CFO Support Services

The Chief Financial Officer or CFO is one of the busiest executives in any organization. The CFOs traditionally leads the finance and accounting department of the organization. The CFO's responsibility is to inform the rest of the leadership, especially the CEO, regarding the organization's financial well-being.

However, recent developments in the finance and accounting department have made the CFO an essential part of the organization in contrast to other parts of the administration and operations. Along with the Finance and Accounts Department, the CFO supports the different departments with updated data on their financial standing, internal controls, and budgetary requirements that ensure the processes run at optimal levels. Many roles are assigned to the CFO. Other finance and accounting professionals in the organization must help him perform his work in a better way.

Who is a CFO?

A Chief Financial Officer or CFO is the senior manager responsible for managing the organization's financial actions. The CFO's duties include tracking cash flow and financial planning as well as analyzing the company's financial strengths and weaknesses and proposing corrective actions.

The CFO is quite similar to a treasurer or controller because they are responsible for managing the accounting and finance divisions. They also ensure that the company's financial reports are accurate and are completed on time. Many of the CFO's have a CMA (Cost and Management Accountants) designation.

What is the role of CFO Support Services for the companies?

The role of CFO support services is very crucial for the operational excellence of the business. His principal purpose is to face the challenges and provide support in the company's finance function. Some of the duties performed by the Chief Financial Officer in the company are as follows:

- Evaluates the finance of the organization;

- Helps in reviewing the company's business process and it's financial systems;

- Review work for the existing financial reporting of the company;

- Helps the company in designing and also in implementing new business approaches;

- Automation of Financial reporting;

- Implementation of ERP;

- With all of his experience, he can add value to the business;

- Reviews the ongoing process and internal controls in the company; and

- Reviews the reconciliation process and controls.

What are the Benefits of a CFO Service over a Full-time CFO?

In comparison to a full-time CFO, a CFO Service offers various advantages, like:

- More Independence: Before hiring a full-time CFO, you must first gain a strategic perspective or input and world-class reporting from the CFO Support Services.

- All Skills and Experience is Covered: No single person can have all the required skills over time. With the help of a CFO Service, you will benefit beyond the experience of a person only as a service. .

- Expertise Expands according to the need of Your Company: CFO Service will help maintain the continuity of working with the trusted resources over the long term.

- No Geographic Limitations: You can engage a service outside your region; there are no geographical boundaries set for a CFO Service.

- Save Money: Delay the idea of hiring a full time in house CFO and hire CFO Services. It will help you in saving cash throughout the way without compromising on financial leadership.

What are the Benefits of Financial Analytics and Reporting done by CFO Support Services?

The benefits of financial analytics and reporting that is done by CFO Support Services are as follows:

- Assist in developing the transparency of the company.

- Market Trends: The clear /image of the prevailing market trends comes through analysis and reporting.

- For financial restructuring of the company, business analytics and reporting helps.

- It predicts the forecast of future growth and prospects. It also helps in reducing the cost of the products and services that are offered.

Why is the Role of CFO Support Services Essential in MIS and Board Reporting?

The primary role of MIS (Management Information System) is to focus on the information related to the organization. It also helps in developing technology systems. The CFO analyzes the business problems and prepares designs and uses software to solve the organization's problems.

Board reporting is an attempt to update the financial reporting process. By way of board reporting, the directors are provided meaningful and timely financial information. It is preparation of a complete checklist for the senior management explaining the critical performance indicators. It can be understood as consolidation and redesigning of financial reports, investment reports, business analysis reports, budget reports, etc. Hence this involves both internal and external reporting by preparing detailed MIS reports.

What are the Types of Businesses that will benefit from Our CFO Support Services?

Generally, all businesses benefit from our CFO Support Services. However, the companies that benefit the most are:

- Start-Up and Growing Companies;

- Mature SME (Small and Medium Enterprises)’s experiencing challenging circumstances.

What are the Types of CFO Services?

There are different types of CFO Services. Hence it is essential to see which type of CFO Services is vital for your business. The following listed are some kinds of CFO Services available:

A consultant consists of experienced CFOs who will provide short term work with your company for setting up of specific procedures and reporting. They may also serve as an interim CFO for some particular project or during a transition stage.

Virtual CFO are agencies that offer a long term solution to your financial management systems. Here the agency oversees your financial staff but is not on location nor involved in the day-to-day corporate management of your company.

This is operated by one person that provides CFO services for multiple clients. You must first ensure that this individual is familiar with your specific industry and also can fulfill your requirements if you have an urgent, all in project.

These are generally companies who will provide you with their efficient and best staff available.

These networks provide CFO consultation services on both a regional and nationwide basis.

What are the Risks of not taking CFO Services?

The risks associated with not taking a CFO Support services are:

- Unproductive and weak processes.

- Wasted time and effort.

- Loss of investor and client confidence.

- Lack of critical resources at times of need.

- Missed opportunities for business and misguided decisions.

- Revenue loss.

- Exposure to unnecessary legal or tax risks.

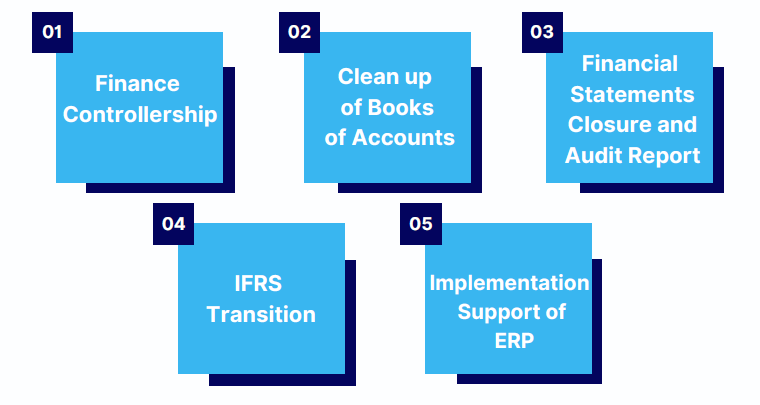

What are the CFO Services Provided in TAP GLOBAL?

Being your partner, we will not only play an advisory role but will also take ownership of the accounting and finance functions, including the implementation of ERP, audit support, and legacy accounting. Our in-depth knowledge and experience benefits the clients in decreasing the risks associated with F &A function.

The TAP GLOBAL team can help you in any or all of the following needs:

Finance Controllership

Many times companies lack a dedicated CFO or a finance controller. This could be due to various reasons such as a change in location of the business (leaving no time to focus on the financial aspects of the business), attrition of senior management or the employees, lack of skilled financial management.

Our dedicated and experienced team of professionals helps you ensure continued reporting and compliance by handling daily Financial and Accounting Activities. We will manage the entire range of Financial and Accounting Services including the accounting and bookkeeping, audit closure report, banking support, representing the Financial and Accounting function to the board of directors or other parties, decision-making related to financial issues, Compliance and regulatory filing, optimization of the finance procedure and also internal control review.

Clean up of Books of Accounts

The finance and accounting staff many times, adopt inefficient practices that lead to disorderly accounting. This leads to the reliability of the financial statements and also non-compliance with the existing laws.

Our professionals can perform a comprehensive review of the books and manage your records. A typical book keeping process includes an in-depth review of books, compliance checks, inter-company reconciliations, compliance checks, verification of fixed assets, and other tasks.

Financial Statements Closure and Audit Report

It is becoming difficult for companies to handle audits and auditors. These difficulties may be due to employees lack of expertise in managing the audits or expanding the regulations continuously.

Our team is deeply rooted in the assurance domain. Our team can manage auditors professionally to complete the audits in time and also minimize audit qualifications. Audit support generally involves preparing financial statements, liaising with the auditors, and advising on audit remarks or qualifications and representation to the audit committee or the board of directors.

IFRS Transition

MNCs these days are increasingly shifting towards IFRS from GAAPs. This change requires these businesses of many aspects that fall beyond the purview of the finance function. Throughout this transition process, our team will assist you by supporting the decisions made on accounting choices, Preparing balance sheets and making changes to the ERP.

Implementation Support of ERP

Implementing the new ERP in the existing environment and also modifying the existing ERP is a challenging task for the organization. We can help you in selecting the ERP as per your business requirements.

Who can assist the CFO in Providing Services in the Organization?

The primary role of a CFO is to support the company by ensuring that the financial books are properly maintained. Management accountants assist the CFO in preparing the financial statements and accounts, monitoring the budgets and costs of the projects, and forecasting future expenses and profits. Apart from this management accountants must also make recommendations to the CFO regarding how to reduce the costs. They can also help the other managers to make better business decisions.

The financial controller assists the CFO in providing organizational support in various aspects of the business. The critical roles of financial controllers include preparing and reviewing the key performance indicators and implementing cost-reduction strategies. Basically, they help in planning, implementation, and monitoring the internal controls of the organization. By performing these roles, the financial controllers can assist the CFO in performing his duties.

The CFOs keeps track of both the internal workings of the organization as well as the changes in the economy. In many ways, the CFO supports the organization in performing its business. However, the CFO can't deliver the expected outputs alone. The CFO needs the right people to support the success of his work. These people will not only contribute to your CFO's work, but will also help make sure that your business achieves its financial goals.

How is it to Work with a CFO Service?

- A CFO Support service offers you the best available opportunity to achieve your goals.

- A CFO Service will generate weekly or monthly reports per the business requirements and your current needs.

- A CFO support service will look after your bookkeeping and controller staff to ensure that all procedures have a series of checks and balances to strengthen security and present accurate financials.

- They can assist you in preparing your CFO Service for your board meetings. CFO Services will present a financial package in board meetings to give an accurate picture of the company.

- A CFO Service usually may or may not provide direct investor relations, but it will provide financial reports to attract investors in the company.

How can TAP GLOBAL Help You to get CFO Support Services?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables