Revenue Recognition Services

Revenue recognition is an accounting principle that figures the particular conditions under which the revenue is recognized. Under the AS 9 Revenue Recognition is issued by the ICAI. The Institute of Chartered Accountants of India defines Revenues as the gross inflow of cash, receivables or other consideration that arises in the course of the ordinary activities of an enterprise from the sale of goods or rendering of services and various other sources like interest, royalties and dividends.

Revenue must be measured by the amount charged to the clients for the sale of goods and services.

However, in the case of an agency relationship, the revenue needs to be measured by the amount charged for commission. It is not on the gross inflow of the cash, receivables or other consideration.

There are some exceptions in the statement as mentioned above where the special consideration applies:

- Revenue that arises from construction contracts.

- Revenue arising from Government grants and other similar subsidies.

- Revenue of insurance companies arising from the insurance contracts.

Revenue recognition is concerned with the timing of recognition of revenue in the statement of profit and loss of an organization. The amount of revenue arising on a transaction is generally determined by an agreement between the involved parties the transaction. During existing uncertainties, the amount is determined with its associated costs; these uncertainties influence the timing of the revenue.

Applicability of AS 9 Revenue Recognition

This standard that was issued by the ICAI in the year 1985 and the initial years, it was re-commendatory for only Level I organizations but has been made mandatory for all other organizations from April 1st, 1993.

According to ICAI, an enterprise means a company that is defined in section 3 of the Companies Act, 2013.

Level I enterprises is referred to those enterprises where the turnover for the immediately preceding accounting year exceeds an amount of Rs. 50 crores. The turnover does not include any other income and is applicable for holding as well as subsidiary companies.

Explanation to Revenue Recognition

- Revenue Recognition provides emphasize on the timing of recognition of revenue in an enterprises statement of profit and loss account.

- The amount of revenue that arises from a transaction is generally determined by an agreement between the parties that are involved in the transaction.

- Whenever uncertainties arise with regard to the determination of the amount or any of its associated costs, these uncertainties might influence the timing of the revenue.

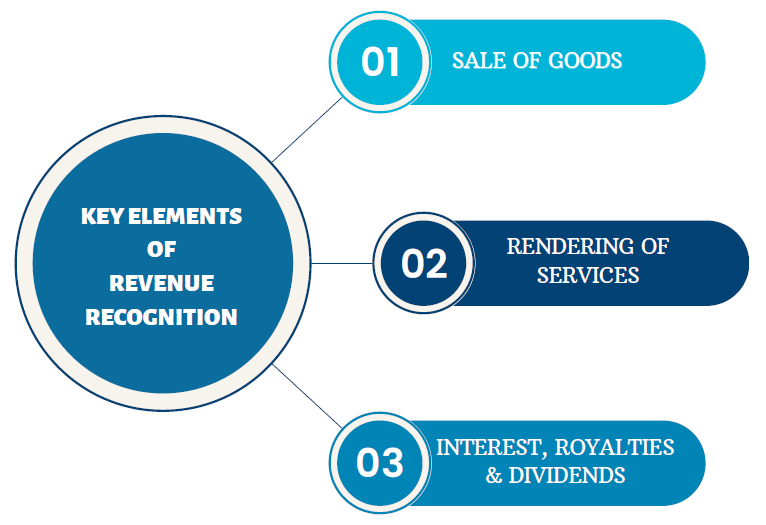

Key Elements of Revenue Recognition

The following are the key elements of revenue recognition:

Sale of Goods

An essential element for determining the recognition of revenue of a transaction involves the sale of goods. A seller has transferred the property in the goods to the buyer for consideration. In many cases, the transfer of property in the goods results from the transfer of major risks and rewards in the ownership of the goods.

However, there are many situations where the transfer of significant risks does not match with the transfer of goods to the buyer. In this type of cases, revenue must be recognized at the time of transfer of goods to the buyer. In such instances, revenue must be accepted at the time of transfer of significant risks and rewards to the buyer. For example, goods that are sent to the consignee on approval basis.

There are many cases in the industry where the performance might be substantially complete before the execution of the transaction that generates revenue.

The goods are valued as per the net realizable value (NRV) in the following situations:

- When the sale is assured under Government guarantee;

- Forward Contract; and

- Where the market exists, and there is a negligible risk of failure to sell.

These type of amounts are not explained in the definition of revenue but are sometimes recognized in the statement of profit and loss, for example, Harvesting of Agricultural crops or extraction of mineral ores.

Rendering of Services

Revenue recognition of services also depends on the performance of service. This is further divided into two ways:

- Proportionate Completion Method: This methodology of accounting recognizes revenue in the profit & loss statement proportionately with the degree of completion of each service. Here the completion of service consists of the execution of more than one act. The revenue is recognized with the completion of each such act.

- Completed Service Contract Method: This process of accounting recognizes revenue in the statement of profit and loss account during the rendering of services in a contract that is completed or substantially completed.

Interest, royalties & dividends

The use by others of the enterprise gives rise to:

- Interest: Here, the revenue is recognized as per time proportion basis after taking into account the outstanding amount and the applicable rate. For instance: If the interest on Fixed Deposit is due on 30th June and 31st December, On 31st March when the books are closed, though the interest for the mentioned period from January-March will be received in June, still the revenue will be recognized on March.

- Royalties: A royalty generally includes the charge for the use of patents, trademarks, and copyrights. Revenue must be recognized on the accrual basis and in accordance with the related agreement. For Example: In case the royalty is payable as per the number of copies of the book, then it has to be recognized on that basis only.

- Dividends: The revenue must be recognized when the owner's rights to receive the payments are established. It is inevitable when the company declares the dividends on the shares, and the directors decide to pay dividends to its shareholders.

Conditions Given for Revenue Recognition

According to the Indian Accounting Standards criteria, for recognizing the revenue, the following conditions must be satisfied:

- The Risks and rewards of ownership must be transferred from the seller to the buyer.

- The seller does not any longer have control over the sold goods.

- The collection of payment from the goods or services is assured reasonably.

- The amount of revenue can be measured reasonably.

- The costs of revenue can be measured reasonably.

a) The Conditions specified in points (1) and (2) are referred to as Performance. Regarding performance, it is said that when the seller has done what is expected and is be entitled to payment.

b) The Condition specified in point (3) is referred to as Collectability. The seller shall have a reasonable expectation that he or she will be paid as per the performance.

c) Conditions (4) and (5) mentioned above are referred to as Measurability. As per the accounting guidelines, the seller must be able to match its revenues to the expenses. Hence, both revenues and expenses must be reasonably measured.

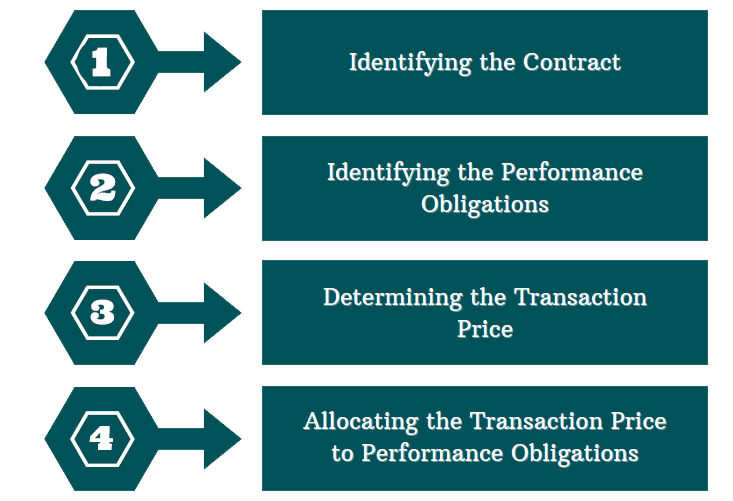

What are the Steps in Revenue Recognition from Contracts?

The five steps for revenue recognition in contracts are as follows:

Identifying the Contract

All conditions need to be satisfied with a contract to form:

- Both parties need to approve the contract (whether it is written, verbal, or implied).

- The point of transfer of goods and services must be identified.

- Payment terms must be identified.

- The contract also has commercial substance.

- There is a probability of collection of payment.

Identifying the Performance Obligations

Some contracts involve more than one performance obligation. For example, the sale of a car with a complementary driving lesson would be considered as two performance obligations – the first being the car itself and the second being the driving lesson.

Performance obligations must be distinct from each other. The following conditions must be satisfied for a good or service to be different:

The buyer (customer) can benefit from the goods or services on its own. The good or service is separately identified in the contract.

Determining the Transaction Price

The transaction price is generally determined by the cost fixed in the contract. For example, the price of a car for sale is Rs. 6 lakh along with a complementary driving lesson. The transaction price here would be Rs. 6 lakhs only.

Allocating the Transaction Price to Performance Obligations

The allocation of the transaction price to more than one performance obligation must be based on the separate selling prices of the performance obligations.

Effect of Uncertainties on Revenue Recognition

The effect of the uncertainties on revenue recognition has been explained below:

- For the purpose of revenue recognition, the revenue must be measurable, and at the time of sale or the rendering of service, it will be unreasonable to expect ultimate collection.

- Where the ability for assessing the collection lacks at a reasonable level, revenue recognition is postponed to the extent of uncertainty involved.

- In some cases, it will be appropriate to recognize revenue only when it is reasonably certain that the ultimate collection will be made. The revenue is recognized at the time of sale or rendering of service even though instalments make payments.

- When the uncertainty that relates to Collectability arises following the sale or rendering of service, it is suggested to make a provision to reflect the change rather than adjusting the amount of revenue recorded.

- When the consideration amount, which is an essential element of revenue recognition, is not measurable is within reasonable limits, the revenue recognition gets postponed.

- When the revenue recognition is postponed due to the effect of uncertainties, it is considered as revenue of the period that is adequately recognized.

Checklist in a Revenue Recognition Policy

Every Entity must consider developing a revenue recognition policy under Ind AS 115. The policy shall be documented, reviewed and approved at appropriate levels of management.

It includes the following for each performance obligation:

- Describing the Performance obligation.

- Form of the arrangement of contract for the performance obligation.

- The transfer occurs at a single point in time that is upon shipment or delivery, as the services are rendered at completion.

- The transfer occurs over some time (a description of the output method or input methods that are used and also how those methods are applied).

- Qualitative information related to economic factors that are the type of customer, its geographical location and also the type of contract that affects the nature, amount, timing and uncertainty of revenue and cash flows of a performance obligation.

- Significant terms of payments for performance obligation, such as when the payment is due, whether the consideration is fixed or variable and if the estimate of variable consideration is constrained.

- The timing of satisfaction of the performance obligation that relates to the typical timing of payment and the effect these factors has on contract asset and liability balances.

- Obligations for the returns or refunds and types of warranties and its related obligations relating to the performance obligation.

- Provide a proper discussion of whether the company is a principal or agent for the performance obligation and also determining as to how it was made.

Required Financial Statement Disclosures for Revenue Recognition

Establishing a revenue recognition policy will also help with the preparation of financial statement disclosures.

The companies must make the following disclosures in the financial statement for the purpose of revenue recognition:

General Disclosures

- The revenue from contracts with the customers and its related contract assets and liabilities must be presented transparently so that the financial statement user will be able to understand the nature, timing, amount and any uncertainties of revenues and cash flows of such contracts.

- The beginning and ending values of contract assets or contract liabilities and the related receivables should be disclosed.

- The transition disclosures must be made.

Disaggregated Revenue

The disaggregated revenue must be based on the timing of the transfer of goods and how the economic factors affect each of the disaggregated revenue streams.

Performance Obligations

- Disclosing the nature of goods or services the enterprise has promised to transfer (that includes when to act as an agent).

- The specific payment terms must be disclosed.

- Any obligations for returns, refunds and any similar obligations need to be disclosed.

- The warranty types and their related obligations must also be disclosed.

Significant Judgments

- Disclose all the judgments that significantly affect the determination of the amount and also the timing of revenue from contracts with the customers and any changes to the judgements.

- Disclose the judgments that relate to the timing of satisfaction of performance obligations and transaction price and amounts allocated to performance obligations.

- Disclose methods, inputs and assumptions used for assessing an estimate of variable consideration that is strained.

How can TAP GLOBAL Help you?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables