Overview of Finance and Accounting Outsourcing Services

Businesses across the world are going through an unpredictable and unstable market scenario. The constant shift between globalization and delocalization is forcing companies to streamline their operations and make their results and financial outcomes more predictable. While many businesses still believe in self-reliance, the Chief Financial Officers (CFOs) of top companies are looking for external assistance to plan their financial operations. For this, companies are opting for Finance and Accounting Outsourcing services and assigning their fiscal management to financial experts outside their organizations.

Among the business classes, small businesses, startups and new entrepreneurs especially find it difficult to hire and retain a full-time expert for their financial management. Though they are able to appoint an experienced financial professional, the services offered by them are limited. Additionally, finding competent experts with multi-disciplinary expertise can cross the financial budgets of a small business. This has led to many small companies to opt for Finance and Accounting Outsourcing services from management consultancy firms who can provide end-to-end financial assistance.

Finance and Accounting Outsourcing Services

Businesses have recently identified the large potential that lies in outsourcing their key business operations to outside individuals and firms. Be it Human Resource Outsourcing, Customer Service Outsourcing and even Finance and Accounting Outsourcing, businesses are shifting from in-house operations to outsourced functioning.

Finance and Accounting are crucial components of a business, allowing it to stay afloat and fuel its growth ambitions. When it comes to outsourcing these Finance and Accounting needs of a business, businesses transfer their financial responsivity to external professionals while still keeping the overall control of their financial operations. Outsourcing of Finance and Accounting management and planning involves all the different kinds of bookkeeping, accounting, taxation, financial planning and analysis.

Finance and Accounting Outsourcing allows companies to shift the financial management of their business to a group of individuals. These firms have the required knowledge, skill sets, and subject matter qualifications to handle the multiple tasks involved in maintaining their financial health. Finance and Accounting Outsourcing services allow businesses to improve the way their accounting and financial management is done in a cost-efficient way.

The outsourcing of Finance and Accounting requirements of a company has recently gained popularity as a strategic measure to improve efficiency and accuracy. With more pressure to increase performance and reduce costs, businesses are looking to shift their burden to external experts that cost less than a full-time in-house team.

Key Benefits of Finance and Accounting Outsourcing

While many businesses still prefer to have their finance and accounting operations managed in-house.

They may end up facing the following issues in the long run:

- Inability to catch up with the different updates by the government in the compliance requirements, accounting rules and financial norms.

- Difficulty to cope up with the increasing operating costs associated with the recruitment, training and payroll of an internal team.

- Unintentional non-compliance of the need to fulfil the financial returns and compliance filing requirements.

With globalization, businesses across the world have open access to outsource their business requirements to external experts. Companies that opt for Finance and Accounting Outsourcing services benefit in several ways. The primary benefits of outsourcing the finance and accounting activities of a business to an FAO company include:

Adherence to Latest Compliances

By opting for finance and accounting outsourcing services, a company stays up-to-date with the latest changes and notifications in the compliance policies, norms, regulations, and accounting standards. By going through the outsourcing route, a company transfer the worries and responsibilities of tracking and adhering to the latest policies and changes to the Finance and Accounting Outsourcing company, along with the risks inherent to them.

Technological Advancement

Companies that choose Finance and Accounting Outsourcing are able to access the best of technological innovations and accounting software. When the finance and accounting functions are outsourced, a company is able to access the latest software and security measures without paying any extra money.

Finance and Accounting Expertise

When a company outsources its Finance and Accounting needs, it is able to access expert guidance from experienced financial professionals. The quality of its financial management, bookkeeping and accounting also increases as compared to the quality of these activities performed in-house with limited resources.

Reduction in Operational Costs

Outsourcing Finance and Accounting activities also help a business to reduce the operational costs associated with these functions. It is because the company does not require to maintain an in-house team of accounting or finance experts and can cut down its costs significantly.

Expansion of the Company's Finance and Accounting Operations

A business outsourcing its accounting and financial functions gets the ability to scale such functions up or down as per its business requirements. Finance and Accounting Outsourcing gives a business the needed flexibility to maintain its budget associated with these functions as per its needs and abilities. For instance, a business that only needs part-time assistance can scale down its Finance and Accounting Outsourcing for a short period and again scale up its outsourcing needs when it expands its operations. Financial expertise can be availed by the company at any time, at any level as per its current finance and accounting needs.

Better Quality of Services

Finance and Accounting Outsourcing companies give more emphasis on the quality, safety and confidentiality of their services as compared to in-house teams. This gives a company, the assurance that its financial data would be in safe and responsible hands.

Businesses are able to form long-term associations with the Finance and Accounting Outsourcing service provider. They can leverage the higher quality of services, more subject matter expertise and new insights in its operations to improve their overall efficiency.

Improved Connectivity

Finance and Accounting Outsourcing companies come with the benefit of constant connectivity. Their experts are available for 360-degree guidance to the company round the clock. It means managers can make prompt and efficient business decisions for the business growth.

Reduced Liabilities

A business can reduce the risks and liabilities associated with any errors or omissions in the tax compliance of the business. It helps the business to avoid the heavy penalties associated with such non-compliance.

Increased Efficiency

Finance and Accounting Outsourcing brings out the best in a company's financial management and overall productivity. Since many outsourcing companies use client-oriented technologies and efficiency-based business methods, they are able to support the efficiency standards required by a business.

The increasing competition in the outsourcing industry also leads to outsourcing companies putting their best foot forwards and retain their clients by providing efficient finance and accounting services.

Prevention of fraud

Companies with completely in-house finance and accounting operations are more susceptible to fraud as compared to companies that opt for Finance and Accounting Outsourcing. This is because the risks involved with assigning all the financial responsibilities to a few individuals may increase the change of deliberate errors and data threats.

Reduction in Employment Needs

Outsourcing the Finance and Accounting function allows a company to minimize its needs to hire a full-fledged finance team or worry about the leaves, employee benefits, bonuses, and other costs associated. It also reduces the need for a company to train an in-house finance and accounting team.

Innovation

By outsourcing the Finance and Accounting Outsourcing functions, companies can access better innovation and focus more on their strategic operations. The innovative processes offered by FAO firms are low-cost, high-value, and therefore, give a competitive edge to the businesses. A company not only shift from an internal to the outsourced business model but also to innovation.

Higher Data Security and Privacy

All the data transactions that are done by the Finance and Accounting Outsourcing companies over the Internet are completely protected and confidential. Most FAO firms use VPNs (Virtual Private Network) and encrypted data transfer in order to provide end-to-end safety to the sensitive data of their clients. Other tools like Firewalls and Antivirus software are also employed to ensure that the finance and accounting outsourcing services are provided in the most secure manner. The limited authorization also allows FAO companies to implement high data security standards.

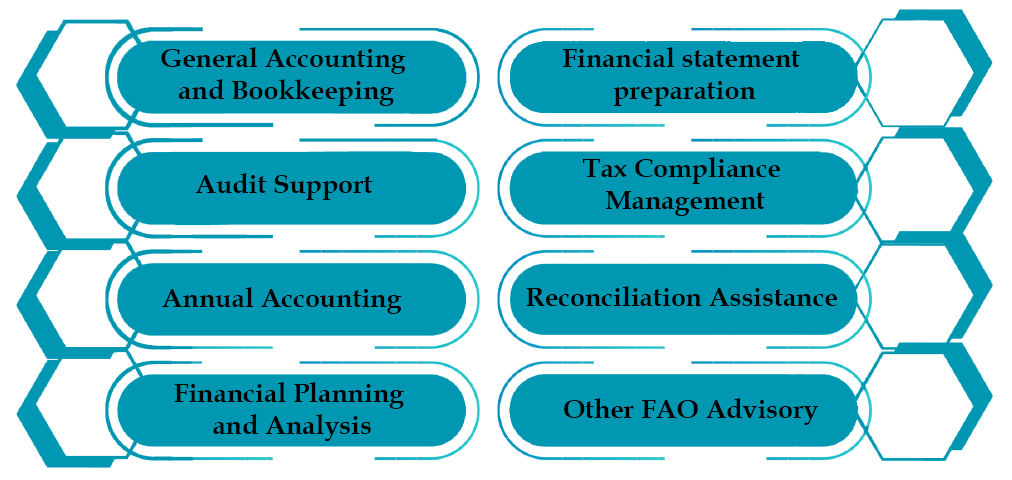

Functions Included in Finance and Accounting Outsourcing Services

The various functions that can be allotted by a company to Finance and Accounting Outsourcing service providers include:

General Accounting and Bookkeeping

Finance and Accounting Outsourcing services include preparing and managing the daily bookkeeping as well as the monthly and quarterly accounting activities. Outsourcing the general accounting and bookkeeping activities can allow a company to deal with the most common problems faced by in-house accounting departments. The general accounting and bookkeeping outsourcing services allow a company to outsource its back-end management without increasing human resource costs. The Finance and Accounting Outsourcing company can provide detailed reports of the financial data of the company, which can allow the company to make more informed financial decisions. The general accounting and bookkeeping outsourcing services include:

- Customer invoicing and payments

- Deferred revenue

- Employee reimbursement processing

- General ledger maintenance

- Financial reporting

- Month closing registers

- Payroll management

- Payment management

- Expense management

- Vendor invoice processing and payments

Financial statement preparation

Financial statements of a company consolidate the key financial information of the business. Financial statement preparation and management is also required for compliance filings and annual audit of the business.

The Finance and Accounting Outsourcing services related to financial statements include:

Audit Support

Finance and Accounting Outsourcing also includes the function of complete auditing of the financial accounts of the business. The Finance and Accounting Outsourcing company appoints independent auditors for its clients for its financial audits and assessment of its financial health. The FAO firm can also assist the company in dealing with all the suggestions and red flags highlighted by the auditor to improve the company's financial standing.

Tax Compliance Management

A company can also outsource its requirements relating to preparation and management of tax returns and tax compliance filing. Finance and Accounting Outsourcing also includes the functions of tax processing, tax planning, direct and indirect tax returns, notice replies and tax litigation.

Annual Accounting

With the closure of books after each financial year, a business needs to adhere to many financial regulatory compliances. A Finance and Accounting Outsourcing company can assist a business with its annual accounting, making it easier for the business owners or entrepreneurs to compliant with the tax forms.

Reconciliation Assistance

Reconciliation of financial data is crucial for the healthy finance and accounting functioning of a company. Many small companies, startups and entrepreneurs lack the skills needs to reconcile bulk financial data, and therefore, face difficulty with their compliance, financial planning, and business valuation.

Financial Planning and Analysis

Finance and Accounting Outsourcing also includes the most critical components of a business- financial planning and analysis. An FAO firm can help a company to analyses its financial data plan its finances accordingly, especially when a company lacks an in-house finance and accounting team. Also, when the entrepreneur does not possess the skills, expertise, time and resources for the financial planning, the FAO company can provide them with the right guidance. By opting for Finance and Accounting Outsourcing services, a company can gain comprehensive insight and evaluation of its financial standing. The financial experts of a Finance and Accounting Outsourcing company can help a company with:

- Auditing

- Director report preparation

- Business decision making

- Financial data analysis

- Investor reporting

- Management reporting

- Financial planning

- Financial budgeting

- Financial forecasting

Other FAO Advisory

A company can also access various other finance and Accounting Outsourcing Advisory services. These services include payroll services, financial forecasting, cash needs analysis, legal support, creditor payments, cash handling, financial investigation and treasury management, high-interest deposit management, current accounts management, accounting software management, accounts receivable and accounts payable management and accounting setup services.

Management consultancy firms like TAP GLOBAL, who provide Finance and Accounting Outsourcing services, have a team of domain specialists who can help companies to achieve their business goals. TAP GLOBAL can guide companies with their different finance and accounting requirements in the most approachable and cost-efficient manner.

Finance and Accounting Outsourcing Services by TAP GLOBAL

TAP GLOBAL is a team of industry professionals who possess the necessary expertise and relevant market knowledge. Our team of experts provides cost-effective and high-quality finance and accounting outsourcing services to businesses to enable them to increase their efficiency and improve every aspect of their financial requirements. Our tailor-made solutions allow our clients to focus on their critical and primary business functions, while that add value to their finance and accounting functions.

We provide assistance for an array of finance and accounting processes such as bookkeeping services, accounts reconciliation, payroll management, financial planning, tax compliance and financial administration. We manage the finance and accounts functions of our clients with the utmost levels of care, accuracy, appropriateness, privacy, honesty, competence and expertise.

Our Finance and Accounting Outsourcing services include the following:

- End-to-end bookkeeping services & general accounts management services.

- Timely assessment and compilation of financial accounts and financial statements.

- Preparation of financial statements.

- Financial planning, forecasting, budgeting and analysis.

- IFRS and Indian Accounting Standards compliance.

- Tax compliance assurance: Monthly, quarterly and yearly financial accounts management.

- Indirect and direct tax return preparation and filing.

- Payroll management.

- Financial administration and regulatory compliance support.

- Audit support.

- Financial investigation and Treasury management.

- Accounts receivable and accounts payable management.

Why Choose TAP GLOBAL

Outsourcing of the financial and accounting functions of a company is a careful decision, and choosing the right service provider is important for a successful and fruitful outsourcing decision. The outsourcing arena keeps on changing, and a Finance and Accounting Outsourcing company must be able to keep up with the changing demand of its clients. By transferring such core functions of the company, a business allows an outsider to access its financial data.

This means that the Finance and Accounting Outsourcing company must have the needed experience in dealing with such crucial data. It is important so as to allow the company to freely outsource its needs while it focusses on the other areas of business. TAP GLOBAL understands this and is globally renowned for proving the utmost quality of services to clients. The value proposition of TAP GLOBAL for Finance and Accounting Outsourcing services include:

- Highly Experienced Team: We have an extensive team of 300+Qualified professionals from different fields such as CA, CS, CPA, Lawyers, and other business management experts who possess extensive industry experience.

- Industry Experience: We have served hundreds of businesses from startups, MSMEs, large corporate houses and multi-national giants with their management consultancy and outsourcing requirements.

- Diverse Portfolio: Our services are designed to address the unique business requirements of assorted business sectors including but not limited to finance, healthcare, manufacturing, hospitality, technology, telecom and insurance.

- One-stop Solution: TAP GLOBAL provides a wide range of accounting and finance services, along with other business management and outsourcing services, making us the all-inclusive answer to all your business requirements.

- Cost-efficient Solutions: TAP GLOBAL provides best-in-class services at 50-60% lower costs as compared to other services providers. Our Finance and Accounting Outsourcing services are aimed to not only help our clients thrive but also help them to save up on the expenses related to such services. We streamline business solutions and provide efficient assistance for the steady and financially-viable growth and expansion of our clients.

- Security and Confidentiality: One of the most important aspects of Finance and Accounting Outsourcing services is the security and confidentiality of financial data. TAP GLOBAL has a robust mechanism for the secure FTP server and encrypted e-mails and multi-layered data storage protection to safeguard the privacy of our clients data.

How Can TAP GLOBAL Help you?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables