Financial Reporting Services

In any industry whether it is manufacturing or service, there are multiple departments, which functions on a daily basis to achieve organisational goals. The functioning of all these departments has a common thread that is the Accounting & Finance Department. The accounting and the financial aspects of each and every department gets recorded and reported to several stakeholders. There are two types of reporting that is specified:

- Financial Reporting “ For various stakeholders and;

- Management Reporting “ For internal management of an organization.

Considering the number of stakeholders and also other statutory and regulatory requirements, financial reporting is an essential task for any organisation.

Financial Reporting services are required for all organisations today. Every organisation must know its performance during a specific financial year. Financial reports help in assessing a company's financial performance hence the need for financial reporting and analysis arises. Companies by taking help of financial reporting services can prepare an outlook of its performance as excellent, good, satisfactory or poor.

What is Financial Reporting?

Financial Reporting is a practice done by every organization or business mainly to evaluate and analyze the company's financial performance in the previous financial year as well as on quarterly basis. In other words, financial reports provide the organization with an appropriate analysis regarding how the company has performed in the past and also its present performance.

Financial Reporting also involves the disclosing of financial information to various concerned stakeholders regarding the financial performance and also the financial position of the organization, for a specified period of time. The stakeholders in terms of financial reporting include Investors, Public, Governments, Debt providers and Government agencies.

In case of the listed companies the financial reporting must be done quarterly and annually. The end product of Accounting is said to be Financial Reporting.

What are the Objectives of Financial Reporting?

The objectives and purposes of financial reporting are listed below:

- Providing detailed information to the management of an entity that is used for the purpose of planning, benchmarking, analysis, and decision making.

- Providing a data to the investors, debt provider, promoters, and creditors that are used to permit them to make rational and prudent decisions with regard to investment, credit etc.

- Provide detailed information to the shareholders and general public with regard to listed companies about the various aspects of the organization.

- To provide data regarding the economic resources of an organization, claims made to those resources (liabilities & owners equity) and how these resources and claims have gone through change over a period of time.

- Providing information regarding how an organization is using its resources.

- Providing data to different stakeholders with respect to execution of their fiduciary duties and responsibilities.

- Providing all sort of information to the statutory auditors to facilitate audit.

- Enhancing the social welfare by looking into the interest of all its employees, trade union, and Government.

What is the Importance of Financial Reporting Services?

The importance of financial reporting services is known by every organization. It is needed by each and every shareholder for many reasons. The following listed points highlight the importance of financial reporting:

- It eases performing of statutory audit. The statutory auditors are needed to audit the financial statements of an organization to provide their opinion.

- It helps the organization in complying with the various statutes and regulatory requirements. The organizations need to file financial statements to ROC (Registrar of Companies) and Government Agencies. In case of listed companies, quarterly and annual report must be filed to the respective stock exchanges and also for publication.

- Financial Reports is the backbone for financial planning, benchmarking, analysis, and decision making. These are used for the purposes mentioned above by various shareholders.

- Financial reporting helps the organizations to raise capital in both overseas as well as domestic level.

- On the basis of financials, the public can analyze the performance of the organization as well as of its management.

- For the purpose of labour management, bidding, Government supplies etc. Organizations need to furnish their financial reports and statements.

What are the Basic Components of Financial Reporting?

The main components of financial reporting are as follows:

The income statement is considered as the most essential component in financial reporting. The detailed breakdown of a company's profit (or loss) is presented in the income statement.

To prepare an income statement, you need to calculate the gross profit or loss. To calculate this you can subtract the total income with the total cost of the goods sold. The cost of goods sold is calculated by the opening stock plus net purchases minus the closing stock.

The second subsection in the income statement is the net profit or loss of a company. The amount of net profit or loss is generated by subtracting the gross profit or loss with the operational costs, such as the taxes, salaries, rents and many others.

The balance sheet is a part of financial reporting that shows the ability of the company to honor the debt and obligations as compared to the company's total assets.

The non-current assets such as laptops or computers, machines and office furniture can be recorded in a balance sheet along with the current assets. The current assets to be recorded are: inventory, accounts receivable, and cash.

Non-current liabilities such as trade payables and bank overdrafts must also be recorded. The balance sheet also provides the company's equity position in a certain period.

Cash flows are the next component of financial reporting. It reviews the company's inward and outward cash movements. The outflows and inflows of money can be generated from investments, operations done and financing activities.

The cash flows that are generated from operations generally focuses on day to day activities of the company. The sales and inventory purchases are categorized as the company's process. The investments that are related to the incomes and expenses from the long term programs of the projects. While financing is as cash flow is related to the sale of shares and distribution of dividends.

The last component in terms of financial reporting is the changes made in equity. The component also reports the amount and sources of equity changes. Any changes made during a certain period are monitored from the increase or decrease of the starting balance in comparison to the ending balance. This component usually reports the equity composition that keeps on changing from time to time.

What are the Financial Reporting Services Offered in TAP GLOBAL?

At TAP GLOBAL, we have a dedicated team of experts who are focused on ensuring that you fulfil your financial reporting requirements with the following services:

- Preparation of Financial Statement as per the Indian GAAP, IND-AS or IFRS for the single entities or consolidated groups as required.

- Preparation of Consolidated Statements from the Subsidiary Company and its divisions.

- Liaising with the Statutory Auditors.

- A well prepared financial report for the purpose of management and decision making. Periodic ( monthly or quarterly or half yearly or Annual) reports, division or profit centre based reporting, product or project based reporting, analysis of employee revenue and its contribution, other reporting and analysis based on requirement.

- Financial Preparation Support as well as pre and post merger accounting.

Why Financial Reporting Services must be outsourced?

In any organization financial reporting is a critical tool. Financial reporting involves the collection, summarization, analysis, and presentation of financial health of a business.

Outsourcing financial reporting services to an expert like TAP GLOBAL can provide your organization with lots of benefits:

- Save your time in analyzing and preparing financial reports.

- Save your money by not spending your money on costly financial software.

- Efficient and improved decision making

- Accurate and free analysis of data.

- Focus on your core business operations.

- Fast and accurate services.

- Cost-effective as well as high quality services.

What are the Financial Reporting Services Provided at TAP GLOBAL?

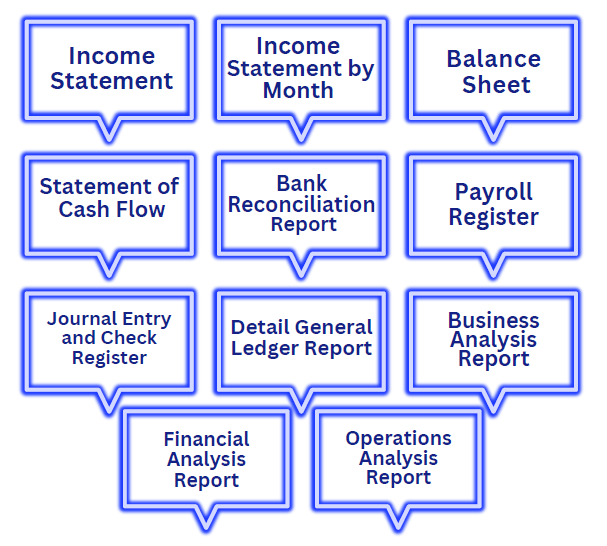

At TAP GLOBAL, we have well trained and skilled professionals who can provide efficient financial reporting services. We will provide you the following professional financial statements:

The income statement is a complete summary of costs, expenses, and revenue that is acquired over a particular period of time. The period of time usually is a financial year or a quarter. The income statement is also called as the profit and Loss statement or income and expense statement.

-

Income Statement by Month

Income statements by month are prepared to provide complete information for the previous twelve month period. These statements are displayed every month.

The balance sheet is the most important financial statement. The balance sheet displays the organization net equity, assets, and liabilities at a specific date.

This statement provides the cash flow activities of the organization. The statement of cash flow also highlights the sources and uses of cash for that particular year.

-

Bank Reconciliation Report

The bank reconciliation report presents the information about the cash balance shown on an organization books at a particular date. This report settles the balance with the displayed amount on the bank statement of the organization.

The payroll register displays all the required information in an alphabetical order about all the employees paid during a particular month. The payroll taxes as well as other deductions with the gross pay are displayed.

-

Journal Entry and Check Register

The journal entry register displays all the cheques written during a specific month. The register associates the checks with the general ledger accounts that are charged by them. The register also displays all dates regarding when the check was written.

-

Detail General Ledger Report

This report displays all the organizations activities in a particular month.

The business analysis report provides financial information from the statement of income, balance sheet and cash flow statement. This information effectively helps in calculating performance metrics. This report can also help in analyzing the financial performance of the organization.

-

Financial Analysis Report

This report helps in evaluating the balance sheet of the latest month with previous month balance sheet. This report basically shows the changes in the equity, assets, and liabilities.

-

Operations Analysis Report

This report shows the expenses, costs, and sales by category. The report here presents information related to a particular month and also compares the information between previous year and current year. We also can provide you with the management reporting services, sales tax reports, sales reports and purchase reports.