Finance and Accounting Modernization

Emerging technologies like artificial intelligence, predictive analysis, and machine learning are taking towards customer-facing innovation. Yet the Finance office is held back by legacy technology, despite the push for the CFOs to be more prepared, forward-looking, and business-focused. As per a survey, a staggering of 54% of the respondents like to be more innovative but rarely get the time, support, and funding to invest in the finance operations.

To succeed in today's fast-paced business environment, finance, and accounting modernization, organizations must continuously focus on improving performance by driving positive operational enhancements. With the impacts of a global economy, regulatory changes, and the advancement of technology, finance professionals must be at the forefront of driving organizational performance.

Globalization has changed the way companies operate and put more of a focus on operational efficiency. Regulatory changes have a continuous impact on companies and put a strain on operations. The technology landscape is constantly changing, providing finance the opportunity to truly drive organizational performance through improving access to relevant operational data. Finance organizations must be positioned to help develop and drive critical strategic business enhancements.

Approach to Finance and Accounting Modernization

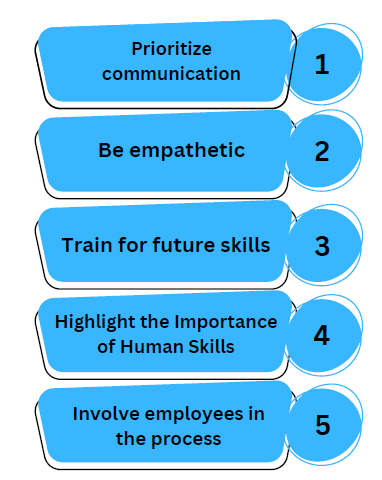

To help the employees adopt new technology and processes, organizations need to take a humanistic approach to finance and accounting modernization.

In the midst of progress, correspondence is critical. Facilitate any worker concerns or fears by resolving to open and straightforward communication around modernization activities, courses of events, and effect on the organization, division, and individual jobs. Build up a correspondence plan that considers what you will share, just as when and how you will impart it. Maybe this incorporates a division-wide gathering to present starting data, at that point on-going group or one-on-one meetings to address explicit subtleties and answer any inquiries. Support input and request workers to be transparent with their interests. This will help in finance and accounting modernization.

It tends to be anything but difficult to concentrate on the strategic side of revealing another procedure, executing another framework or programming, or gathering precise information. Regardless of how tumultuous your calendar or how complicated the venture subtleties, make sure to tune in and be compassionate to your most significant asset: your staff. Workers are frequently alright with their jobs and current procedures and might be reluctant to grasp change. Tune in to these worries and get some information about any feelings of dread. Frequently, they are the consequence of vulnerabilities and can be handily alleviated or decreased. Come to the situation from your workers' perspective and told them how any more significant issues are being tended to finance and accounting modernization. Make a point to concentrate on the advantages of innovation and how it will, at last, assist them with playing out their activity, or let loose them for progressively crucial errands.

Help further facilitate workers' feelings of dread by being proactive about preparing for new projects, procedures, and abilities. Numerous in the fund calls, particularly those in increasingly senior jobs, we're ready for conventional methods and techniques. Artificial intelligence is another skyline. Show your promise to people's progressing achievement and acknowledge they might be reluctant about their capacities to handle new strategies. Consolidate preparing and new aptitudes into their proper vocation advancement plans. You may likewise need to have a couple of people become specialists in the space and offer distributed preparing, while at the same time filling in as task advocates.

-

Highlight the Importance of Human Skills

For example, in relevant fields, bookkeeping and funding, human abilities are crucial in imparting the significance of information and offering importance to numbers. For example, narrating capacities regularly set the best and powerful money related experts separated. Emotional quotient and initiative abilities are additional qualities the modern machines can't duplicate. See how innovation and human bits of knowledge can best supplement one another for finance and accounting modernization. Urge workers to sharpen aptitudes that can improve understanding and incentive to modernization endeavors. As a rule, AI can evacuate human irregularities, inclinations, and blunders. It has its constraints and shouldn't be utilized in seclusion; the human brain is as yet significant in precise and subtle dynamics.

-

Involve employees in the process

The more included workers are, the more probable they will get changes and bolster them. Topic specialists are frequently acquired to lead these activities, empowering full-time pioneers to stay concentrated on their standard obligations. Representatives frequently wonder what these extraordinary activities mean for them and their areas of expertise. Consider reconsidering this procedure and inquiring about whether they would need to take an interest or help drive these tasks effectively. By including your staff in a hands-on way, they'll become more contributed and focused on the procedure. Get topic specialists to oversee every day remaining tasks at hand, or request that current staff work intimately with them on modernization ventures. These advisors are specialists in their fields and require little increase time, empowering your area of expertise to keep running without any holes in yield or productivity.

What is the Process Followed in Finance and Accounting Modernization by CFOs?

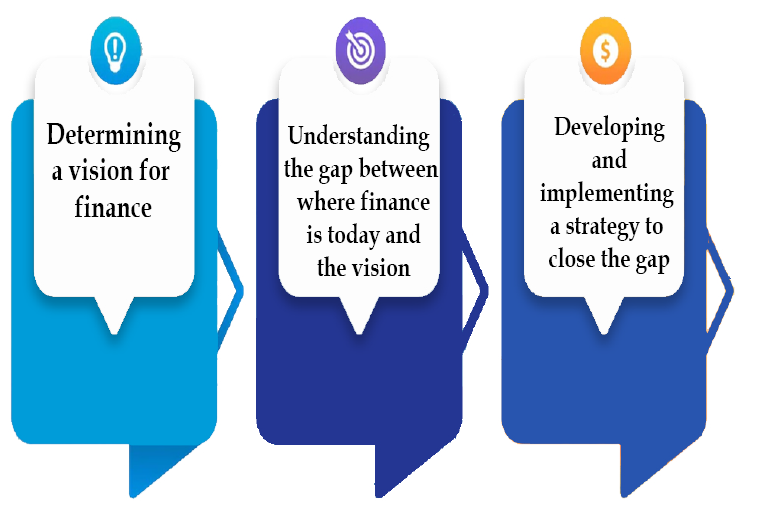

The following process needs to be followed in finance and accounting modernization by CFOs:

-

Determining a vision for finance

CFOs need to set out the role Finance clearly will play in the future. In particular, it will contribute to helping achieve the organization's strategic objectives for finance and accounting modernization.

-

Understanding the gap between where finance is today and the vision

CFOs need to understand finance's current capabilities and determine where it needs to change in order to realize its future vision.

-

Developing and implementing a strategy to close the gap

CFOs need a plan that moves finance from its current role to its future one, which will often require building capabilities within three key areas: finance insights, financial close, and forecasting.

What are the Changes in Recent Years in Finance and Modernization?

While much may have remained the equivalent for a long time, one significant change that has happened has been in the volume and multifaceted nature of finance's work. Likewise, the business support, working examination, financing backing, and irregular revealing "asks" that CEOs, different officials, proprietors, sheets, and review advisory groups are creating their CFOs and Finance groups are proceeding to increment. CFOs are very much aware of the way that, in the present interconnected, unpredictable worldwide working condition, their associations should have the option to comprehend genuine outcomes in close to continuous, just as envision future advancements under various situations. CFOs are likewise very much aware of the way that finance needs to change on the off chance that it is to have the option to convey on those desires. They realize that funding needs to move from creating information to delivering bits of knowledge. Besides, these bits of knowledge should be connected to yields, and finance is relied upon to connect the procedure that reaches out from the overall record to gauging. CFOs likewise comprehend that by deliberately planning individuals, processes, and innovation to remove and convey applicable bits of knowledge, finance will significantly change the incentive it brings to the association. Shockingly, in any case, despite unmistakably understanding that investment needs to change, hardly any CFOs are even somewhat down that street. On the off chance that CFOs aren't eager to lead the finance adjustment, numerous sheets of executives are flagging that they will discover a CFO who will.

The turnover rate among CFOs has increased to 16 percent, up from 12.5 percent two years ago for finance and accounting modernization.

- More than half of the new CFOs are being selected from outside the association as sheets scan the driving talent market.

- The new desires that associations have for finance are additionally reflected in the ranges of abilities they expect in a CFO. Among outer recruits, 25 percent of new CFOs have extensive administration experience, and only 14 percent have a controllership foundation.

- Of the CFOs selected inside, more than 33% originated from outside the Finance work, and only 25 percent had controller/head bookkeeping official foundations. Upping your game -Modernizing Finance for 2020 CFOs understand that they and their Finance teams need to reposition themselves if they are to meet the organization's growing tasks and bring more excellent value to it.

What does a Team Need to do for Finance and Accounting Modernization?

For the purpose of finance and modernization, the finance team needs to:

- Identify where Finance is today and determine the capabilities it needs for the future.

- Create a compelling vision for finance that is aligned with, directly linked to, and supportive of the overall corporate idea.

- Define the characteristics and attributes that describe and can be demonstrated in the Finance team members' actions and activities as they bring the idea to life.

- Develop an actionable roadmap consisting of 180-day "sprints" that describe what finance needs to do to move towards its desired future state.

Reasons to Re-Evaluate your Financial Systems for Purpose of Finance and Accounting Modernization

Top 10 Reasons to Re-evaluate Your Financial Systems for the purpose of finance and accounting modernization are:

- Large data volumes slow down the current system

- Data model requires expansion

- Overall system performance is poor

- Greater control of the data going into the ledger is needed

- Access to real-time data is limited or unreliable

- Improved reporting requires a streamlined accounting, and the ability to leverage sub-ledgers

- Close times are too long

- A better foundation is needed for integration with other systems

- The company has outgrown its current system

How to Reach TAP GLOBAL?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables