Tax Audit Services

There are many laws drafted in India that govern different kinds of audits like an income tax audit, cost audit, stock audit, company, or statutory audit as per the Companies Act, 2013. Income tax audit evaluates whether an individual or company has filed tax returns of the assessment year appropriately. Section 44AB of the Income Tax Act of 1961 lays down the provisions for an income tax audit.

Taxpayers who need to get their accounts audited under any law other than Section 44AB of the Income Tax Act of 1961 do not have to get their accounts checked for the purpose of an income tax audit. In this type of case, the accounts that are audited under any other law can be presented as a tax audit report for income tax filing. The audit report must be submitted before the stipulated due date.

The following other sections under the Income Tax Act of 1961 also lay down regulations related to an income tax audit in India:

- Section 44BB: For Non-Resident Indians (NRIs) involved in the business specializing in the mineral oils industry, like exploration.

- Section 44BBB: International Company that is involved in the business of civil construction etc. or in specific power projects.

- Section 44AD: Any business except those businesses that are specified under Section 44AE.

- Section 44ADA: This section covers the regulations with regard to the income tax audits for eligible professionals.

- Section 44AE: This section focuses on businesses specializing in leasing, hiring, and plying of goods carriages.

What is a Tax Audit?

- Tax Audit refers to the verification of the books of accounts of the taxpayer. The auditor examines or reviews the books to form an opinion on matters related to taxation compliances that are carried out by the assesses.

- The assesses must comply with the provisions of the Income Tax Act, 1961, while preparing the books of accounts, particularly from Section 28 to Section 44DB.

- The provisions specified in these sections deal with the income from any business or profession that is chargeable to tax computes incomes, chargeability, various allowances, or disallowances.

- Tax audit also ensures proper maintenance of books of accounts concerning the provisions of tax laws.

- It also ensures that tax liability has been discharged on time, and there is no concealment of income by the assesses.

- The main goal of a tax audit is to ensure that the details related to the income, expenditure, and tax-deductible expenditure information is filed correctly by the business undergoing an audit.

- Section 44AB of the Income Tax Act, 1961, lists all the relevant requirements and provisions to carry an Income Tax Audit as per the Act.

What are the Objectives of the Tax Audit?

The objectives of the tax audit are as follows:

- An analysis of the accuracy of income tax returns filed in the assessment year by companies and individuals and maintenance of records by the Chartered Accountant (CA).

- Report the findings by the tax auditor after making precise analysis of accuracies or inaccuracies in the filed tax returns.

- Tax audit checks on all the frauds and malpractices in filing income tax returns.

- To report the essential details with regard to compliance, tax depreciation, etc., as per the income tax laws. These streamline the processes for the authorities of income tax in the calculation and also assessing the accuracy of the income tax return filed by the individual or company.

Who needs to get a Tax Audit Done?

A taxpayer needs to get a tax audit carried out if the turnover, sales or gross receipts of business exceed Rs. 1 crore in the financial year. However, a taxpayer must get their accounts audited in certain other circumstances. The circumstances have been categorized in the tables mentioned below:

NOTE: The threshold limit of Rs 1 crore for tax audit has increased to Rs 10 crore with effect from AY 2021-22 (FY 2020-21) if the taxpayer's cash receipts are limited to 5% of the gross receipts or turnover, and if the taxpayer's cash payments are limited to 5% of the aggregate payments.

The categories, along with the threshold, are explained below:

|

S. No

|

Business Category

|

Threshold Limit

|

|

1.

|

Carrying on business but not opting for the presumptive taxation scheme

|

Total turnover, gross receipts, or gross sales must exceed Rs 1 crore in the Financial Year.

|

|

2.

|

Carrying on business that is eligible for presumptive taxation under Section 44AE, 44BB or 44BBB

|

Claims profits or gains lower than the prescribed limit under presumptive taxation scheme.

|

|

3.

|

Carrying on business that is eligible for presumptive taxation as per Section 44AD.

|

Declares taxable income below the prescribed limit under the presumptive taxation scheme and also has income that exceeds the basic threshold limit.

|

|

4.

|

Carrying on the business and is not eligible to claim presumptive taxation under Section 44AD due to opting out for presumptive taxation in any one financial year of the lock-in period i.e., 5 consecutive years from when the presumptive tax scheme has opted.

|

In case the income exceeds the maximum amount not chargeable to tax in the subsequent 5 consecutive tax years from the financial year when the presumptive taxation was not opted.

|

|

5.

|

Carrying on business, which declares profits according to the presumptive taxation scheme under Section 44AD.

|

If the total sales, turnover or gross receipts does not exceed Rs 2 crore in the financial year, then the tax audit will not apply to such businesses.

|

|

Sl.No

|

Category-Profession

|

Threshold Limit

|

|

1.

|

Carrying on profession

|

Total gross receipts must exceed Rs 50 lakh in the Financial Year.

|

|

2.

|

Carrying on the profession eligible for presumptive taxation under Section 44ADA

|

1. Claims profits or gains lower than the prescribed limit under the presumptive taxation scheme.

2. Income exceeds the maximum amount not chargeable to income tax.

|

|

S.No

|

Category-Business Loss

|

Threshold Limit

|

|

1.

|

In case of loss from carrying on of business and not opting for presumptive taxation scheme

|

Total sales, turnover or gross receipts exceed Rs 1 crore.

|

|

|

If taxpayer's total income exceeds the basic threshold limit, but he has incurred a loss from carrying on a business (not opting for presumptive taxation scheme)

|

In case of loss from business when sales, turnover or gross receipts exceed 1 crore, the taxpayer is subject to tax audit under 44AB.

|

|

2.

|

Carrying on business (opting presumptive taxation scheme under section 44AD) and having a business loss but with income below the basic threshold limit

|

Tax audit not applicable.

|

|

3.

|

Carrying on business (presumptive taxation scheme under section 44AD applicable) and having a business loss but with income exceeding the basic threshold limit.

|

Declares taxable income below the limits prescribed under the presumptive tax scheme and has income exceeding the basic threshold limit.

|

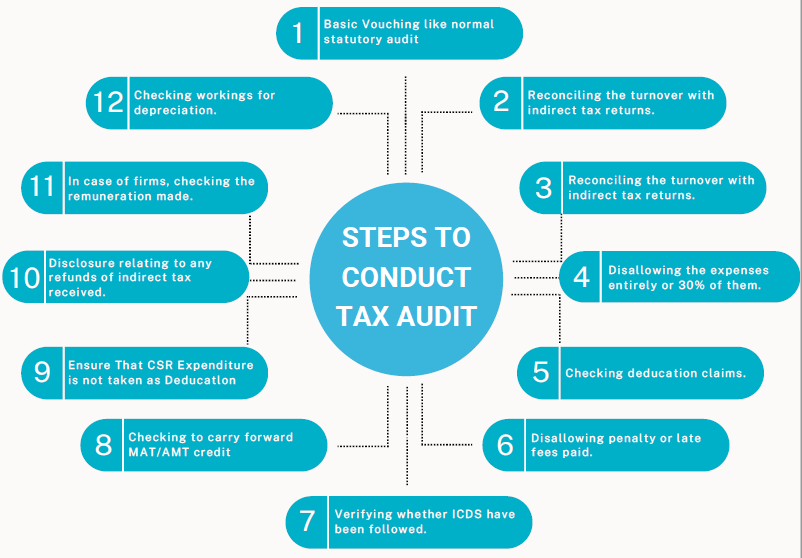

Steps to Conduct Tax Audit

What is the Procedure for Filing Tax Audit Report?

The procedure for filing a tax audit report is explained below:

- The tax audit report must be filed on or before the pre-determined due date of filing the income tax return. The due date for filing the income tax returns are:

- Once the auditor uploads the tax audit report, the taxpayer either has to accept or reject it on their login portal. In case the taxpayer rejects the tax audit report, the entire process must be repeated until he or she accepts the tax audit report.

- The taxpayer also needs to mention the relevant information regarding their Chartered Accountant in their login platform.

- The auditor or Chartered Accountant (CA) assigned to conduct a tax audit of an individual or organization needs to present a tax audit report online, by using his/her official login credentials.

a) 30th November of the subsequent assessment years for taxpayers engaged in an international transaction.

b) 30th September of the subsequent assessment year for other taxpayers.

What are the Important Points to be noted With Regard to Tax Audit?

The following points must be noted with regard to Tax Audit:

- In case a person runs a business as well as a profession, then the tax audit is not based on total turnover from both.

- You will have to get your account books audited in case the gross receipts of all the professions cumulatively cross Rs. 50 lakhs-If you operate more than one profession.

- You will need to audit your accounts if the total turnover of all your businesses is more than Rs. 1 crore- If you are involved in more than 1 transaction.

a) If the business turnover is more than Rs. 1 crore, an audit is required for the business accounts.

b) If the gross receipts from the profession are more than Rs. 50 lakhs, then the profession accounts need to get audited.

c) But if the business turnover is Rs. 90 lakhs and your professional receipts are Rs. 40 lakhs, then no audit is needed for either of the accounts.

- If the turnover of your profession or business is below Rs. 50 lakhs or Rs. 1 crore, but you have sold a fixed asset, then the amount received will be considered as part of your professional profits or business. The following items sale are excluded from calculation into total gross receipts or turnover of a professional or business person:

a) Assets held as an investment (e.g., Shares, securities, or stocks).

b) Fixed Assets.

c) Rental Income.

d) Income from the interest that is not part of the business income.

e) Any expense that is reimbursed by the client.

f) Once the tax audit report is filed online, it cannot be revised.

What is the Penalty for Non-compliance with Tax Audit?

Non-compliance of regulations of tax audit attracts a penalty of whichever is lower from the following:

- Some of the permitted reasons are:

- If the taxpayer proves he has a genuine reason for delay or non-filing of audit report, then as per Section 273B, no penalty will be charged.

- In case of delay in completing the audit and submitting the report on time, i.e., before or on 30th September, then 0.5% of the turnover or a maximum of Rs. 1.5 lakh has to be paid as a penalty.

- If the books of accounts are not audited as per Section 44AB, then the taxpayer needs to pay the penalty as per Section 271B of the Income Tax Act.

- A penalty of Rs. 1, 50,000.

- 5% of the Total Sales or Gross Receipts or Turnover;

a) Delay made due to the resignation of the tax auditor.

b) Delay caused due to death or physical inability of the partner responsible for accounts.

c) Delay that is caused by labor issues such as strikes or lockouts.

d) Delay caused due to loss of accounts as a result of theft or fire or other incidents that are not under the taxpayer's control.

e) Natural calamities.

What are the Forms Required For Tax Audit?

- Rule 6G of the Income Tax Act, 1961, lists all the forms that need to be used for submitting the income tax audit of a business or profession under Section 44AB.

- If a business person or professional needs to get their accounts audited under any law other than the Income Tax Act, they need to file -Form 3CA (Audit Form) and 3CD (Statement of Particulars).

- If a business person or professional has to audit their accounts only as per the Income Tax Act, then they must use Form 3CB (Audit Form) and Form 3CD.

- If it is mandatory for the taxpayer to conduct an audit of his business under more than one law-for instance under both the Companies Act and Income Tax Act-then he/ she need not perform the audit twice in the same year. The taxpayer can submit the same audit report for the purpose of proper scrutiny. However, if the auditing is conducted for different Acts in different accounting years, the tax audit needs to be undertaken again as per the Income Tax Act in the relevant year.

When is a Tax Audit Ordered?

Section 44AB of the Income Tax Act, 1961, stipulates the groups of the income taxpayer who must undergo income tax audit mandatorily. These groups include:

- A self-employed person who is engaged in business with an annual turnover of Rs. 1 crore and above.

- A self-employed professional person whose income receipts are aggregate of Rs. 50 lakhs or more in a financial year.

- A person who qualifies for the presumptive taxation scheme as per Section 44AD but claims that the calculated profits are lower than the total tax paid for the financial year.

- A self-employed person whose recorded income for the financial year is more than the amount that is exempted from tax or not chargeable for taxation.

- If the taxpayer who is qualified for taxation under the presumptive taxation scheme opts out of it for a specified period, after opting out of the presumptive taxation scheme, the taxpayer needs to choose into presumptive taxation for a continuous period of 5 assessment years.

- A person who is qualified for the presumptive taxation scheme as per Section 44AE but claims that the profits are lower than those calculated as per the presumptive taxation scheme.

- Any individual who qualifies for the presumptive taxation scheme as per Section 44BB but claims that the profits are lower than those calculated with the presumptive taxation scheme.

Who cannot be a tax auditor?

There are specifically specified prohibitions on the appointment of tax auditors, which are enumerated below:

- Any member in part-time practice is not eligible to perform a tax audit.

- A chartered account cannot audit the accounts of a person to whom he is indebted for more than Rs.10, 000.

- A statutory auditor will be deemed to be guilty of professional misconduct if he/she accepts the appointment of Public Sector Undertaking/Government Company/Listed Company and other Public Company having turnover of Rs 50 crores or more in a year and accepts any other work, assignment or service regarding the same undertaking/company on a remuneration which in total exceeds the fee payable for carrying out the statutory audit of the same undertaking/company.

- The Chartered Accountant who is assigned with the task of writing and maintaining the books of account of the assesses should not audit such accounts.

- The audit of accounts of a professional firm of Chartered Accountants cannot be performed by any partner or employee belonging to such a firm.

- An internal auditor of the assessed cannot be appointed as a tax auditor.

- An auditor cannot accept more than 45 tax audit assignments in a particular financial year.

What should you do to be safe from a Tax Audit?

The primary motive behind indulging in any kind of business or professional activity is to earn a financial profit. The profit should be earned legally and appropriately. You must perform the following mentioned activities to result in a healthy tax audit:

- Maintain the books of accounts in an adequately specified way.

- Compute your profit or gain under Chapter IV of the Income Tax Act, 1961.

- Check whether income is taxable or not.

- In the Income Tax return file, mention the taxable income and permissible loss.

What is the Limitation on the CA's for the Number of Tax Audits?

- The maximum number of Tax Audit Assignments as per Section 44AB undertaken by a Chartered Account is 60.

- Hence if a firm has four partners, the maximum number of tax audits that can be undertaken by the firm in an assessment year will be 60*4=240.

- In case the firm undertakes all the 240 assignments, the partners would not be able to take any tax audit assignment.

- The Practicing Chartered Accountant conducting the tax audit needs to prepare the tax audit in an electronic format.

How can TAP GLOBAL Help you?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables