Secretarial Audit - An Overview

Such requirements of this form of audit are required for most companies in India. There are specific provisions which have to be complied by the company for carrying out audit. The main law that regulates secretarial audit in India is the Companies Act, 2013. Under section 204(1), companies are required to obtain a secretarial audit report from the secretarial auditor. Such provision has to be read with rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014.

Features of Secretarial Audit

- This form of audit ensures that the company is carrying out the requirements as per the Companies Act, 2013.

- It promotes good practices amongst the members of the company.

- As it is carried out by group of individuals, it promotes independence throughout the organization.

- By carrying out proper procedures related to this form of audit, the company can manage and handle different forms of risks.

- Managing risks is one of the main objectives of a company. This can be easily carried out by having a system related to secretarial audit.

Secretarial Audit Applicability

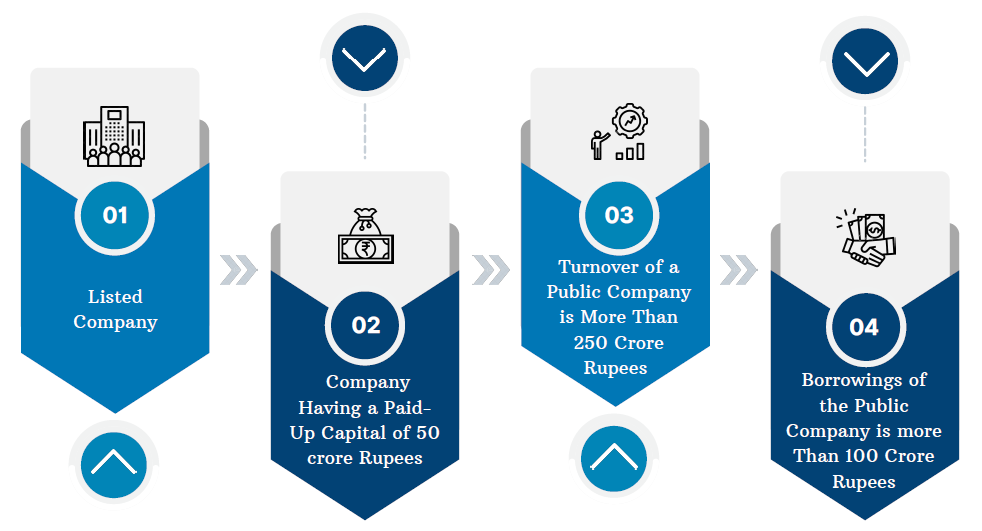

As per section 204(1) read with rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014, the following companies require to carry out secretarial audit:

Hence if the above criterion is met, then carrying out secretarial audit is mandatory.

Conditions for Carrying out Secretarial Audit

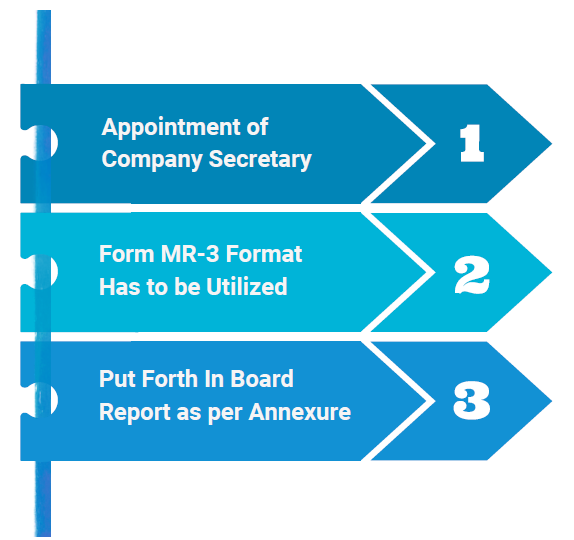

The following conditions have to be satisfied for carrying out this form of audit:

Who can carry out the above compliance related to Secretarial Audit?

Usually an individual who has completed the Company Secretary course from the Institute of Company Secretaries in India (ICSI) would be qualified to carry out this form of audit in India. However, the individual must possess the training as required to carry out this form of audit.

Provisions related to Secretarial Audit

- Compliance Requirements related to the company.

- Any form of flexibility in the compliance certificate of the company.

- Scrutiny of the company documents and records.

- Time line for carrying out secretarial audit.

- Appointment of auditors for carrying out this form of audit.

Benefits of Carrying out Secretarial Audit

- It would be helpful in carrying out due diligence, for a prospective buyer in a private acquisition transaction.

- It would provide some form of indemnity to the management and shareholders of the company.

- Complying with the law ensures that proper standards related to audit are followed by the company.

- Reduces the amount of risk which an organization takes.

- It helps in preserving different forms of legal records for the company.

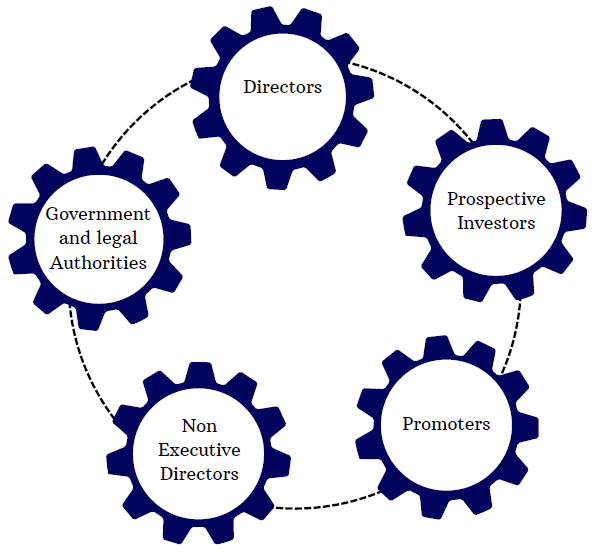

Beneficiaries of Secretarial Audit

The following are the beneficiaries of performing this type of audit:

Statutory Laws related to Secretarial Audit

This form of audit has to be carried out in accordance with the requirements of the Companies Act, 2013. Apart from this the following laws would be applicable for carrying out secretarial audit in India:

- The Companies Act, 2013 and respective rules

- The Securities Contracts (Regulation) Act, 1956 (SCRA) and respective rules

- The Depositories Act, 1996 and the Regulations and Byelaws and respective rules

- Foreign Exchange Management Act, 1999 and rules related to Overseas Direct Investment, Foreign Direct Investment and Other Allied Laws in India

- Apart from this, the regulations under the Securities Exchange Board of India would be applicable to carry out secretarial audit in India.

Procedure for Carrying out Secretarial Audit

The following procedure has to be utilized for carrying out secretarial audit in India:

- Appointment of Company Secretary

Under Rule 8 of the Companies (Meetings of the Board) Rules 2014, the company is required to conduct a board meeting and pass the resolution related to appointment of a secretary auditor.

- Formal Communication regarding this

The appointment of the secretary auditor is supposed to be formally communicated to the individual carrying out the audit. This would be formally carried out by receiving a letter of engagement from the company.

- Signing the Letter of Engagement

Once the auditor is appointed, the letter of engagement has to be signed in order to ensure that duties and responsibilities are carried out in performance of audit functions.

- Preparing Working Papers Report

This step would include any reports related to secretarial audit which is carried by a company. Such summary related to secretarial audit would be carried out by the individual appointed as a secretarial auditor.

- Submission of Audit Report

In the last step, the report has to be submitted in accordance with the requirements of the Companies Act, 2013. When carrying out the submission of the report, a thorough analysis has to be carried out by a secretarial auditor. With this analysis some form of remarks related to the report must be provided. Such remarks have to be made in the report itself. As the audit is carried out by an independent party, the report must be unbiased. This report must be in the form of an opinion.

- Not Providing Opinion

If the work carried out by the auditor is hampered and not able to perform functions due to limitations imposed by the company, then such limitations must be highlighted in the report related to secretary audit. A remark has to be made that carrying out the compliance in restricted areas cannot be performed. If such opinion or remarks are present in the report, then the Board of Directors must provide an explanation of the same.

Which Companies Cannot Carry out Secretarial Audit?

Secretarial audit would only be applicable to few companies. Usually this would be carried out only by public limited companies and listed companies that have their shares in the stock exchange. As per section 2(71) of the Companies Act, 2013 a public company is defined as a company where its shares and securities is listed in a recognized stock exchange.

However, if a private company is a subsidiary of a public company, then secretarial audit would be carried out as per the requirements of the public company.

Non- Compliance related to Secretarial Audit

As per section 204(4) of the Companies Act, 2013 if a company does not carry out secretarial audit or the officers or executives contravene the provisions related to secretarial audit, then they would be penalized.

As per section 448 of the Companies Act, a company would be carrying out fraud if the following activities occur during an audit process:

- Falsifying any statement or material fact related to the company

- Suppressing any information which is supposed to be stated by the company

- Omits any material fact from being published.

Any person or individual who is liable of committing fraud as per section 447 would be punishable with imprisonment for the following periods:

- Not less than 6 months but can extend up to 10 years.

- The offender would be required to pay a fine which is not less than the amount involved in the fraud related to secretarial audit. However the fine can increase more than three times the amount.

- If there is some form of public interest with respect to the fraud, then the offence would attract imprisonment for a period of 10 years.

Documents Required for Carrying out Secretarial Audit in India

The following documents are required for carrying out secretarial audit in India:

- Documents related to the company such as the charter documents and other information as applicable

- Board Documents such as minutes of the board meeting and the resolutions which are considered in the meeting.

- Financial Statements of the company and audited reports of the company

- All information related to listing of the company. This would include important documents related to listing of the company

- Information on the Annual Performance Reports, Lease Deed, Bonds and returns

- Filings with RBI (If there is a foreign investment) and other statutory departments

- All labour law registered as maintained which is prescribed under respective laws.

- Admission and Statement for code of conduct received from the directors

- Remuneration and Sitting fees details paid to directors.

- Particulars of CSR amount

- SAST Disclosures (Substantial Acquisition of Shares)

- Bank account details for dividend

- Details of ECB (External Commercial Borrowings) Returns, in case of foreign borrowings in the company.

How to reach TAP GLOBAL for Secretarial Audit

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables