Credit Co-operative Society- An Overview

A society which is formed by a group of different types of individuals with a same motive to promote self sufficiency is known as a Co-operative Society. When there are different individuals carrying out such motives, then the society is understood as a Credit Co-operative Society.

Such societies are governed by the provisions of the Multi State Cooperative Societies Act, 2002. This act along with different rules helps to promote the betterment of the society. This would also provide functional autonomy for societies to operate properly. The government in order to promote such requirements passed 'The Multi State Cooperative Societies Bill' which received royal assent from both the houses of the parliament before it became a law.

Hence co-operative societies are formed for the betterment of the community. A Credit co-operative society includes providing different forms of credit to its members. This would also include providing a loan and other forms of credit facilities to its members. Hence this type of society is formed as a financial co-operative and under the control of the members.

Usually this type of society is formed to provide reasonable computation of financial products to its members. This would include provisions of loans and interest related to loans. Apart from this, the Credit Co-operative society would also accept deposits from its members.

There are two types of Credit Co-operative Societies:

- Agriculture Credit Societies

These forms of societies is found in villages. Such societies would provide loans to local artisans and farmers.

- Non-Agriculture Credit Societies

Non-Agriculture Credit Societies are found in Metropolitan and Urban Areas. Such loans are provided to individuals in these areas.

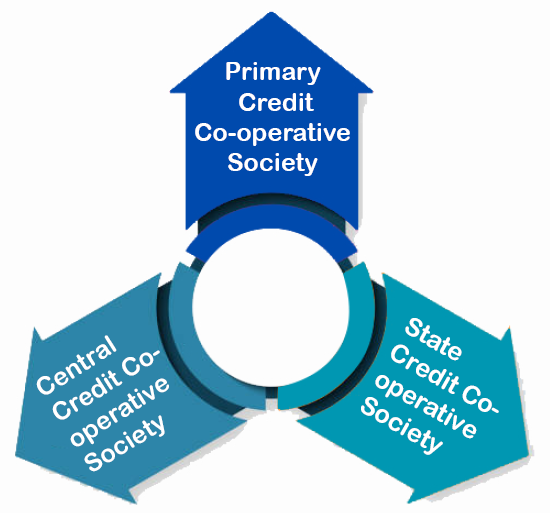

Tier Category of Credit Co-operative Society

There are different tiers related to category for credit co-operative societies. The following are the types of tiers present under Credit Co-operative societies:

- Primary Credit Co-operative Society

Such societies are present in a particular area. Membership to this society is usually open to all types of individuals.

- Central Credit Co-operative Society

Membership in this type of society is limited only to few people. Usually, these would be members of the banking union and other forms of union. Such types of societies are usually formed at a district level.

- State Credit Co-operative Society

This type of society is usually involved in accepting deposits from particular class of individuals.

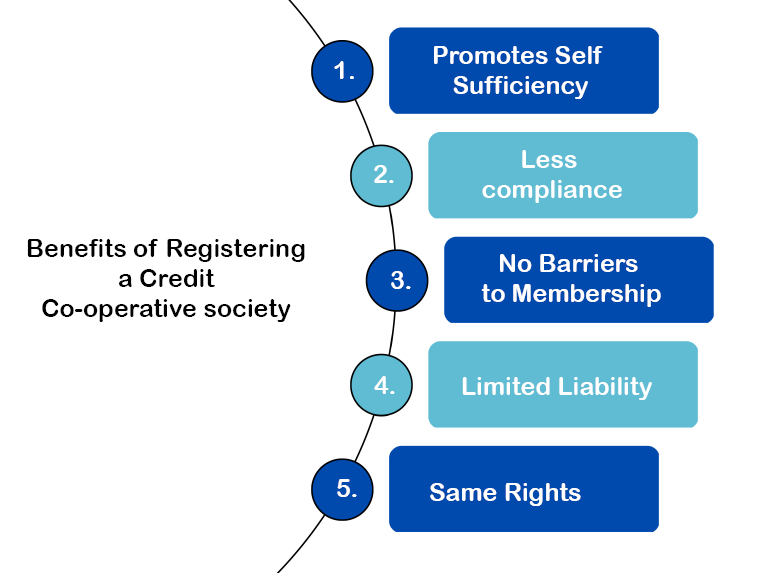

Benefits of Registering a Credit Co-operative society

The following are the benefits of registering this form of Society:

- Promotes Self Sufficiency

By registering this form of entity, the interests related to promoting self sufficiency can be established. This can be achieved as members would be able to avail different forms of loans with less interest rate. In comparison to this, the interest rates offered by a traditional bank would be quite high.

- Less compliance

This form of society can be easily formed with less than 10 members. Also to form this society there is only basic registration with the Multi State Cooperative Societies Act, 2002. Hence such societies can be easily established with less compliance and no burden.

- No Barriers to Membership

Any individual can be a member of the society. Hence there are no barriers related to membership of this form of society. An individual is not restrained on the basis of a particular requirement to be a member.

- Limited Liability

The liability of the credit co-operative society is limited. This means that the members do not have any personal liability for acts which are carried out by the society. Hence by forming this society, the personal assets of an individual can be safeguarded properly.

- Same Rights

The constitution of this form of society is based on the members. Hence all the members can take decisions related to their respective rights and liabilities of the society. All members have their rights related to voting on particular matters.

Eligibility Criteria for Forming a Credit Co-operative Society

The following eligibility criterion has to be sufficed for forming a credit co-operative society in India:

- Bank Certificate

The members of the society must have a letter from the bank stating that credit balance is present to satisfy the requirements related to the credit cooperative society.

- Minimum Number of Members

There has to be minimum number of members to form this type of society. For a state there has to be minimum of fifty members.

- Minimum Number of Directors

The board members or the number of directors have to satisfy the requirements related to a credit cooperative society. Minimum of seven board members should be present. The upper limit on the number of members is 21.

- Information on the Credit Cooperative Society

A comprehensive document must be provided regarding the credit cooperative society. In this document, information on 'how the society helps in social and economic development' must be provided. Along with this the name of the credit cooperative must also be provided. Along with this, information on the registered office of the credit cooperative must also be provided.

- Capital requirements

The members also have to provide information that all the requirements related to pre-registration of the society has been met. This would include the information on the initial capital of the company, number of members and other relevant information related to the credit society.

Procedure for Registering a Credit Co-operative Society

The following procedure has to be considered for registering the credit co-operative society:

- Go Online

First and foremost, the applicant has to go online to the following website. In the website visit the 'Forms Tab' where different forms are available. The applicant can go for the process of offline registration or online registration. For the offline process the applicant has to download 'Form 1'. This form is downloadable in PDF format.

- Provide Information

Such societies can be formed under the Multi-State Cooperative Societies Act, 2002. All the information related to the society must be provided by the members. A formal declaration has to be made by the members that a multi state cooperative society has to be formed. Along with this, information on the following must be provided:

- Name of the Society

- Registered office of the society

- Capital of the Society

- Number of members of the society

- All respective certificates

- Registered Office of the Society

- Information on the Promoters of the society

- Submit the Form

In the next step, the form must be submitted to the 'The Central Registrar of Cooperative Societies, New Delhi. Along with this, specific documents have to be submitted for forming this type of society.

Online Procedure for registering a Credit Co-operative Society

If the members follow the online procedure for registering a credit co-operative society then the following has to be considered:

- Go Online

First and foremost, the applicant has to go online to the following website. After this the applicant has to go the tab, 'MSCS-MIS'. When going here a drop down menu would appear. The applicant has to go and click on 'New User Registration'.

- Provide information

All the forms with relevant information has to be filled by the applicant. Along with this, information on the MD, Chairman, Vice Chairman and other officers has to be filled. Information related to PAN also must be filled by the applicant.

- OTP

After this step is complete; the applicant would receive a One Time Password (OTP). An auto generated mail would be sent to the applicant's email.

- Login

After receiving this, the applicant would have to login and provide the user name and password for registering the Credit Co-operative Society.

Documents required

The following are the documents required for registering a Credit Co-operative Society:

- Information on the list of members. Such information has to be provided state wise along with information on their date of birth. The registration would only be allowed if there are minimum at least 50 members for each state.

- Copies of the PAN Card and Aadhaar Card. Such documents have to be attested by the society's promoter.

- Information on the operation of the society in different states. These forms of societies are allowed only to operate in maximum of two states. This would only be for a period of two years.

- Resolution for the appointment of the promoter of the society.

- Certificate from a nationalized bank stating the formation of the society:

• Balance present in the account when the application is filed by the society.

• Solvency Status of the applicants.

• If the member has taken any form of overdraft facilities in the past three financial years.

• If overdraft has been excessively used in the past three financial years, then information on when the overdraft facility has crossed the excessive limit.

• If there are any violations and penalties related to overdraft, then the reasons for the violations must be provided.

- Financial Statements of the Past Three Financial Years. Such statements are not required, if the cooperative society is older than three years.

- Information on the society taking steps to take part in democratic decisions.

- Bye-Laws of the society as attested and presented by the promoter.

How to reach TAP GLOBAL for Credit Co-operative Society

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables