Enterprise and Strategic Risk Management Services

Strategic risk management is considered a business discipline that focuses on uncertainties and untapped opportunities affecting an organization's strategy and execution.

Strategic risk management is basically explained as the process of identifying, assessing, and managing the risks in an organization's business strategy that includes taking action whenever the risks are realized. Strategic risk management evaluates the full range of possible events and scenarios that will affect the procedure and its execution, having an ultimate impact on the company's value. Risk is all-inclusive, including everything from product innovation risk and market risk to supply chain risk and reputational risk. The primary component and foundation of enterprise risk management require the organization to explain tolerable risk levels as a guide for decision-making strategically. It is a continuous process that must be embedded in a strategy setting as well as strategy execution.

Enterprise risk management can encompass a broad range of risks faced by any organization. Some risks reflect the exposures that, although harmful, will not threaten the overall health of an enterprise or its ability to meet its objectives.

Some risks reflect the exposures that, although it is harmful, will not threaten the organization's health. Other significant events can be catastrophic that will result in losses that cannot only impair an organization's ability to achieve its goals.

What Is Strategic Risk Management?

Strategic risk management is a process of developing strategic risks for an organization. This inhibits an organization's ability to achieve its strategy and strategic objectives to create and protect the shareholder and stakeholder value. It is an essential component and necessary foundation of Enterprise Risk Management. This definition also incorporates the principles of risk management:

- It is a process for identifying, assessing, and managing both the internal and external events and risks that can affect the achievement of strategy and strategic objectives.

- The main aim is to protect shareholder value.

- It is the main component and necessary foundation for the organization's overall enterprise risk management process.

- It is affected by the Board of Directors, management, and others.

- It also needs a strategic view of the risk and consideration regarding the internal or external events or scenarios that will affect the organization's ability to achieve its objectives.

- It is considered a continuous process embedded in strategy setting, execution, or management.

What are the Essential Steps for Strategic Risk Management?

Strategic risk management is viewed as the foundation for both the management and board levels. The exact steps taken by an organization shall depend on the level of maturity of the ERM(Enterprise Risk Management) process. The correct actions taken by an organization depends on the level of maturity of its ERM processes.

The steps for strategic risk management are as follows:

- Assess the maturity of the organization ERM efforts that is relative to its strategic risks.

- Review the process for strategy, including the identification of related risks.

- Review the processes for measuring and monitoring the organization performance.

- Develop an ongoing process to update the assessment of strategic risks periodically.

What is the Difference Between Strategic Risk and Operational Risk?

Recognizing and taking action on strategic risks is essential to mitigate long term issues. But strategy risks and operational risks are different in the following ways:

- The strategic risks come from both the internal and external forces. The operational risks tend to stoop solely from the internal processes within the business, especially when they will disrupt the workflow.

- It can also be said that strategic risk is about what you will do, and operational risk is how you will do it.

- For example, second-hand machinery can slow down the production that will delay completion of the work and ultimately damage the employee's morale. Here the operational risk can stem from what appears to be a non-critical problem but can drag down productivity.

How to Identify Strategic Risk?

In strategic risk management, two things are essential:

- A deep understanding of the organization, the target audience, the market sector, competitors, and the environment in which the business operates.

- An awareness of the organization strategic goals, from beginning to the proposed execution.

Collecting data on both areas requires time and investment, but it is worth achieving the most accurate insights into the strategic risks. There is more information that can be drawn. You will be able to implement processes and safeguards that facilitate organizational success.

One more approach to identifying the risk is to have a word with a range of stakeholders and to know about their views on strategic risks. Suppose you consult a big group. They will have different perspectives on an organization from that of your dedicated employees.

Types of Strategic Risks to Prepare a Proper Strategic Risk Management Plan

The strategic risks that are relevant to your business depend largely on your sector, consumer range, product range, and many other factors. There are some broad types of strategic risks. They are as follows:

Let us imagine an organization starts work on a new product or plans a new service set to transform the market. Sometimes it spots a gap in the industry and then finds a way to fill it. However, the regulations change with time, and the product or service suddenly becomes unacceptable. The company cannot deliver the result of its labor to the target audience, risking a substantial loss of revenue. The organization had hence prepared for unexpected regulatory change. The completed project elements can be incorporated into another or adapted to offer a slightly different solution. It is essential for the companies to stay updated on all the relevant regulations to the market and be aware of the possible changes in the future.

Many industries are highly competitive. The companies can lose the ground if their market rivals release a similar product at the same or lower cost. The pricing may be irrelevant if the product is in any way, superior.

The competitor analysis can help mitigate this strategic risk. The businesses should never operate in a vacuum.

It is difficult to predict economic risks, but they can pose a real danger in even a well-prepared strategy. For instance, the economic changes lead a business target audience to lose mush of disposable income.

What are the Steps for Proper Strategic Risk Management?

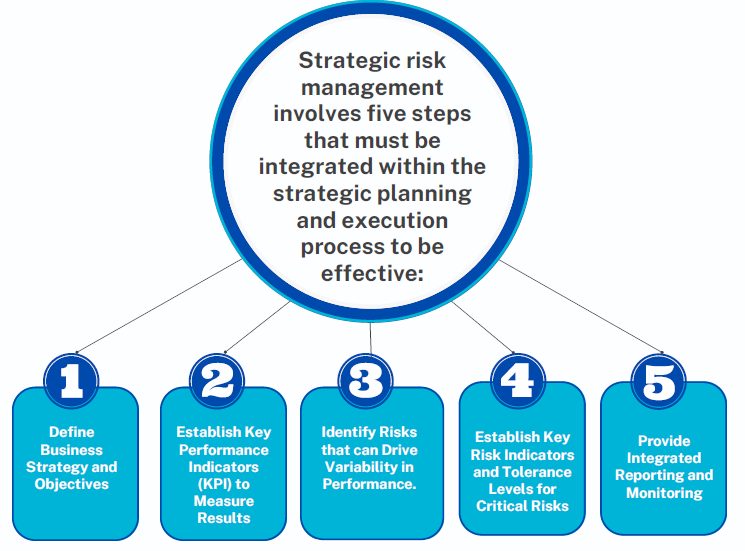

Strategic risk management involves five steps that must be integrated within the strategic planning and execution process to be effective:

-

Define Business Strategy and Objectives

There are many frameworks that the companies commonly use to plan out a strategy, from simple analysis to a more nuanced and holistic balanced scorecard. The thing that is common in these frameworks is their failure to address risk. The companies must take additional steps to integrate risk at the planning stage.

-

Establish Key Performance Indicators (KPI) to Measure Results

The best key performance indicators that offer hints to the company can also help in improving them. Hence, the complete sales make a poor KPI, while the transaction made per customer basis lets the company search for answers.

-

Identify Risks that can Drive Variability in Performance.

These are the unknown issues, such as future customer demand, that will help determine results.

-

Establish Key Risk Indicators and Tolerance Levels for Critical Risks

The KPIs measure historical performance, whereas Key Risk Indicators or KRIs, are forward-looking leading indicators intended to anticipate the potential roadblocks. The tolerance levels serve as triggers for action.

-

Provide Integrated Reporting and Monitoring

Finally, the companies need to regularly monitor the results and KRIs to mitigate risks or grasp unexpected opportunities.

What is the Process for Strategic Risk Assessment?

There are seven steps for conducting a proper strategic risk assessment:

-

To Achieve a Deep Understanding of the Strategy of the Organization

The first step in the assessment process is to get a clear understanding of the organization's business strategies and objectives. Some organizations have well developed strategic plans and objectives, whereas others can be more informal in their articulation and documentation of the strategy.

A foundation for integrating risk management with a business strategy can be established in this step.

-

Gather Views and Data on Strategic Risks

The next step is the gathering of information and views on the organization strategic risks. This can be done by way of interviews of managers and directors, surveys, and the analysis of information. This data gathering must also include both internal and external auditors.

-

Prepare a Preliminary Strategic Risk Profile

The level of detail and the type of presentation must be tailored to the culture of the organization.

-

Validate and Finalize the Strategic Risk Profile

The initial strategic risk profile shall be formed and validated. can involve validation with all managers and directors.

-

Develop a Strategic Risk Management Action Plan

While a significant effort is needed in an initial risk assessment and strategic risk profile, the real product of this effort must be an action plan to enhance the risk monitoring or management actions related to the identified strategic risks. This process's vital reason is to help and enhance the organization ability to manage and monitor its highly rated risks.

-

Communicate the Strategic Risk Profile and Strategic Risk Management Action Plan

Enhancing the organization risk culture is a communications effort with two main focuses.

The first focus is the communication of the organization top risks and the strategic risk management action plan in understanding how to manage risks.

The second focus is the communication of the management's expectations regarding risk to help reinforce the message that the understanding and management of risk is a core competency for people across the organization.

-

Implement the Strategic Risk Management Action Plan

The main value resulting from the risk assessment process comes from implementing an action plan for managing and monitoring risk. These steps define a necessary, high-level process and allow a significant amount of tailoring and customization to reflect the organization's maturity and capabilities.

How to Reach TAP GLOBAL?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables