IFRS Reporting Services

A vast number of companies adopt International Financial Reporting Standards (IFRS) based on accounting or parallel reporting. The reporting is made voluntarily, which is a result of regulatory requirements. The prominent benefits of IFRS include increased comparability as well as improved transparency of financial reporting.

The financial reporting field in India has seen significant changes in the last five years. With the trade moving beyond national boundaries, the compliance and reporting requirements also shift accordingly.

Presenting the financial statements of a company in accordance with the reporting requirements of every country is quite difficult practically. A company that operates internationally faces numerous challenges.

TAP GLOBAL has extensive experience in IFRS reporting for companies in varied economic sectors. These include banks, insurance companies, telecom companies, investment funds, oil and gas, real estate, and other multiple industries.

Our IFRS specialists can assist you in IFRS reporting by providing the appropriate resources, knowledge, and practical support in all areas.

International Financial Reporting Standards or IFRS

The International Financial Reporting Standards (IFRS) are the specified accounting guidelines developed by the International Accounting Standards Board (IASB). It mentions a common accounting language that can be used by the companies for the preparation of Balance Sheets and financial statements globally. With the increasing globalization and cross-border business relations, it is now mandatory to prepare financial accounts and balance sheets in a similar way. As of now, the IFRS Reporting is applicable in 120 countries.

- Every country has its own specified set of accounting standards. IFRS reporting makes the process of comparing easy as it helps in understanding the accounts of companies across International boundaries with the help of a common accounting standard.

- The IFRS principles open more doors for investing in public trading as the companies will be clear and transparent with regard to their global market information.

- IFRS accounting needs extensive disclosure about the management of the company and internal financial transactions. In this way, the companies can be held accountable for any type of error or poor judgment.

Hence, the IFRS system ensures a high level of responsibility in the financial reporting and disclosure system.

What is IASB?

The International Accounting Standards Board (IASB) is set up as an independent body in 2001. Its formation was done with the sole responsibility of establishing the International Financial Reporting Standards (IFRS). IASB succeeded in the International Accounting Standards Committee (IASC), which was responsible for establishing the international accounting standards, IASB is based on its office in London. It also provided the 'Conceptual Framework of Financial Reporting' issued in September 2010 that offers conceptual understanding and the basis of the accounting practices under the IFRS.

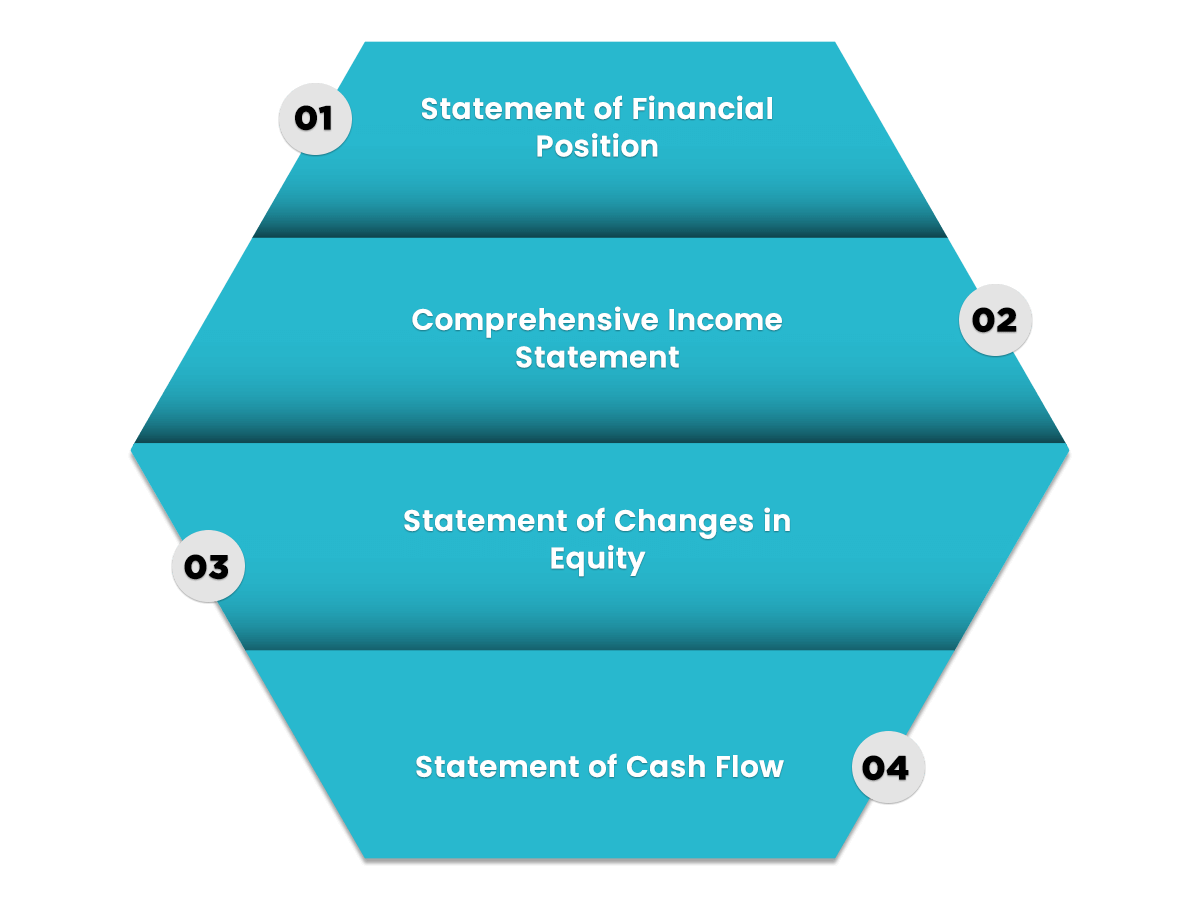

Components for IFRS Reporting

-

Statement of Financial Position

The statement of financial position is also known as the Balance Sheet. IFRS influences the ways of reporting the components of a balance sheet.

-

Comprehensive Income Statement

This can be one complete statement, or it can also be separated into a Profit and Loss Statement and a Statement of other income that includes the property and equipment.

-

Statement of Changes in Equity

It is also referred to as a statement of retained earnings. This documents the company's change in the revenues or profit for the specified financial period.

The company's financial transactions are summarized in this report for the given period. It separates cash flow into operations, investing, and financing. Along with these necessary reports, a company also needs to give a summary of its accounting policies. The complete report is usually checked with the previous report, to show the changes in the profit and loss account. A parent company for each of its subsidiary company must create a separate account reports.

List of International Financial Reporting Standards (IFRS)

The accounting standards issued by the IASB are called IFRS. Some of the standards set up by IFRS are mentioned below:

|

Standard No.

|

Title of Standard

|

|

IFRS 1

|

First-time Adoption of International Financial Reporting Standards

|

|

IFRS 2

|

Share-based Payment

|

|

IFRS 3

|

Business Combinations

|

|

IFRS 4

|

Insurance Contracts

|

|

IFRS 5

|

Non-current Assets Held for Sale and Discontinue Operations

|

|

IFRS 6

|

Exploration and Evaluation of Mineral Resources

|

|

IFRS 7

|

Financial Instruments: Disclosures

|

|

IFRS 8

|

Operating Segments

|

|

IFRS 9

|

Financial Instruments

|

|

IFRS 10

|

Consolidated Financial Statements

|

|

IFRS 11

|

Joint Arrangements

|

|

IFRS 12

|

Disclosure of Interests in Other Entities

|

|

IFRS 13

|

Fair Value Measurement

|

|

IFRS 14

|

Regulatory Deferral Accounts

|

|

IFRS 15

|

Revenue from Contracts with Customers

|

|

IFRS 16

|

Leases

|

|

IFRS 17

|

Insurance Contracts

|

|

IAS 1

|

Presentation of Financial Statements

|

|

IAS 2

|

Inventories

|

|

IAS 7

|

Statement of Cash Flows

|

|

IAS 8

|

Accounting Policies, Changes in Accounting Estimates and Errors

|

|

IAS 10

|

Events after the Reporting Period

|

|

IAS 11

|

Construction Contracts

|

|

IAS 12

|

Income Taxes

|

|

IAS 16

|

Property, Plant, and Equipment

|

|

IAS 17

|

Leases

|

|

IAS 18

|

Revenue

|

|

IAS 19

|

Employee Benefits

|

|

IAS 20

|

Accounting for Government Grants and Disclosure of Government Assistance

|

|

IAS 21

|

The Effects of Changes in Foreign Exchange Rates

|

|

IAS 23

|

Borrowing Costs

|

|

IAS 24

|

Related Party Disclosures

|

|

IAS 26

|

Accounting and Reporting by Retirement Benefit Plans

|

|

IAS 27

|

Separate Financial Statements

|

|

IAS 28

|

Investments in Associates and Joint Ventures

|

|

IAS 29

|

Financial Reporting in Hyperinflationary Economies

|

|

IAS 32

|

Financial Instruments: Presentation

|

|

IAS 33

|

Earnings per Share

|

|

IAS 34

|

Interim Financial Reporting

|

|

IAS 36

|

Impairment of Assets

|

|

IAS 37

|

Provisions, Contingent Liabilities, and Contingent Assets

|

|

IAS 38

|

Intangible Assets

|

|

IAS 39

|

Financial Instruments: Recognition and Measurement

|

|

IAS 40

|

Investment Property

|

|

IAS 41

|

Agriculture

|

What are the Benefits of IFRS Reporting?

IFRS reporting has got many benefits; some of them are discussed below:

- Wider acceptability: IFRS reporting is accepted globally. The financial statements prepared as per IFRS are widely accepted in all the countries.

- Comparability of Financials: Since IFRS reporting is done as per global standards, the companies of different nations following IFRS can be easily compared.

- Elaborated Guidance: IFRS reporting provides elaborated guidance on the procedures to apply principles given in standards in varied situations.

- Changes in standards as per economic conditions: The principles of IFRS reporting are revised or modified if there is any significant change in the economy.

Application of IFRS Reporting

Nations across the world can either adopt similar IFRS reporting standards, or it can be adopted after IFRS convergence. This has been explained in detail below:

The adoption of IFRS explains that the country will adopt IFRS in its original form without any deviation. The companies in that particular nation where IFRS is applicable must comply with these standards completely.

Countries can deviate from IFRS issued by IASB to some extent. The deviation can be a change of terminology used, modifying principles for recognizing assets, liabilities, income or expense, addition or deletion of disclosures (considering the local law of the country applying IFRS), addition or removal of examples.

The main logic of applying IFRS after applying convergence is that the rules of one country will conflict with the above principles. It will create confusion in corporate reporting. Hence, Indian Accounting Standards are substantially similar to the IFRS but with some carve-outs to ensure that these standards are suitable for application in the environment of the country opting for convergence.

Applicability of IFRS Reporting in India

India has opted to apply IFRS reporting after making some deviations from the original IFRS (. In India, IFRS reporting in their converged form is popularly known as Ind AS. These Ind AS are applicable to specified category of reporting as enumerated below:

In Case of Companies:

- Companies whose equity or debt securities are listed or are in the process of being listed on any stock exchange in India or outside India.

- Unlisted companies are having a net worth of Rs. 250 crore or more.

- Holding, subsidiary, joint venture, or associate companies of companies covered in point (1) and (2) above.

Voluntary applicability: Company may voluntarily apply Indian accounting standards (Ind AS).

Companies on which Ind AS is not applicable will continue to follow existing Accounting Standards (AS), which will be upgraded by ICAI.

Banking Companies and Insurance Companies:

Banking Companies and Insurance Companies have their statues. They shall apply Ind AS as notified by the Reserve Bank of India (RBI) and Insurance Regulatory Development Authority (IRDA), respectively.

However, for the purpose of consolidation, the insurance company shall provide financial statements in compliance to Ind AS for the purposes of preparation of consolidated financial statements by its parent, investor, as required by such parent or investor to comply with the requirements of these rules.

What is the Purpose of IFRS Reporting?

The primary purpose of implementing IFRS reporting is as follows:

- It shall lower the cost of capital.

- It will bring in new opportunities.

- IFRS Reporting will also improve brand value.

- IFRS Reporting will enable benchmarking with global peers.

- By way of IFRS reporting, the fair value can also be checked as if it is feasible or not.

The Indian authorities have taken steps to fully cover the IFRS for remarkable development and up-gradation of standards.

What is the Impact of IFRS Reporting in India?

The impact of IFRS in India is mentioned below:

- In the Indian market, where the activities are generally carried out by small and medium-sized companies, determining an appropriate fair value is difficult.

- India is a growing economy. Hence, it does not have adequate skilled resources for meeting the demands of complex technology and proper trainers that are required for the successful implementation of IFRS reporting.

- The cost of complying with the IFRS reporting provisions is comparatively higher than the benefits received by it.

- Understanding IFRS reporting is complicated as it is mostly based on the models and analytics.

- With IFRS reporting, companies in India can present themselves in the foreign markets that were really difficult with the traditional methods of accounting principles.

How can TAP GLOBAL Help you?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables