Insurance Audit Services

An Indian Insurance Company is registered under the Companies Act, 2013. The aggregate holdings of the equity shares by a foreign company either by itself or through its subsidiary companies or nominees must not exceed twenty-six percent of the paid-up equity capital of such insurance company. The primary object of an Indian Insurance Company is to carry on life insurance business or general insurance business or reinsurance business.

The Insurance auditors while conducting insurance audits shall examine the policy and liability procedures, tax documents, risk valuation and other financial records of insurance. This is done to ensure that proper insurance rates and premiums are implemented, and the insurance companies follow regulator laws. Some of the core areas to verify during insurance audits are claims and commissions. Further, the insurance auditors must also maintain the quality control between the insurance companies and policyholders.

What is Insurance Audit?

According to Section 12 of the Insurance Act, 1938, the financial statements of every insurer must be audited annually by the auditor. As prescribed by IRDA, 1999, every insurer with respect to his insurance business and also its shareholder's funds should prepare:

- A Balance Sheet

- A Profit & Loss Account

- Separate Account of Receipts

- Payments and a Revenue Account

All these must be done as per the IRDA regulations at the end of each financial year.

An insurance audit is an independent examination of accounting records that expresses a professional opinion about their accuracy.

What are the Types of Insurance Where Insurance Audits Applies?

The insurance audit service applies to all types of insurance contracts, either it is for individuals or companies.

Some of the types of insurance where insurance audit is applicable are as follows:

- Property insurance that can be of stock, buildings, reserves, home.

- Liability Insurance such as employer's liability, public liability, professional indemnity, environmental liability, product liability, etc.

- Business Interruption as well as employee embezzlement insurance.

- Insurances related to the theft of money and property.

- Transit Insurance that includes sea, air, or land.

- Life Insurances such as Permanent Insurance, Term Insurance, etc.

- Health Insurance that is individual or group insurance.

- Employees benefit Insurance Plan that includes life, accident, and health.

- Pension Insurance that includes individual or group pension insurance.

- Vehicle Insurance consisting of individual and vehicle fleet.

What is the Role of Insurance Auditors in Insurance Audit?

- The Central and Branch Auditors of an insurance company is appointed at the Annual General Meeting of the Company.

- Before making the appointment an appointment from the Comptroller and Auditor General must be received.

- The insurers as per the guidelines of the Insurance Act, 1938, and the Companies Act, 2013 must comply with the provisions with regard to the appointment of auditors.

- As per the recommendation of the Audit Committee, the board appoints the statutory auditors, subject to the shareholder's approval at the general meeting of the Indian Insurance Company.

- The appointment of branch auditors is made to conduct the audit of the divisions having the same rights and obligations as per the statute. The branch auditors submit their report to the statutory auditors.

- However, at the division level, the branch auditors certify the Trial balance and incorporate the financial statements of the branches under the divisions.

- The insurer does not have the power to remove the statutory auditor without taking the approval of the authority.

- An audit firm cannot audits of more than three insurers (Life insurance or Health Insurance or Reinsurer or Non-Life Insurance) at a time.

- They made an appointment that can be canceled if it is found that the appointment of auditors by the insurers is not as per the proposed guidelines.

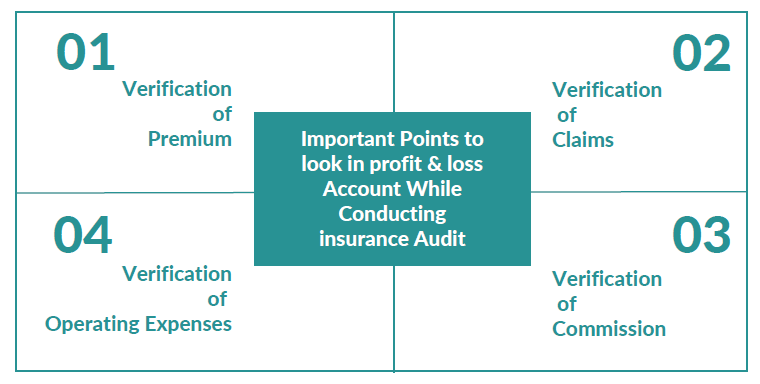

What are the Essential Points Checked in a Profit & Loss Account During Insurance Audit?

The essential points to look in Profit and Loss Account while conducting insurance Audit are as follows:

Verification of Premium

- In a separate bank account, the premium collections are credited. No withdrawals are generally permitted from that account for the purpose of a general expenditure.

- As prescribed in the policy of insurance company, the collections are transferred to the Regional Office or Head office.

- According to Section 64 VB of the Insurance Act, 1938, the insurer shall assume no risk without the receipt of premium.

- It is of utmost importance to an auditor to verify a premium because the insurance premium is collected upon issuing policies.

- It is a consideration for bearing the risk of the insurance company.

The auditor shall apply the below-mentioned procedures:

- Before starting the verification of premium income, the auditor must look into the internal controls and compliance, which is laid down for the collection and recording of premiums.

- The cover notes must be numbered serially.

- The auditor needs to check if the premium registers are maintained chronologically, providing complete details including GST charged according to the acceptance advice daily.

- The auditor must verify if they figured the premium amount mentioned in the register tally with those shown in General Ledger.

- The auditor will also verify that the installments that are due on or before the balance sheet date has been received or not, have been accounted as premium income for the year under audit.

Verification of Claims

The auditor from each division or branch must obtain the information for all classes of business.

The auditor shall determine the total number of documents that is to be checked, providing due importance to claims of higher value.

The claim account gets debited with all the payments that include the repair charges, survey fees, photograph charges etc. The auditor shall verify:

- Check the provision for unsettled claims.

- Check if the provision is made for such claims for which the company is legally liable.

- Check if the provision that is made is not more than the insured amount.

- Check the Co-insurance arrangements; the company has made provisions with respect to its own share of anticipated liability.

Verification of Commission

The remuneration paid to an agent is made through commission. The remuneration amount is calculated by applying a percentage to the premium collected by the agent.

The commission is paid to the agents for the business procured, and it is then debited to commission on Direct Business Account. Insurance agents usually solicit the insurance business. The auditor shall verify:

- Voucher disbursement entries with regard to the disbursement vouchers with the copies of commission bills and statements.

- Check if the vouchers are authorized by the officers-in-charge as per the rules and also income tax is deducted at source.

- Check the amount of commission allowed.

- Check the accounting period of commission.

Verification of Operating Expenses

The auditor must check the following operating expenses:

- Expenses that are more than Rs. 5 lakhs or 1% of the net premium, whichever is higher. This must be shown separately.

- Expenses that are not directly related to insurance business must be shown separately, for example, costs made in the investment department or bank charges etc.,

What Is Checked During Insurance Audit in the Company Balance Sheet?

The essential points considered during an insurance audit in the Balance Sheet of Company are as follows:

Investments

The auditor must follow the following prescribed provisions with regard to the investments of the Insurance Act, 1938, at the time of the inspection of the investments of the insurance company:

- An insurance company can invest only in approved securities. However, it can also invest in securities other than approved securities if the following conditions are satisfied:

a) The investments made must not exceed 25% of the total investments made.

b) The investment must be made with the consent of the board of directors.

- An insurer must not invest in shares or debentures of an insurance or investment company over least of the following:

a) 10% of its own total calculated assets.

b) 2% of the subscribed share capital or debentures of the investee.

- An insurance company must not invest in the shares or debentures of a company other than an insurance or investment company above at least the following:

a) 10% of its own total calculated assets.

b) 10% of the subscribed share capital or debentures of the investee.

- An insurance company is not allowed to invest in the shares and debentures of a private company.

- The insurance companies are not permitted to invest in funds of their policyholders outside India.

Cash and Bank Balances

- The auditor shall during insurance audit prepare Bank reconciliation statements.

- The auditor must obtain the confirmation of Bank Balances for all the operative and inoperative accounts.

- The auditor shall physically verify the Term Deposit Receipts that is issued by the bankers. Generally, it is all cash that is deposited as term deposit with the bank at year-end.

- The auditor shall verify the deposits and withdrawal transactions and also check if the account is operated by authorized persons only.

- In case of funds, that is in transit, and the auditor must verify that the same is appropriately reflected in a reconciliation statement.

Outstanding Premium and Agents Balance

The audit procedures that may be followed in an agents balance are as follows:

- Verify whether the agent's balances, as well as outstanding balances in the outstanding premium account, have been listed, analyzed, and reconciled for the purpose of audit.

- Verify whether the recoveries of large and outstanding deposits have been made post-audit period.

- Check if there are any old outstanding debts or credit balances at the year-end which need adjustment. A written explanation that is obtained from the management must be done.

- Check the agents balances that do not include employees balances as well as balances of other insurance companies.

- Verify that there is no credit of commission is given to agents for businesses.

What are the Legislation's or Guidelines of Regulators for Performing Insurance Audit?

There are several Legislation's with regard to life insurance and general insurance companies. The essential statutory provisions relevant to the audit of life insurance companies are mentioned in the following acts and rules.

- The Insurance Act 1938

- The Insurance Rules 1939

- The Income Tax Act of 1961

- The Companies Act 2013

- The Life Insurance Corporation Act 1956.

- In the case of General insurance, in addition to the above mention, there shall be the applicability of Employees State Insurance Act 1948.

- Along with the acts and rules, there are guidelines for Corporate Governance for the insurers in India. The regulator IRDAI had issued Guidelines on Corporate Governance for the insurance companies on 5th August 2009 which have been amended in 2016.

Why is the Audit Committee Mandatory for Insurance Audit?

According to the guidelines, insurance companies must form the following mandatory committees such as:

- Audit Committee,

- Investment Committee,

- Risk Management Committee,

- Policyholders Protection Committee,

- Nomination and Remuneration Committee,

- Corporate Social Responsibility Committee,

- Profits Committee.

The purpose of the audit committee for the purpose of an insurance audit is explained below:

- Every insurer must constitute an Audit Committee according to Section 177 of the Companies Act, 2013.

- The committee shall look at the financial statements, statements of cash flow, financial reporting both on an annual and quarterly basis.

- The Chairperson of the Audit Committee shall be an Independent Director of the Board with an accounting or finance or audit experience and maybe a Chartered Accountant or a person with a strong financial analysis background.

- The association of the CEO in the Audit Committee must be limited to occasions where the Audit Committee requires eliciting any specific information concerning audit findings.

- As required under Section 177 of the Companies Act, 2013, the Audit Committee shall comprise of a minimum of three directors, the majority of whom shall be Independent Directors.

- The Audit Committee will oversee the efficient functioning of the internal audit department and review its reports.

- The committee will additionally monitor the progress made in the rectification of irregularities and changes in processes wherever deficiencies have come to notice.

- The Audit Committee shall have the oversight on the procedures and processes established to look after the issues relating to maintenance of books of account, administration procedures, transactions, and other matters having a bearing on the financial position of the insurer, whether raised by the auditors or by any other person.

- The Audit Committee shall discuss with the statutory auditors before the audit commences, about the nature and scope of audit as well as have post-audit discussions to address areas of concern.

How will TAP GLOBAL Help You in Insurance Audit?

Our professionals in TAP GLOBAL will provide you with Insurance audit services in the following ways:

- During the audit process, we test the internal control system. We will also assess its effectiveness and offer a set of measures for upgrading it that will help in detecting the potential errors.

- In the accounting system, the insurance company will provide some adjustments to the accounting reports for significant deviations from the current laws.

- We will give recommendations after analyzing the tax system and the fairness tax base to avoid tax sanctions.

- During the detailed analysis of financial activity, measures are offered for increasing the effectiveness and to use internal reserves for managerial decisions.

How Can TAP GLOBAL Help You?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables