Audit Services

In current scenario an audit service is considered more than a formality. It is a prerequisite for protection and growth of a business. Some of the essential features are early warnings, pragmatic solutions and open communication. Audits consists of checks, controls and assurance, which can be complied statutorily or even be held voluntarily by an organization to assure the correct picture of business in terms of finance.

The auditor must take time to understand the client's businesses by providing risk focused service integrating rigorous risk assessment with diagnostic processes .The audit testing procedures must be tailored to the specific audit. At Tap Global, we maintain excellent relationships with our clients. We provide a quality led approach to our members and also provide an intelligent, constructive, and challenging audit to all our clients.

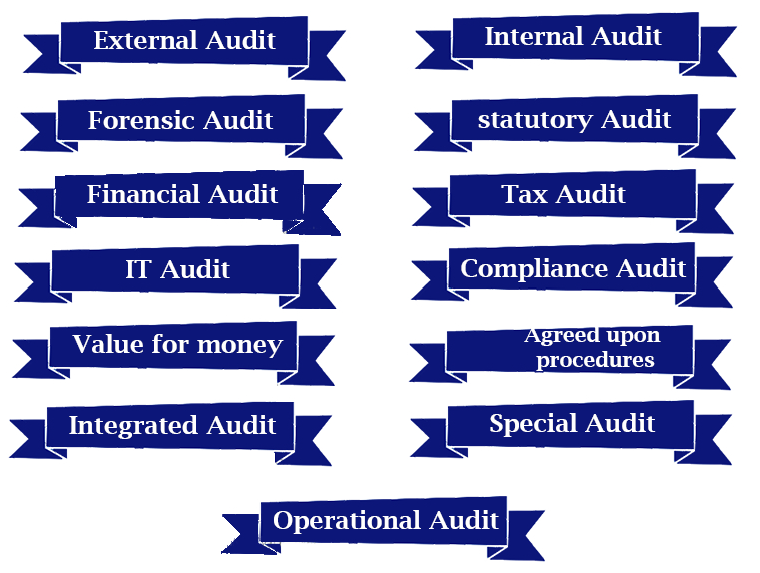

What are Types of Audit in India?

The types of audit for purpose of Audit services have been listed below:

External audit is referred to the audit firms that offer audit services like assurance services, and tax consultancy services. You can get the best audit service in Tap Global. This type of audit service requires a proper professional that follow International Standards on auditing or local standards as required by domestic law. Tap Global works independently right from auditing the clients to resolving any conflict of interest that has occurred.

Proper procedures must be applied to minimize conflicts of interest. The popular services that are offered by external audit firms are audit of financial statements, advisory services and tax consultancy services

Internal audit an independent consulting service that has been designed to add value to the business and also improve the organization's operation. It also provides a disciplined and systematic approach in evaluating and assessing the entity's risk management, internal control, and corporate governance.

The overall scope of internal audit is determined by the audit committee or board of directors that have equal authorization. In case there is no audit committee and board of directors, internal audit committee reports to the shareholders of the entity.

Forensic Audit is usually performed by a forensic accountant who has expertise in both investigation and accounting. The investigation covers number of areas that includes fraud investigation and insurance claims as well as some type of dispute amongst the shareholders. A forensic audit must also have a proper plan, procedure, and report like any other audit engagements.

Statutory Audit refers to an audit done for financial statements for specific type of organizations as required by law or local authority. Statutory audit is generally performed by external audit firms and the audit report issued by the auditor is submitted to the Government body of an entity. The common criteria for organizations to audit their financial statements from the financial firms are the annual turnover, number of employees and the value of assets. Companies that are listed on the stock exchange are generally required to audit their financial statements.

Financial Audit is referred to the audit of the entity's financial statements by an independent auditor or basically an auditing firm. Financial Audit is performed annually and at the end of the accounting period. This type of audit is also known as financial statement auditing. Sometimes if required financial audit is also done on quarterly basis.

The auditor needs to follow audit standards to conduct financial audit to adopt international standards and requirement of local law.

Tax Audit is performed by the Government's tax department or tax authority. A tax audit can be performed as a result of non-compliance of a Government Agency.

Any organization or entity needs to minimize the penalty as a result of the tax audit. The entity must follow the prerequisites set by the tax law in all required areas. For this purpose they can consult a tax consulting firm for further advice.

-

Information System Audit or Information Technology Audit (IT Audit)

This type of audit evaluates and checks the reliability of the security system, the information security structure, as well as the integrity of the system so that an individual can rely on the output of the system.

In some cases financial auditing also requires IT Auditing as with increasing use of technology most of the customers financial reports are recorded in some accounting software. Tap Global provides you IT Audit services as well as financial audit services.

Compliance audit checks on the internal policies and procedures of a company as well as law and regulation where the entity is operating. A compliance audit is a part of the system used by the entity's management for enforcing the effectiveness of the implementation of the governments law and regulation.

Value for money audit refers to the audit that is performed to assess and evaluate three different factors: Economy, Effectiveness, and Efficiency.

Value for money audit is essential for an entity because it helps procuring as well as improving the efficiency of materials used in different processes.

-

Review Financial Statements

Review financial statements are a type of negative investigation done by auditors where the auditors review the financial statement and express their opinion regarding the same. This kind of services is generally needed when an entity requires money from the bank.

-

Agreed Upon Procedures (AUP)

The agreed-upon procedure is a type of negative investigation where the auditors perform their review on the procedures that is agreed with the client. This type of investigation is called limited assurance. Though the procedures are set by the client, the auditors must also ensure that the firm has enough resources for performing the job. An auditor also needs to ensure that there is no conflict of interest between the audit team as well as the client management team.

Integrated audit is performed in situations where there is need of two different type of audit. For example financial audit needs to be done with social audit. An integrated audit is also performed when the entity operates in many different countries and the financial statements are an audited by different audit firms.

A special audit is normally done by an internal auditor. For instance, if there is a fraud committed in a payroll department the audit committee can be requested to conduct special audit.

A special audit is a type of audit assignment that is normally done by an internal auditor. Special audit is performed by the internal staff.

Operational Audit is an audit service mainly focused on the key processes, systems or procedures as well as the internal control system. The primary objective of operational audit is to improve productivity, efficiency, and effectiveness of the operation.

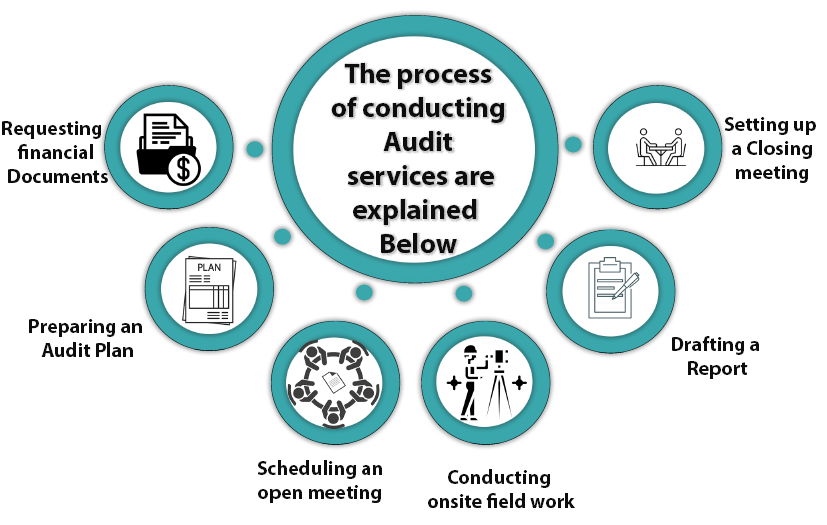

What is the Process of Conducting Audit Services?

The process of conducting Audit services are explained below:

-

Requesting Financial Documents

After notifying the organization regarding the upcoming audit, the auditor generally requests for the documents listed on the audit preliminary checklist. These documents include a copy of the previous audit report, the original bank statements, receipts, and ledgers. Also, the auditor might request organizational charts, along with copies of board and committee minutes as well as copies of bylaws and standing rules.

The auditor checks all the information mentioned in the documents and accordingly plans out how the audit must be conducted. A risk workshop can also be conducted to look at all the possible issues. An audit plan is then drafted by the auditors.

-

Scheduling an Open Meeting

Senior management and key administrative staffs are invited to an open meeting during which the scope of the audit is presented by the auditor. A time frame for the audit is determined, and any timing issues such as scheduled vacations are discussed and handled. Department heads may be asked to inform staff of possible interviews with the auditor.

-

Conducting Onsite Fieldwork

The auditor finalizes the audit plan with the help of all the information gathered from the open meeting. Fieldwork is then conducted by reviewing the procedures and processes as well as communicating to the staff members. The auditor may discuss the problems with the organization giving them an opportunity to respond.

The auditor also prepares a report detailing the all findings of the audit. The report consists of mathematical errors, payments authorized but not paid; posting problems and other discrepancies any other audit concerns (if there) must also be listed. The auditor then writes up a summary describing the findings of the audit and also recommends solutions to problems.

-

Setting Up a Closing Meeting

The auditor asks for a response from the management on the issues mentioned in the report. A description of management's action plan must be addressed along with the problem and a projected completion date. In the closing meeting, all parties that are involved discuss the report and management responses. If any issues are left out, they must be resolved by this point.

Why Tap Global is the best audit firm in India for Consultation of Audit Services?

As a leading audit firm, we ensure to deliver quality services and solutions to our clients. Our well experienced and certified team is capable of covering all the aspects of audit whether it is internal or external. Tap Global assists in:

- Preparation of audit strategy and also planning throughout the audit period.

- Providing a proper internal/external audit service.

- Sharing of knowledge and assistance in training the internal staff for purpose of internal audit (if required).

- Quality Assurance

- Assessing the key risk areas and providing solutions for the same.

How TAP GLOBAL assist our clients in Audit Services?

Tap Global helps our clients in providing Audit Services in following ways:

- Execution of audit process in specialized areas and to improve the internal controls

- Identifying the High risk areas and solutions to remove or pacify such risks.

- To set an internal audit system for all the newly established companies.

- To .provide training to staff on internal audit procedures

- Continuous reviewing and monitoring of both the internal and external audit process.

How our Auditors are who will provide you Audit Services?

Our Auditors in Tap Global will provide you the following services:

- Fully qualified and certified accountants

- Competent to operate as Auditors in your respective industry.

- Complete adherence to Auditor's Code of Conduct.

- Maintaining constant communication with you during the Audit process.

- Deliver a well written professional report specifying all the key findings and corrective actions.

- Trusted Experts who will keep all your information and consultations confidential.

How Tap Global helps you to get the Audit Services?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables