. All applications must have a report related to the feasibility study as provided by the bank. The type of products which are offered by the bank, the technology utilised by the bank and other services provided by the bank must also be mentioned in this report.

2. After this the NBFC has to provide relevant details related to the members, directors and other key management executives who are involved in managing the operations of the bank. If there is some form of foreign contribution here, then details related to the same must be provided.

3. All the details related to this have to be provided to the RBI. For conversion of NBFC into Bank, the RBI would take all the factors which affect the conversion process. All applications would be forwarded to an advisory committee which is set up by the bank. This advisory committee would scrutinise the applications on a case to case basis to consider the requirements for conversion of NBFC into bank. After reviewing the application, the committee would make a decision regarding the approval or rejection.

4. If the application for conversion of NBFC into Bank is allowed, then the bank has to immediately start or commence business operations within a period of one year. This is carried out in order to comply with the requirements of the relevant law. If operations are not commenced within the period of one year, then the approval would become invalid.

5. However, after granting approval if the application has some form of additional requirements or modifications, then the RBI would consider the same and grant approval. However the RBI would provide some form of conditions which have to be adhered by the bank. If the conditions are not complied with then the approval status would be revoked by the RBI.

Post Compliance Requirements for Conversion of NBFC into Bank

The following are post compliance requirement for conversion of NBFC into Bank:

- Compliance

The bank has to regularly monitor any form of updates provided by the RBI and other authorities which would affect its business.

- Maintenance of CRR and SLR

After the process of conversion of NBFC into Bank is completed the bank has to ensure that the CRR (Cash Reserve Ratio) and SLR (Statutory Liquidity Ratio) is maintained as per the requirements related to the RBI.

- Minimum Net Worth

Initially the bank has to have a net worth or capital of more than Rs. 200 crores for commencement of operations. However, after three years of commencement this should increase to more than Rs. 300 crores. Such requirements related to net worth increase to Rs. 500 crore over the period of time.

Documents Required

- Certificate of Incorporation of the entity.

- MOA and AOA (Memorandum of Association and Articles of Association)x`

- Auditors Report.

- Resolution from the Board related to the process of conversion.

- Information related to maintaining liquidity.

- KYC documents of Shareholders and Directors.

- Approval Letter from RBI.

- Any other concerned document as required by the RBI.

How to reach Tap Global for Conversion of NBFC into Bank

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables