These types of funds invest in start-ups and receive incentives from the SEBI, government or other regulating agencies. This consist social venture funds, infrastructure funds, venture capital funds and SME funds.

Category II

These types of funds are allowed to invest in any combination anywhere but they are not allowed to undertake borrowings except for the purpose of day-to-day operations. This includes funds such as private equity funds and debt funds.

Category III

It also includes funds which make short-term investments and then sell such as hedge funds.

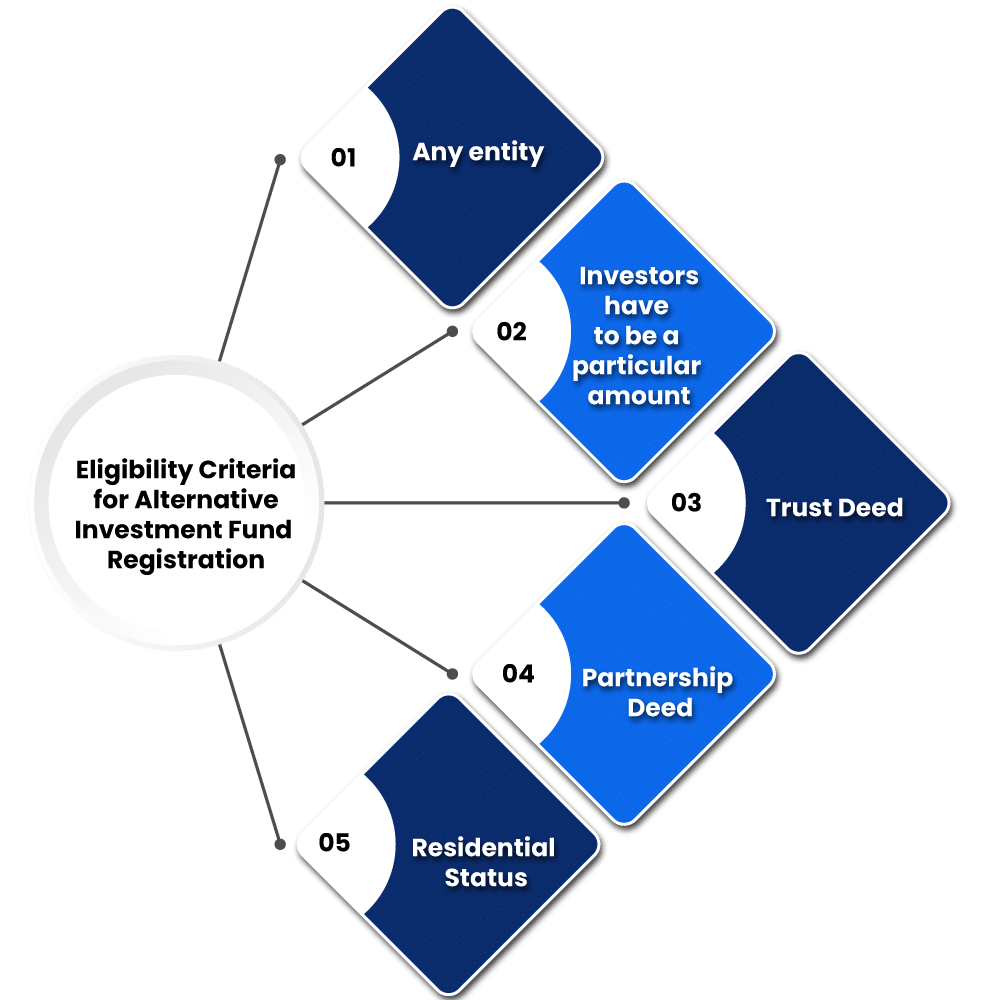

Eligibility Criteria for Alternative Investment Fund Registration

The following eligibility criteria must be satisfied by the applicant for Alternative Investment Fund Registration:

- Any entity- Which is planning to go for the process of Alternative Investment Fund Registration has to ensure that the memorandum of association and articles of association are restricted from inviting public from investing in the entity.

- Investors have to be a particular amount- Though for Alternative Investment Fund registration, there have to be minimum amount of investors. However, the amount of investors in an AIF should not exceed more than 1000.

- Trust Deed- If the AIF is formed as a trust or the society, and then the original deed of the trust must be also furnished in the application for Alternative Investment Fund Registration.

- Partnership Deed- If the AIF is registered as a Limited Liability Partnership under the LLP Act, 2008 has to furnish the original documents related to the deed while going for the process of Alternative Investment Fund Registration.

- Residential Status- Any individual be it an Indian, Non-Resident Indian or a foreigner can invest in an AIF.

Which types of entities would not be considered for Alternative Investment Fund Registration?

When construing the provisions related to SEBI, the following types of trusts will not be considered as an AIF:

- Family trusts set up for the benefit of 'relatives' as defined under Companies Act, 1956;

- ESOP Trusts set up under the Securities and Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme), Guidelines, 1999 or as permitted under Companies Act, 1956;

- Employee welfare trusts or gratuity trusts set up for the benefit of employees;

- 'Holding companies' within the meaning of Section 4 of the Companies Act, 1956;

- other special purpose vehicles not established by fund managers, including securitization trusts, regulated under a specific regulatory framework;

- Funds managed by securitization company or reconstruction company which is registered with the Reserve Bank of India under Section 3 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002; and

- Any such pool of funds which is directly regulated by any other regulator in India;

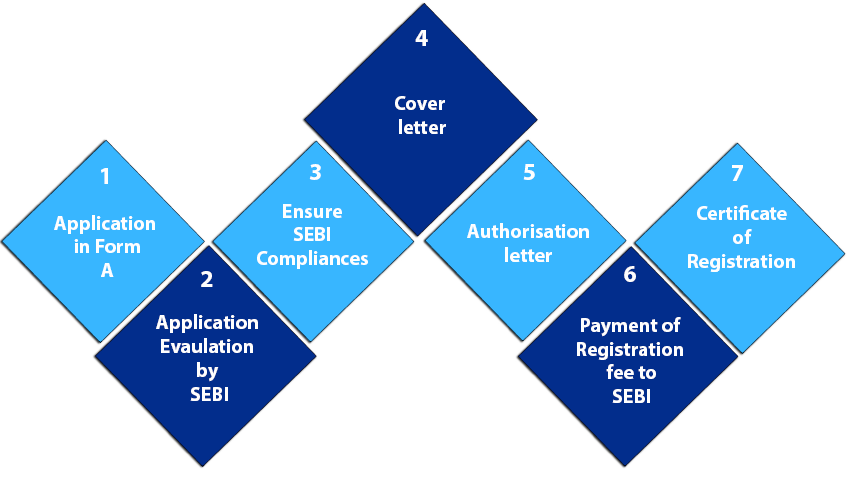

Alternative Investment Fund Registration Process with SEBI

The following steps have to be considered by the applicant for Alternative investment fund registration:

Application in Form A

As per Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012 for Alternative Investment Fund registration, an applicant will make application with SEBI as per the regulations in the Form A along with the cover letter and with the other necessary documents.

Application Evaluation by SEBI

On the receipt of the application, SEBI will reply within 21 working days to the applicant. However the process of registration totally depends on the applicant. If the compliances are filed by the applicant within the correct period, then the process would be seamless.

Ensure SEBI Compliances

For expedite the registration process, an applicant should go through the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012.

Cover Letter

Here are the following details must be mentioned by the applicant in the cover letter:

- Whether it is registered with SEBI as a Venture Capital Fund or not and if yes, then provide details.

- Prior to the application, whether it has been undertaking activities of an AIF. If yes, then provide details.

- Applying for registration of a new fund.

Authorization Letter

In case of an Authorized signatory, there is a requirement of submission of an authorization letter from the Directors/Trustees/Designated Partners of the Fund.

Payment of registration fee to SEBI

For registration, an online application shall be filed according to the guidelines prescribed by SEBI. An applicant will submit form A, which has to be properly filled, numbered, duly signed and stamped with the application fee of Rs.1,00,000/- by way of bank draft in favor of The Securities and Exchange Board of India's, payable at Mumbai.

Certificate of Registration

- For granting certificate of registration SEBI shall consider requirements specified in regulations. After satisfaction, application shall be approved by the SEBI and inform the applicant of the same.

- After obtaining SEBI approval, it is required for an applicant to pay registration fee of Rs.5, 00,000/- (In case applicant is not registered with SEBI as a Venture Capital Fund) and Re- registration fees of Rs. 1, 00,000/- (In case applicant is registered with SEBI as a Venture Capital Fund) to SEBI by way of bank draft in favor of The Securities and Exchange Board of India's, payable at Mumbai.

- SEBI on the receipt of registration/ re-registration fees will grant certificate of registration to applicant as an Alternative Investment Fund.

Compliances for Alternative Investment Fund Registration

- After registration Alternative Investment Fund must comply with the reporting requirements specified by SEBI from time to time.

- For any updating/ circulars/ guidelines issued by SEBI with respect to the Alternative Investment Fund activity, an AIF must check the SEBI website on regular intervals.

- In case of any material change in the details already furnished to SEBI, AIF must intimate to SEBI within a reasonable period of time.

For AIFs fund raising and investment restrictions

- Through private placement, AIFs raise funds and they are not allowed to accept investment of value less than Rs. 1 Cr from an investor. More than 1000 investors are not allowed under this fund and each Scheme should have a corpus of Rs. 20 Crore.

- Another requirement is that manager or sponsor/ promoter of the AIF should have a continuing interest of not less than 2.5% of the initial corpus or Rs.5 crore whichever is lower in the AIF.

- In Category I and II of AIFs are not permitted to invest more than 25% of the investible funds in one Investee Company while it is 10% for Category III AIFs.

- Units of close ended AIFs are allowed to be listed on a stock exchange subject to a minimum tradable lot of 1Crore rupees but only after final close of the fund or scheme.

- It is required for all AIFs to comply with the reporting norms of SEBI on a quarterly basis (for Category I, II AIFs and for those Category III AIFs which do not employ leverage) or on a monthly basis (for Category III AIFs which employ leverage).

- Category III AIFs also have to additionally comply with norms pertaining to risk management, compliance, redemption and leverage as specified in the circular. The leverage for a Category III AIF is specified not to exceed 2 times i.e. the gross exposure after offsetting for hedging and portfolio rebalancing transactions should not exceed 2 times the NAV of the fund.

Legal Entities which can be used for Alternative Investment Fund Registration

According to SEBI (Alternative Investment Funds) Regulations, 2012 AIFs can be established or incorporated in the form of a trust or a company or a limited liability partnership or a body corporate. Generally most of the AIFs registered with SEBI as trust.

Other Points Related to Alternative Investment Fund Registration

'Corpus' is the total amount of funds which is committed by investors as on a particular date to the AIF by way of a written contract or any such document.

- Limit specified regarding number of investors under AIF regulations

No scheme of an AIF (other than angel fund) shall have more than 1000 investors. (Provided that the provisions of the Companies Act shall apply to the AIF if it is formed as a company).

No scheme shall have more than forty-nine angel investors in case of an angel fund.

However, an AIF can raise funds from the sophisticated investors only through private placement and cannot make invitation to the public at large to subscribe its units.

'Sponsor' is a person who set up AIF and includes promoter in case of a company and designated partner in case of a limited liability partnership.

Validity of the Certificate of registration of an Alternative Investment Fund

The certificate of registration of an AIF shall be valid till the AIF is wound up. However, the certificate of AIF registration would be valid for a life time.

SEBI has a web based centralized grievance redress system SEBI Complaint Redress System (SCORES) where investors can lodge their complaints against AIFs.

For dispute resolution, it is required for AIF or through Manager or Sponsor to lay down procedure for resolution of disputes between the investors, AIF, Manager or Sponsor through arbitration or any such mechanism as mutually decided between the investors and the AIF.

Documents for Alternative Investment Fund Registration

The following documents are required for Alternative Investment Fund Registration:

- The Certificate of Incorporation of the Entity

- Partnership Deed in Case the Alternative Investment Fund Registration is carried out by a Partnership registered under the provisions of the Limited Liability Partnership Act, 2008

- Original Deed of Trust in case the Alternative Investment Fund Registration is carried out by a trust or a society which is registered under the provisions of the Trusts Act.

- Shareholders and Directors Information with respect to the AIF

- Copy of the Placement Memorandum of the Entity

- Information regarding the contact and other information of the applicant

- Any other form of business information related to the expansion plans of the company

- Address and Particulars related to the Registered Office

- Memorandum of Association and Articles of Association of the Entity

How to reach TAP GLOBAL for Alternative Investment Fund Registration

Fill The Form

Get a Callback

Submit Document

Track Progress

Get

Deliverables