Microfinance Company Registration- An Overview

In order to provide easy credit to the society, microfinance institutions were an initiative taken by the government of India. These companies provide credit facilities to SME and other forms of organisations which find it hard and difficult to secure loan facilities from large financial institutions and banks. Hence this form of organisation is known as a Micro-Credit agency or a microcredit institution. This institution is framed to provide small loans and finance for institutions.

Usually the amount of loan provided by a microcredit institution would be up to Rs. 50000/- for rural areas and Rs. 125000 for urban areas. A Microfinance company can be easily established by registering it as a section 8 company under the framework which is promulgated as the Companies Act, 2013.

Types of Microfinance Companies- Microfinance Company Registration

An applicant wanting to go for microfinance company registration has to first choose the type of Microfinance Company. The following are the types of microfinance institutions:

Features of Microfinance Company

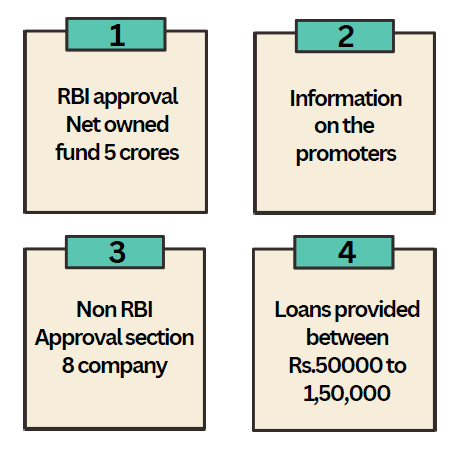

The following features must be present in an entity acting as a Microfinance company:

- The company must be registered under the provisions of the Companies Act, 2013 or the Companies Act, 1956.

- A company that is registered as a Microfinance institution must have the required net worth.

- There must be compliance by the microfinance company in securing the requisite license.

- Usually Microfinance companies serve the lower sections of the society.

- Banking and other forms of services is provided to the smaller sections of the society.

- Usually the clients of a Microfinance company would be in the fishery business, carpentry or other forms of businesses.

- This enterprise is established with the primary motive of not providing any form of collaterals.

Criteria for Microfinance Company Registration

The following criterion has to be present for an entity being registered as a Microfinance Institution:

Can Section 8 Companies go for Microfinance Company Registration?

The registration requirements related to microfinance companies have to comply with the requirements of the Reserve Bank of India. However, the RBI regulates financial bodies such as Non Banking Financial Institutions. However, the RBI has passed a circular related to the operation of a Microfinance Institution as a Section 8 Company. This circular was brought out in 2015 regarding the Microfinance Company.

Microfinance Company Registration- Can securities be received?

Microfinance companies are prohibited from accepting any form of deposits from the public. Hence this would be applicable to section 8 Companies in order to be compliant with the provisions of law. A section 8 company usually raises contributions as per the requirements of carrying out philanthropic and society based activities. Hence such companies would be concentrating more on increasing their income through different forms of donations.

However there is an alternative. First and foremost the company has to be registered as a Non-Deposit taking company as per the requirements of the RBI. After this is carried out you can demand for taking deposits as per the requirements of the RBI.

Benefits of Microfinance Company Registration

The following are the benefits of securing Microfinance Company Registration

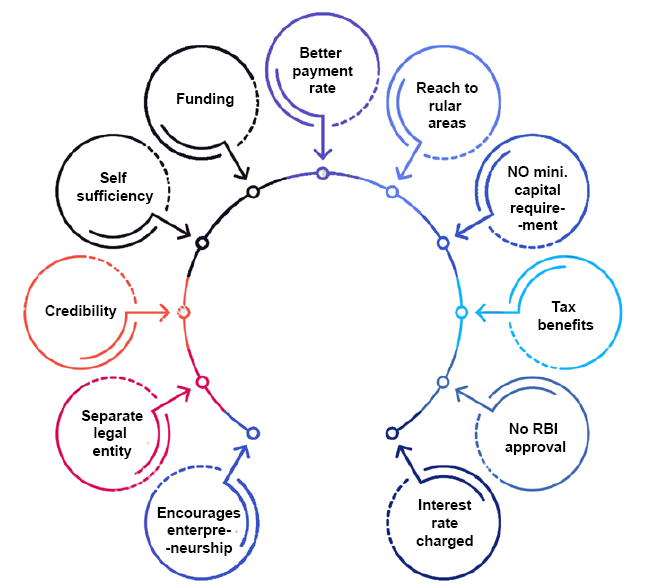

- Self Sufficiency

Once the Microfinance Company is established the operations related to the company would be self sufficient.

- Funding

It is usually simple to secure funding for registering a microfinance company.

- Better Repayment Rate

When compared to banks and financial houses, microfinance companies definitely have a better repayment rate. This would be for small time loans which are provided to individuals and other business houses.

- Reach to Rural Areas

Microfinance companies have better access to rural areas. Such companies can provide loan facilities to rural areas. Usually these financial institutions would be considered having a better reach when compared to large banks and industries.

- No Minimum Capital Requirements

There is no minimum capital requirements for establishing a microfinance company.

- Tax Benefits

By going for Microfinance company registration in India, there are numerous amount of tax benefits.

- No RBI Approval

As there is minimum compliance requirement for establishing a microfinance company; there is no requirement for any form of RBI approval.

- Interest Rate Charged

Microfinance entities are usually free to charge high interest rates. The interest rate charged by a microfinance company can be between 20 to 25 %.

- Encourages Entrepreneurship

Starting this form of entity, encourages entrepreneurship to carry out the requirements of the business.

- Separate Legal Entity

Section 8 Microfinance company has to be registered under the provisions of the Companies Act, 2013. Hence there is separate legal entity of the members of the microfinance company.

- Credibility

Such form of entity is more credible in the eyes of the public. More forms of loans with different disbursements can be provided.

Mandatory Compliances for Microfinance Company Registration

The following compliances have to be mandatorily followed for Microfinance Company Registration:

- RBI Compliance

This form of compliance must be followed by a microfinance company to operate. A microfinance company does not need to comply with the requirements of RBI however; the rules related to microfinance companies must be followed.

- Companies Act, 2013

A Microfinance Company is formed as a section 8 Company. The section 8 company has to comply with the requirements of the Companies Act, 2013.

Apart from the above there are also other compliances such which have to be followed by the microfinance company.

How to Register a Microfinance Company?

The following process is required for microfinance company registration (MFI-NBFC)

- Company Registration

First and foremost the Microfinance Company has to register as a company under the provisions of the Companies Act, 2013. For this SPICe + Form has to be utilised. When the company is initially registered, the type of business structure which is utilised for this form of organisation would either be a private limited company or a public limited company. The capital authorised for the entity can be Rs. 1, 25,000/-.

- SPICe Plus Service

Usually the above service would be easily carried out by the applicant as the whole process of registration is online. This service would provide name reservation, DIN, Mandatory Issue of the PAN, TAN, EPFO, ESIC and other forms of registration which is required. The following compliances have to be carried out after the above process:

• If the company is started as a new entity, then the name has to be reserved.

• All the other compliances related to EPFO, GST, Income Tax, PAN, TAN, Bank Account and professional tax registration (If Required) has to be carried out in compliance with the required law.

- Application in SPICe Plus

The applicant has to click on SPICE plus under the respective MCA services. The applicant would be redirected to another page to apply for a new application. If the company already exists then existing application has to be clicked on. Then the applicant has to check the correct category of the company. Under this the sub-category of the company must also be check on.

All the activities which are carried out by the company have to be mentioned. Hence if an applicant going for a particular process of microfinance company registration has to specify the industrial activities.

- Check For Name

If the name of the company for Microfinance Company Registration is present, then the applicant has to click on auto check to fulfil the requirements related to name of the company. All the other information related to the name of the company must be submitted. Both part A and part B must be submitted. The following details have to be submitted along with the above:

• Name of the company

• Location of registered office of the company

• Activities which are carried out by the company

• PAN , TAN and other forms of registrations have to be carried out

• It would be useful to carry out a pre-scrutiny check for the above process related to registration

• All the particulars in Part B of the PDF has to be downloaded. The digital signature certificates of the directors must be affixed to the forms. All the requisite forms must be downloaded which include the AGILE-PRO, SPICe+MoA and SPICe+AoA, URC-1 and INC-9. These forms must be linked and uploaded online. A request number would be generated after this. The applicant has to provide payment then the information present in the forms would be processed.

- Capital Raising

In the next step for Microfinance company registration, the company has to raise about Rs 5 Crore or 2 Crore as per the requirements.

- Opening a Bank Account

In the next step the applicant would open a bank account. A certificate related to no lien created would be required for the above process. An application would be presented to the RBI for this form of certificate.

- Microfinance Company Registration- Apply to RBI

All the certified copies of the microfinance company have to be provided to the RBI. The following documents or certified copies have to be submitted to the RBI:

• Incorporation Certificate- Copies

• Memorandum of Association and Articles of Association

• Copy of the FD (Fixed Deposit Receipt)

• Certificate from Bankers Related to No Liens on the Net Owned Fund.

- Application

In the next step, the applicant has to make an online registration with the RBI for Microfinance company registration. With this the applicant would receive a ‘Company Application Reference Number’.

- Submission of Hard Copy

After this process, the applicant has to submit hard copies with the respective regional office of the RBI. The RBI would carry out scrutiny and respective due diligence to confirm with the requirements.

Process for Registering a Section 8 Company in India

- Prepare DSC and file Name Approval

The very first step for Section 8 company registration is to prepare DSC. Apply for Digital Signature Certificate (DSC) as soon as possible. Section 8 companies should contain words like Foundation, Society, Association, Council, Club, charities, Academy, organisation, Federation, Institute, Chamber of Commerce, Development and many more.

- Filing of Section 8 Incorporation Forms on MCA Portal

After getting approval from the regional director, we will proceed to file the section 8 company registration application with the requisite documents before ROC. Once all clarifications are provided to ROC, the ROC shall issue a Certificate of Incorporation along with a Company Identification Number (CIN). This would be carried out as per the requirements under SPICE plus (Spice +)

- MoA and AoA file submission

Once you get the License, you need to draft the Memorandum of Association (MoA) and Article of Association (AoA) to file section 8 company registration applications.

- PAN, TAN and Bank Account

You must have your PAN, TAN and bank account ready while going for Section- 8 Company registration in India.

Documents Required for MFI Registration in India

The documents required for Microfinance company registration would be similar to the documents as required by a section 8 company. The following documents are required for Microfinance company registration in India:

- Duly tested copy of Company Incorporation certificate

- Copy of 'Memorandum and Articles of Association' (MOA & AOA) of the entity

- Resolution of the Board regarding the decision to carry out functions related to a microfinance company

- Banker's Report

- Bankers Certificate related to No Lien

- Report from auditors related to ‘minimum net owned fund (NOF) of the entity or the applicant entity

- A certificate of 'Chartered Accountant’ related to information of the members or the executives of the company. Along with the above, details of investments in other 'NBFCs' as shown in the 'Performa Balance Sheet'

- Educational Certificates and other certificates related to the key management executives and shareholders of the company

- Permanent Account Number: PAN for Indian Citizens

- Passport size photograph: Not more than ten months old photo of directors and shareholders

- ID proof: Copy of Aadhaar card/voter identity card/passport/driving license of directors and shareholders. Aadhaar number is mandatory requirement for any form of registration.

- Address proof: Electricity bill, water bill, bank statement, gas or telephone bill of shareholders and directors

- Copy of the rent agreement- If the premises is rented then a copy of the rent agreement must be provided

- Utility Bills such as Electricity bill, water bill, bank statement of the registered office must be provided

- Know Your Client (KYC) or Income Proof Related to Directors and Key Management Executives

- No Objection Certificate from the Company

- Net worth certificate of the directors

- Financial Report related to the Directors

- Credit Statement of the Directors and Key Management Executives

- Detailed Information related to the risk and evaluation process which is carried out for Microfinance Company Registration

- Detailed Structure and Plan of the Organization

- Proof of Passport if the national is an Indian. For any foreign nationals apostilled or notarized copies of the passports must be submitted.

- All the documents which are submitted should not be less than 2 months old.

Loans provided by Microfinance Institution

Usually small amount of loans would be provided by a Microfinance Company. As these loans are provided to the rural sectors of the society, such loans would not be secured. However the company is capable of charging interest rate in accordance to the requirements.

- Interest rate charged by a microfinance company must not exceed a particular level.

- The interest rate charged by a MFI must be reasonable.

- The requirements of the loans being paid must comply with the requirements related to an MFI.

How to reach TAP GLOBAL for Microfinance Company Registration

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables