Cash Flow Management

In any type of business, when it comes to financial management it is often said that cash is king. Managing cash flow in the business is very essential, whether your business is growing or struggling. There is a statistic saying that over 60% of the business that fair profitable, just ran out of cash. In case an organization uses a lot of their working capital, without proper management they might face a cash crunch, preventing them from paying to suppliers, paying salaries, or buying materials. There is always a delay in paying the suppliers because receiving money from the customers is a problem and the only solution is cash flow management. Hence it is essential to maintain a level of working capital that allows you to move out of the cash crunch and also helps in operating the business. Managing cash flow delays outlays of cash as long as possible while the customers are encouraged to make payments as soon as possible.

What is Cash Flow Management?

Cash flow management is a process by way of which an organization maintains control over the inflow and outflow of funds. The primary aim of cash flow management is to ensure that the incoming flow of funds is higher than the outgoing funds so that the business remains on surplus. Cash flow management also serves as a subsidiary function for ensuring that the surplus funds are invested or held wisely to get proper returns on the blocked capital. Cash is the lifeblood of any business. Whenever the cash stops circulating, all the crucial operations can come to standstill.

The basic goal of cash flow management is to ensure that the business does not face cash shortages. No business must overdue payment to its creditors. Similarly, it must also not have any long-standing debtors on its books. The occurrence of such cases is an indication that the cash flow manager must take charge.

However, it is essential to clarify that the cash flow is not similar or equal to profits. Businesses can have positive cash flows and still be loss-making. Cash flow management can be considered as an intervening tool between payment to vendors or banks as well as a receipt from customers. It coordinates the payments and receipts in a manner that the payment to vendors is feasible according to the terms of the credit and also after considering the payment cycle of the customers.

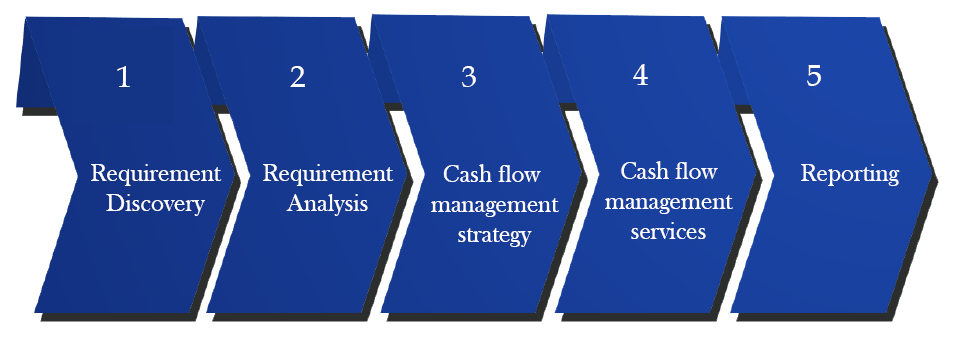

What is the Process of Cash Flow Management Followed by us?

The process of Cash flow management in TAP GLOBAL is:

What is the Importance of Cash Flow Management?

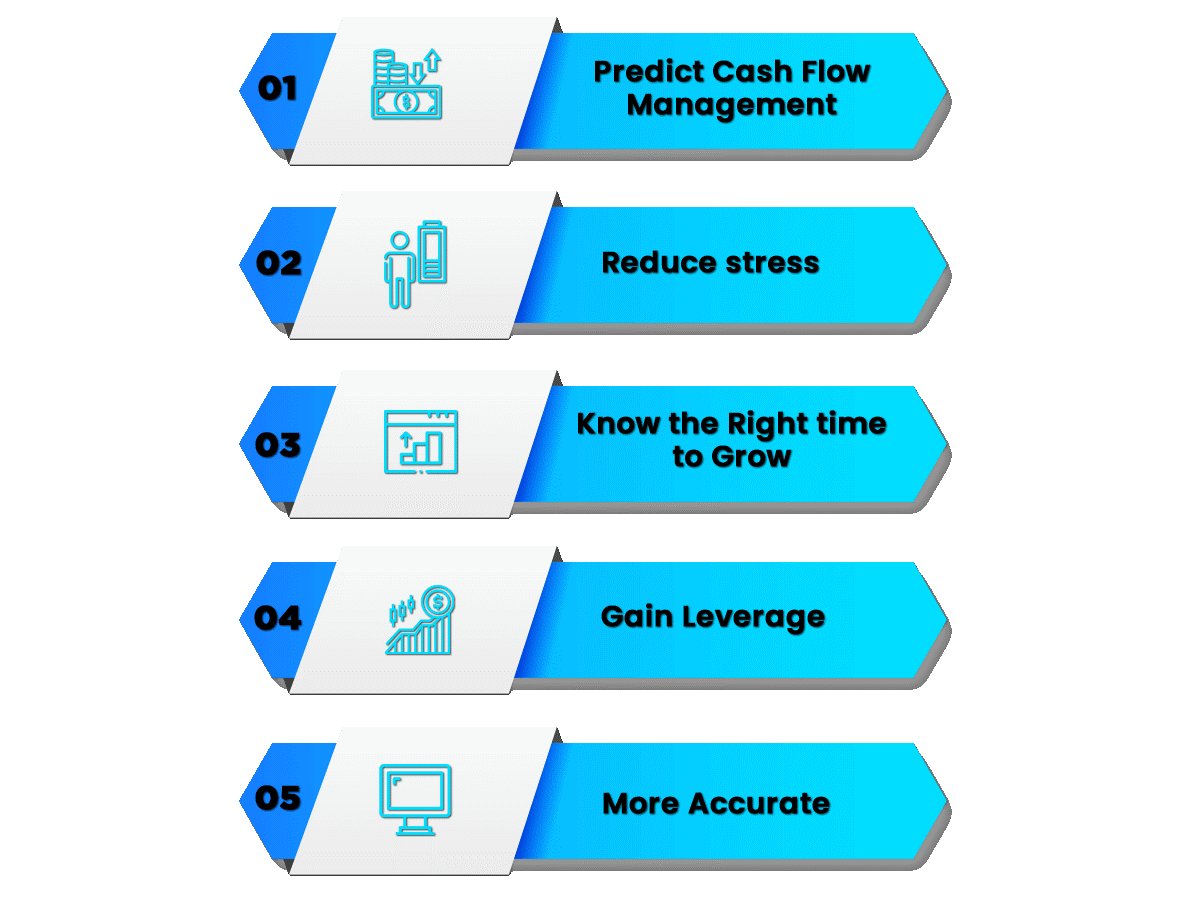

There are several benefits to cash flow control and to prioritize effective cash flow management.

The first and the most apparent benefit in managing cash flow and working capital is to know ahead of time when you will be having shortfalls. If you have a good system in place you can predict the shortfalls weeks, sometimes even months ahead of time, which will provide you proper time to come up with a new plan.

Below are some examples of predicting shortfalls:

- Delaying a shipment by a couple of weeks to prevent from paying customs duty.

- Make collection to clear up the outstanding bills.

Managing cash flow / cash flow management releases a lot of stress. Many entrepreneurs experience anxiety issues in paying bills from not knowing what is going on and worrying about whether or not the things will work out. It is better to know what is on the way, even when the outlook is not good.

Managing cash flow helps you in knowing exactly how much amount is spend on the growth. Just because your Profit and Loss Account shows that there is some extra money, does not mean it will materialize your life. When you have an eye over the cash flow over weeks and months, you will know exactly how much money should be spent and how much should be kept in hand to be used in growth in the future.

Good cash flow management gives you influence. If you need a credit extension from the bank to get you through a setback or you need to get a supplier to offer you a reprieve for half a month without intruding on administration, a proper cash flow management will back you up and set up a trust.

Banks commonly prefer to see this sort of arrangement, particularly on the off chance that you can plainly show when you will be able to reimburse the assets. Suppliers are considerably more liable to be adaptable if you can let them know precisely how you will pay and when as opposed to cutting correspondence like most organizations do during extreme periods. These individuals need your business and will be all the more ready to work with you through the high points and low points on the off chance that they can confide in you.

Cash flow management is said to be more accurate than the budget. Budgets tell you what you want to do, whereas cash flow projections tell you the actual occurrence, even if that does not go according to the plan made at the beginning of the year. Almost all of us hope to manage everything by not managing cash flow. But cash flow management will make you feel better by staying on top of your money.

How can you Protect Your Company from Future Cash Flows by Cash Flow Management?

A person can protect its company from future cash flows by proper cash flow management, in the following ways:

Cost-cutting will have a more quick effect on your main concern than the income raising endeavors. You could for example stop bonuses and extra time installments. You could likewise reduce the number of workers through steady loss or excess. You could likewise approach creditors requesting better payment terms.

Prior to taking on new customers, do credit checks. Organizations that normally make late payments or default on payments ought to be red-flagged. You ought to likewise get new customers to sign agreements that incorporate your payment terms.

-

Offer early payment discounts

You can encourage your clients to do early payments by offering discounts on early payments. The early payment discount must be used when the company needs urgent cash. If you do it regularly, there will be a huge gap in the profit margins.

-

Reduce your payment terms

Decrease your payment terms from 60 to 90 days. It is a good business idea, just imagine when you allow your customers to pay in arrears for your products and services, you are providing them short term unsecured loans.

Consider renting instead of buying vehicles, property, office furniture, apparatus, and IT and media communications hardware. The advantage of leasing, as opposed to purchasing, is that you will just need to make small scheduled installments. This will enable your money to stream. You can likewise guarantee the rent cost.

Organizations are frequently hesitant to raise their costs because of the fear that they will lose esteemed clients to competitors. But a little raise in costs can work on your overall revenues. You can overcome clients' protection from a value ascend by offering packaged items or services.

Many organizations do not give invoices rapidly enough or pursue late payments. Every company needs to collect money by issuing invoices. If in case they fail to collect the invoices on time they would not be able to raise money for making further payments.

One should hire a company that provides financing to receive immediate cash. Such companies give funding against your unpaid invoices for a fee.

You could move towards banks or credit lending organizations for a short-term credit or utilize other subsidizing sources, for example, self-account, partners, investors and peer to peer lending.

-

Hire CFO Support Services

CFO Support services will look for all things that pose a threat to the company and will also work with you to resolve all the issues. Your CFO will find for ways you can meet your financial requirements and also review all incomings and outgoings to see where improvements and savings can be made.

The CFO will prepare cash flow forecasts. Such forecasts will alert you regarding the possible cash shortfalls soon. You can then make arrangements for additional borrowing (if needed). It will help in making decisions with regard to the hiring of new staff, to raise your prices, find new suppliers or tender for a large contract.

Outsource Cash Flow Management Services to India in TAP GLOBAL

In house cash flow management requires a qualified staff and a proper certified Chartered Accountant. By outsourcing cash flow management services in TAP GLOBAL, you will benefit from cost savings and will also develop a better understanding of the way in which money flows in an organization. It must have been very difficult for you to get an updated financial forecast. We as an outsourcing partner will provide you with regularly updated financial forecasts. We will also provide you cash flow projections based on the rolling forecasts for the next 2 to 3 years. Our primary objective as a cash flow management service provider is to enable you focuses on your core business activities.

However, our cash flow management services cover a wide range of area in order to give a basic idea; here are the highlights of some of the services provided by us:

- We will be providing complete support for financial leverage reports.

- We will monitor all your investment growth in a regular basis.

- We will provide you cash flow analysis that will assist in the expansion and purchase decisions.

- Complete sales and revenue statements will be provided by our experts on request.

- We will help you in minimizing the risk and expansion.

- We have all the latest software and IT support for cash flow management work and hence you do not need to provide extra efforts on your infrastructural resources.

- We have an economical package for SMEs and Startups.

How can TAP GLOBAL Help You?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables