Overview of IRDA Insurance License

Before the Insurance Regulatory Development Authority of India (IRDAI), insurance was regulated under the Insurance Act 1938. Over the years, various amendments were passed to ensure that insurance business is appropriately regulated. There were several laws and regulations which were passed after 1938. In the mid-1950s, insurance companies were nationalized. This also included the nationalization of the Life Insurance Corporation of India (LIC). Mainly all life insurance businesses would come under the ambit of the LIC. After several nationalizations occurred, the number of insurance firms reduced in India. All the firms came under the purview of several insurance firms offering services.

The Insurance Regulatory and Development Act 1999 (IRDAI Act) was brought out with the view to regulate the insurance businesses in India. Such regulation was brought out for the development of the Insurance Sector in India. This regulation governs the registration of insurance business in India, granting of IRDAI License for starting an insurance business and protection of the interests of the policyholders. Apart from this, the nodal agency ensures that firms are compliant with the regulations which are brought out from time to time.

Insurance products can be sold to policyholders, either online or offline. IRDA License provides a certificate for Insurance companies to operate.

Purpose of securing an IRDA License for your Insurance Business

Insurance Regulatory and Development Authority of India (IRDAI) has been set up as a nodal agency to regulate the insurance sector in India. Apart from this, the agency also monitors the regulation of insurance businesses in India. This regulator ensures to maintain the balance between insurance firms and policyholders. Securing an insurance License for your business is crucial as it involves dealing with financial linked products. Insurance contracts are contracts that provide indemnity to the policyholder on the happening of a particular event. Therefore these areas require regulation constantly. Hence it is essential to obtain an IRDA License before commencing an insurance business.

Requirement of IRDA License

An IRDA License would be required for the following reasons:

- To ensure that the insurance business is compliant with the laws and regulations that are passed by the IRDAI from time to time.

- To control the business of insurance in India. Insurance sector requires to be heavily regulated to protect the interests of consumers.

- It also assures the people and authorities that proper rules and regulations, and extra care and protection are followed while carrying out the business of insurance.

- The IRDAI ensures that insurance business are being monitored and regulated on a constant basis.

- The IRDAI would also handle any form of grievance of policyholders. This would be addressed as a grievance handling mechanism.

- Securing an insurance License would ensure that a business is compliant with all regulations governing insurance.

Therefore for the above reasons, an IRDA License is required before starting an insurance business in India.

Who Regulates IRDA License

The primary regulatory authority and the law behind securing insurance (IRDA License) are:

- IRDAI- Insurance Regulatory Development Authority of India.

- Companies Act 2013 (the Companies Act)/ Companies Act 1956.

- IRDA (Registration of Indian Insurance Companies) Regulations 2000 (the Registration Regulations).

- IRDAI (Re-insurance) Regulations 2018 (Reinsurance Regulations).

- Any other relevant regulations which apply to securing an Insurance License in India.

Eligibility criteria for securing an IRDA License/ Insurance Business in India

The applicant has to ensure that the promoter or the company has the following requirements:

- The amount of capital that is required to start an insurance business is 100 crores, and the reinsurance business is 200 crores.

- Apart from this, the applicant must ensure that any form of previous application for starting an insurance business is not rejected.

- The following other conditions are present for starting an insurance business:

1. In the last five years, an application for starting an insurance business is not rejected

2. The certificate has not been cancelled or revoked by the IRDAI.

3. The name of the business must contain the word insurance company.

- If the Equity Investment is by a foreign company or a Non-Resident Indian, then 26% must be held by the Foreign Company or Non-Resident Indian.

- If Banking Companies want to start the business of insurance, they have to take permission from the Reserve Bank of India.

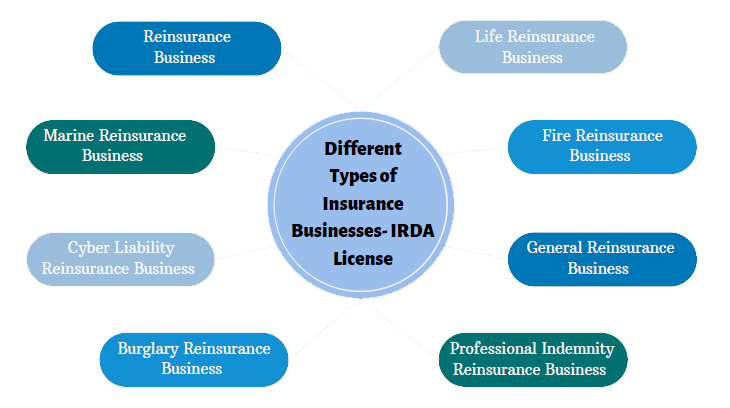

Different Types of Insurance Businesses- IRDA License

All the below businesses require an IRDA License. IRDA License is provided for the following businesses:

Process / Procedure of securing an IRDA License

- A company that wants to start an insurance business must make a formal application online.

- This application is made under Form IRDA/R1.

Step 1- Filling up the IRDA/R1 form and submitting it to IRDA (IRDA License)

- An applicant desiring to carry on insurance business in India shall make a requisition for registration application in Form IRDA/R1. An applicant, whose requisition for registration application has been accepted by the Authority, shall make an application in Form IRDA/R2 for grant of a certificate of registration.

- To be considered as an Insurance company, the company must be a Public Limited Company under the Companies Act 2013 or Companies Act 1956.

- A certificate of registration is required for each category of insurance-related business. In essence, there will be a certificate of registration for Life Insurance Business and Certificate of Registration for General Insurance Business.

- The application must be accompanied by the following :

- A certified copy of the Memorandum of Association and Articles of Association. This would be applicable where the applicant is a company that is incorporated under the Companies Act 2013 or Companies Ac 1956.

- The name, address and the occupation of the directors and principal officer;

- A statement of the class of insurance business proposed to be carried on;

- A statement indicating the sources that will contribute to the share capital required.

- Any other documents that are required by the IRDA.

- Once the IRDA/R1 form is complied with - the authority will grant the IRDA/R2 form for certificate of registration.

Step-2- Authority Satisfied with IRDA/R1 and Grants Form IRDA/R2 for the applicant to make further registration

The IRDA/R2 application should contain the following:

- Documentary proof evidencing the making of deposit required under section 7 of the Act.

- Evidence of having rupees one hundred crore or more paid up equity share capital, in case the application for grant of certificate is for life insurance business or general insurance business;

- Evidence of having rupees two hundred crore or more paid up equity share capital, in case the application for grant of certificate is for re-insurance business;

- Affidavit by the principal officer and the promoters of the applicant certifying that the requirements related to the paid-up share capital is adequate after excluding any preliminary expenses incurred in the formation and registration of the company and the deposit which is made by the company;

- A statement indicating the distinctive numbers of shares issued to each promoter and shareholder in respect of share capital of the applicant;

- An affidavit by the principal officer and the promoters of the applicant certifying that the paid-up equity capital does not exceed more than 26%

- A certified copy of the published prospectus;

- A certified copy of the standard forms of the insurer and statements of the assured rates, advantages, terms and conditions to be offered in connection with insurance policies together with a certificate by an actuary in case of life insurance business that such rates, advantages, terms and conditions are workable and sound;

- A certified copy of the memorandum of understanding (MOU) entered into between the Indian promoter and the foreign promoter or amongst the promoters as a whole including details of the support comfort letters exchanged between the parties;

- The original receipt showing payment of the fee of rupees fifty thousand for a class of business;

- A certificate from a practicing chartered accountant or a practicing company secretary certifying that all the requirements relating to registration fees, share capital, deposits and other documents which have to be provided by the applicant;

- Any additional information required by the authority during the processing of the application for registration; and

- The fee of rupees fifty thousand for each class of business for registration shall be remitted by a bank draft issued by any scheduled bank in favour of the Insurance Regulatory and Development Authority payable at New Delhi.

Step 3- Applicant to start insurance business within 12 months of the date of registration (IRDA/R3 Form)

- If all the particulars are satisfied and the authority believes that the business is sound and fit to carry the business of insurance, then it will grant the certificate Form IRDA/R3.

- The applicant who has been provided the certificate of registration should commence the insurance business within 12 months of the registration date.

- If the applicant company does not feel that it cannot begin its operations within 12 months, it has to take an extension from the authority before the 12 months period expires.

Documents required for IRDA License

The following documents are required for an IRDA License:

- Evidence of Capital for an Insurance Business- that is equity capital of 100 crores.

- Evidence of Capital for a Reinsurance Business- that is the equity capital of 200 crores.

- Name and address of the directors.

- Qualifications of the directors.

- Certified Copy of the Prospectus.

- A statement indicating the distinctive numbers of shares issued to each promoter and shareholder in respect of share capital of the applicant.

- A certified copy of the standard forms of the insurer and statements of the assured rates, advantages, terms and conditions to be offered in connection with insurance policies together with a certificate by an actuary in case of life insurance business that such rates, advantages, terms and conditions are workable and sound.

- The original receipt showing payment of the fee of rupees fifty thousand for a class of business.

- A certificate from a practicing chartered accountant or a practicing company secretary certifying that all the requirements relating to registration fees, share capital, deposits, and other requirements of the act have been complied with by the applicant.

- Any additional information required by the authority during the processing of the application for registration.

Validity for Insurance License- IRDA License

IRDA License would be valid for one year. The applicant has to make a fresh application for renewing the insurance License in India.

IRDA License Renewal in India

An applicant who has the insurance License will make an application under Form IRDA/ R5. This application must be made before 31st December of each year. When an application for renewal is made, the following must be provided as evidence of renewal:

- Fifty thousand rupees for each class of insurance;

- One-fifth of one percent of the total gross premium of the insurance business during the financial year before the year in which the application for the renewal of the certificate is required to be made;

- Or Rs 5 Crore whichever is less.

If renewal is not made by the insurance company before 31st December every year, then the application would be accepted by the authority. However, a penalty of 10 percent of the fee payable will be levied on the applicant for delayed payment of fees.

The fee will be paid into the account, which is maintained by the Insurance Regulatory and Development Authority of India with the Reserve Bank of India.

Duplicate Certificate

The IRDAI also has the authority to issue a duplicate certificate to the insurance business. The applicant has to make an application under IRDA/R4 and make a payment of Rs 5000/-.

How can TAP GLOBAL help

- We file the application form on your behalf to get the insurance license for your business.

- We will also help to renew your License for your insurance business.

- We monitor and track the status of the application on behalf of the client.

- We value your time and money.

- We also offer post compliance services for your insurance business.