Investment Banking Advisory - An Overview

Investment banks form the backbone of M & A advisory services in the world. These banks have to be differentiated from traditional retail banks. The services offered by an investment bank are different from a retail bank. The retail bank's services include accepting deposits, providing loans and credit, mortgages, and a clearinghouse for cheques of consumers.

Investment banks act as a merchant and a broker in conducting IPO transactions and M and A transactions.

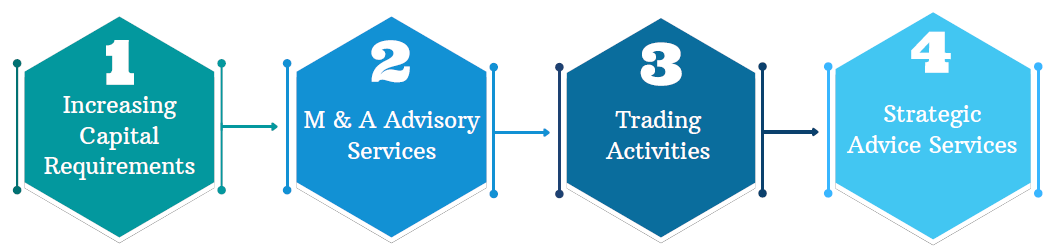

Services offered by an Investment Bank

Increasing Capital Requirements

The primary services offered by an investment bank is to raise the capital for a company. When a company wants to raise funds for a project, an investment bank's advice is required to fund the project. If a company has a considerable amount of debt, then one of the activities carried out by an investment bank is reducing the debt. Raising equity and other capital for a company also comes under the activities of investment banking advisory services.

M & A Advisory Services

Investment Banks advise complex M and A transactions apart from dealing with corporate finance activities. Investment banking services majorly comprise conducting M & A advisory services for organizations. Some of the advisory services under mergers and acquisitions include:

- Due Diligence Services.

- Corporate Advisory.

- Pre-deal and Post-deal advisory services.

- Buyer Side Advisory.

- Seller Side Advisory.

Trading Activities

Companies that want to increase capital go for options such as primary offerings or Initial Public Offerings (IPOs). In an IPO, securities are offered to the public in a stock exchange, which is regulated by a securities regulator. In India, stock exchanges are regulated by the Securities Exchange Board of India (SEBI). The SEBI is the primary authority to seek permission to raise funds through the public. Apart from primary offers (IPOs), investment banks also assist companies in secondary offers and issues.

Strategic Advice Services

These services usually include the valuation strategies carried out by a company when it merges with another company. Accounting and valuation principles have to be carried out by a company as per the International Standards of Valuation. Accounting principles must be as per the IFRS. In India, the valuation procedures would be conducted by a SEBI registered merchant banker or a chartered accountant. Apart from valuation, investment banks offer other services, including strategic planning, business restructuring, and liquidation. Investment banks also play a vital role in carrying out asset management activates and managing large pension funds in the world.

What are the objectives of M & A Advisory and Investment Banking Advisory?

The objectives of the above services are:

- Investment banks act as a link between corporations and investors. Advice from an investment bank would improve the finances of the company. The company would also know to balance the needs of the investors and the company.

- An investment bank assists in the seamless transaction between the buyer and the seller.

- Using M & A advisory services will improve the chances of a successful merger and acquisition transaction between the buyer and the seller.

- The parties in a transaction would not need to worry about regulatory compliance, as this will be handled by the investment bank or third party consultant.

- The investment bank will carry out thorough pre-merger checks, due diligence, and post-merger checks, which affect the transaction.

- Using a renowned management consultant for carrying out the above services will increase the standing of the company. The reputation of the company will improve using a consultant.

TAP GLOBAL is one of the leading management consultants providing the above services. Our team of experts will guide you throughout the M & A transaction. We offer your company seamless advice to raise funds in public through primary and secondary issues of securities.

M & A advisory services

Depending on the type of transaction between the parties, TAP GLOBAL offers services tailored to the client's needs. We offer services both dealing with the buyer side transaction and the seller side transaction. In complex Mergers, we offer advice on the transaction as a whole. In Acquisitions, we provide strategic advice to the buyer and seller based on their requirements. For an Initial Public offering, we liaise with external authorities to ensure that there are no delays in issuing your companies securities to the public.

Apart from the above investment banking advisory services, we offer end to end advice based on the requirements of the interested party.

Sellers Side- Target or Acquired Company

In an acquisition transaction, the parties involved are the buyer, the seller, and the target. We assist the seller in the following:

- Ensure that valuation methods are carried as per the international standards which are accepted across the world. For a valuation process, we recommend using a SEBI registered merchant banker or a chartered accountant. This is the general practice that is followed while carrying valuation services for your asset or business. Apart from this, we will also develop a strategy to guide you through the whole process.

- We will assist you in drafting all the crucial documents. This will include preparing the term sheet of the merger and acquisition agreement and the company's information memorandum. This is useful for the company to ensure your transaction is marketable.

- We would also conduct research and analysis to find potential buyers for the above transaction. Through our strategy, we will market your company to find out potential buyers.

- Based on your requirement, we will identify a potential buyer that matches your company's needs and transactions.

- In a private acquisition process, buyers would be contacted to indicate formal bids. We will determine the highest bid offered by the buyers to go ahead with the transaction.

- Setting up the backup software, and we would also undertake data room procedures in the above process. The following has to be carried out in the data room procedure:

a) Securing all information and documents for the data room.

b) Ensuring that the data is backed up with servers.

c) Ensuring that there are adequate systems in place to have recovery and disaster management software.

- Apart from this, we also handle post transaction negotiation.

Buyer Side Transaction- Acquiring a company

In a private acquisition transaction, the buyer is the company acquiring a target. We provide independent advice to the buyer for acquiring the target company.

Some of the services which we provide are as follows:

- Ensure that the target has no issues related to financing or post-transaction.

- Conducting the following due diligence on the target- Financial Due Diligence, Commercial Due Diligence, and Tax Due Diligence.

- Identifying potential synergy opportunities with the target to ensure the transaction between the parties is seamless.

- Drafting agreements such as the private treaty sale agreement and related documents.

- Drafting the terms of sale for the transaction.

- Assisting you with crucial clauses of the private acquisition transaction- these clauses will include the exclusivity clause, Material Adverse Change (MAC) clause, indemnity clauses and other terms that govern the private acquisition transaction.

- Determining finance options for the transaction, such as debt finance or equity finance.

Investment Banking Advisory Services

Our investment banking advisory services would primarily include transactions that cover strategic finance, initial public offering, research, fund management, raising of capital.

We provide the following services:

Information on companies is gathered and provided as per your needs. This information is beneficial if you want to understand the strengths prevalent in the market.

-

Portfolio Management Services

We also provide asset and portfolio management services for securities and mutual funds. A portfolio is understood as a pool of different investments that provide a required rate of return on the investment. We provide advice on suitable investment options, which will provide a maximum return on your investments.

Apart from providing the above forms of advice, we also provide regulatory compliance and advice as per the Companies Act, 2013, SEBI Act, and other respective laws.

Who can use M & A Advisory and Investment Banking Advisory Services?

TAP GLOBAL provides the above services to clients engaged in banking, software, and lending companies. Our services are provided to clients, mainly in the following sectors:

- Non-Banking Financial Companies (NBFC).

- FinTech Companies.

- Regulatory Bodies.

- Start-ups.

- Software Companies.

Applicable Regulation for Investment Banking Advisory and M & A Advisory

Different laws regulate the above services ”however, the main laws are:

- The Companies Act 2013 and previous companies law govern mergers and acquisition transactions. Any form of arrangements that occur between companies is regulated by the companies act. The issue of shares and private placement of securities also come within company law regulation.

- The SEBI law governs the listing of securities within a recognized stock exchange in India. The SEBI (Substantial Acquisitions of Shares and Takeovers) Regulations, 2019 governs mergers and acquisitions in India. This law also governs listings of securities in stock exchanges.

- The Competition Act 2002 regulates antitrust regulation in India. Companies that enter into an M & A transaction have to comply with the relevant regulation related to competition law and the prescribed authorities.

TAP GLOBAL Advantage “Mergers and Acquisitions Advisory and Investment Banking Advisory

- TAP GLOBAL is a recognized management consultant in providing Mergers and Acquisitions services.

- Experts at TAP GLOBAL have conducted M & A and Investment banking services with the primary objective of adding value to your organization.

- We have Multifaceted teams of professionals comprising Chartered Accountants, IT professionals, lawyers, and company secretaries.

- We have extensive experience in handling matters related to mergers, taxation, and accounting matters in India.

How to reach TAP GLOBAL?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables