Tax Preparation Services - An Overview

Tax Preparation refers to the process of preparation of tax returns by an individual or an organization. The development of tax could be in regards applicable to an organization such as income tax, customs duty, excise duty, etc.

Tax Preparation is a very cumbersome and elaborate process. It requires careful perusal of the financial activities of an organization for a specific period and compilation of all bills and relevant documents for computation of tax.

The process further demands the filing of the tax returns with the appropriate tax authorities before the deadline.

Outsourcing of Tax Preparation

Many entities in developed nations have now started outsourcing their work of tax preparation to countries like India. The reason for the same is that India has an abundance of qualified tax professionals who hold expertise in tax preparation for foreign countries. Besides, the services can be availed at comparatively lower prices in comparison to the home country.

Tax professionals in developed nations charge an exorbitant amount for tax preparation services. On the other hand, in India, the same work, without making any compromise on the quality, can be done at almost half the price.

India also has the required infrastructure and technology to be able to provide the tax preparation services efficiently to the foreign clientele.

Process of Tax Preparation

At TAP GLOBAL, we undertake the following step-by-step procedure for tax preparation for our clients:

The procedure begins with the client sending scanned documents, which are relevant to tax preparation. When the documents are received, the corresponding data is entered into the tax software (of the client's choice) by the tax professionals.

When all the relevant data is entered into the chosen software, the tax professionals audit the tax return for checking that all the information has been entered precisely. The audit is done to avoid wrong computation of tax returns.

Once the tax return is audited and has received a green signal from the tax professionals, it is sent to the client for review. The client can raise any questions and leave any comments, in case any issue arises in return. The clients can request as many requests as may be required.

When the tax return has been reviewed and finalized by the client, the same is corrected and updated as per the clients demand. At last, the final copy of the tax return is sent to the client for filing with the relevant authority.

Advantages of Outsourcing Tax Preparation

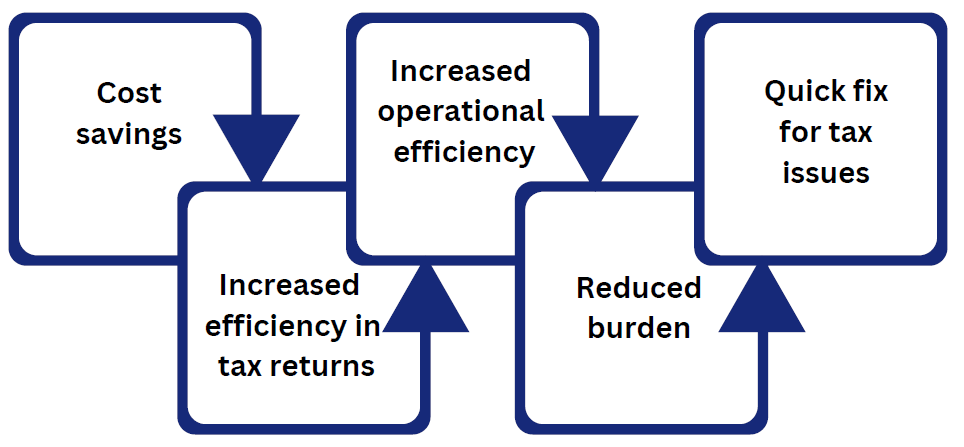

The following advantages can be obtained through outsourcing tax preparation:

By outsourcing tax preparation, an entity can make considerable savings in cost and save up to almost 60% of the amount that would have been spent in its home country. This way, the entity can increase its profit margin.

- Increased efficiency in tax returns:

By outsourcing work, an entity can expect that its returns would be computed very carefully after taking every aspect and law into consideration. Therefore, the chances of mistake are reduced to nil. This would also ensure that returns are filed on time with accurate evaluation having being done.

- Increased operational efficiency:

Outsourcing tax preparation would help an entity in saving a considerable amount of resources that can be used in other core operations of the organization, thereby increasing the operational efficacy of the entity.

Tax evaluation and filing is a cumbersome process. By outsourcing tax preparation, an entity escapes a significant task, and human resources can be utilized in other avenues that can help increase business for the organization.

- Quick fix for tax issues:

Outsourcing of tax preparation ensures that any tax-related concern or query would be handled immediately. Any tax complication can be solved quickly with the help of experienced professionals, well on time.

Importance of Filing Tax Returns

Tax Returns is very vital for any organization as it reflects that it is a law-abiding organization and earns respect and reputation of the society. With the help of timely tax filing, an organization makes esteem in the eyes of the authorities as a dutiful taxpayer.

Since tax computation and filing is an elaborate task and requires a lot of time and expertise, outsourcing the same is a good idea for any organization. This way, an organization can not only use experts in computation and filing of its tax returns but also use their opinion in making crucial financial and business decisions for making savings in tax.

Our team of experts has years of experience and the expertise in rendering tax preparation services of small, medium and large organizations. To avail our services or for any queries related to tax returns, contact us.

Documents Required for Tax Preparation

Some of the general documents required for tax preparation and filing tax Returns are as follows:

- Permanent Account Number (PAN)

- Aadhaar Number

- Bank Information and Details of the Assesses

- Tax Deducted at Source Documents (Form 16, Form 16A, Form 26AS,

- Any other investments proof under 80C, 80D, 80E and 80 TTA

- Travel Bills

- Rental Agreement

- Bank Books Certificates

How to reach TAP GLOBAL for Tax Preparation Services

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables