Fraud and Misconduct Investigation- An Overview

In the global corporate landscape, frauds have been occurring ever since the 1800's. With the beginning of the 19th century there were lot of frauds which escalated in the USA and the UK. Some of these frauds caused the bubble burst throughout the world.

Taking the US perspective, some frauds have severely affected several stock markets, alarming the securities regulator the Securities Exchange Commission (SEC). Such frauds which brought about the Great Depression in 1930's and the 2001 financial crises have affected the economy.

For example, the Enron scandal shook stock and securities markets throughout the world. Due to this the SEC brought out the Sarbanes Oxley Act (SOX Act), which would look into companies that have their securities listed in stock exchanges.

The main motive of bringing this act is to ensure that entities follow the 'comply and explain principle'. Apart from this, the SOX act also gave hope to companies that get their statements audited by accounting firms.

Fraud and Misconduct Investigation- Scenario in India

In early 1990's there have been several scandals which rattled the Indian ecosystem such as the Harshad Mehta Securities scandal. Apart from this the Satyam Scandal, brought the importance of the compliance requirement for companies. However, it can be stated that the Companies Act, 2013 was brought out to handle issues such as this.

Hence companies must place importance in having specific procedures related to Fraud and Misconduct Investigation. There has to be a system in place to identify and assess the amount of risk present in a particular company or firm.

Statutory Meaning of Fraud and Misconduct Investigation

- Fraud

On interpreting the term fraud under the Companies Act, 2013- would include any act or transaction in relation to the company or a particular group of companies which leads to the omission, concealment or abuse of position of the particular executive in order to deceive and gain some form of undue advantage. Such definition is provided under section 447 of the Companies Act, 2013.

- Misconduct

The meaning of misconduct is not present in the Companies Act, 2013. Under the Chartered Accountants Act, 1949 any member of the firm or professional of the firm that carries out activities which are detrimental to the business of the firm is known as misconduct. However, the meaning of professional misconduct would also be covered under the ambit of misconduct.

Benefits of Fraud and Misconduct Investigation

The following benefits are present when a firm carries out fraud and misconduct investigation:

- Assess the Situation

By conducting fraud and misconduct investigation, the firm or key executives of the organisation can assess the situation and take control from future events from occurring.

- Take Corrective Action

By carrying out fraud and misconduct investigation process, the organisation can take corrective action. Taking corrective action would be a situation where action would be taken to mitigate the situation. Mitigating the situation would avoid any form of further investigation or issues.

- Reputation

Having proper protocols related to fraud and risk assessment would help improve the reputation of the organisation or the company. Any organisation or company would want to ensure that their reputation is not breached. Hence it is important to carry out fraud and misconduct investigation continuously in the firm. Such assessments in the firm or organisation would improve the situation.

- Maintains Compliance

By carrying out procedures related to fraud and misconduct investigation, compliance can be effectively maintained by the organisation. Proper protocols would be followed by the company having regular checks and controls over fraud and misconduct investigation.

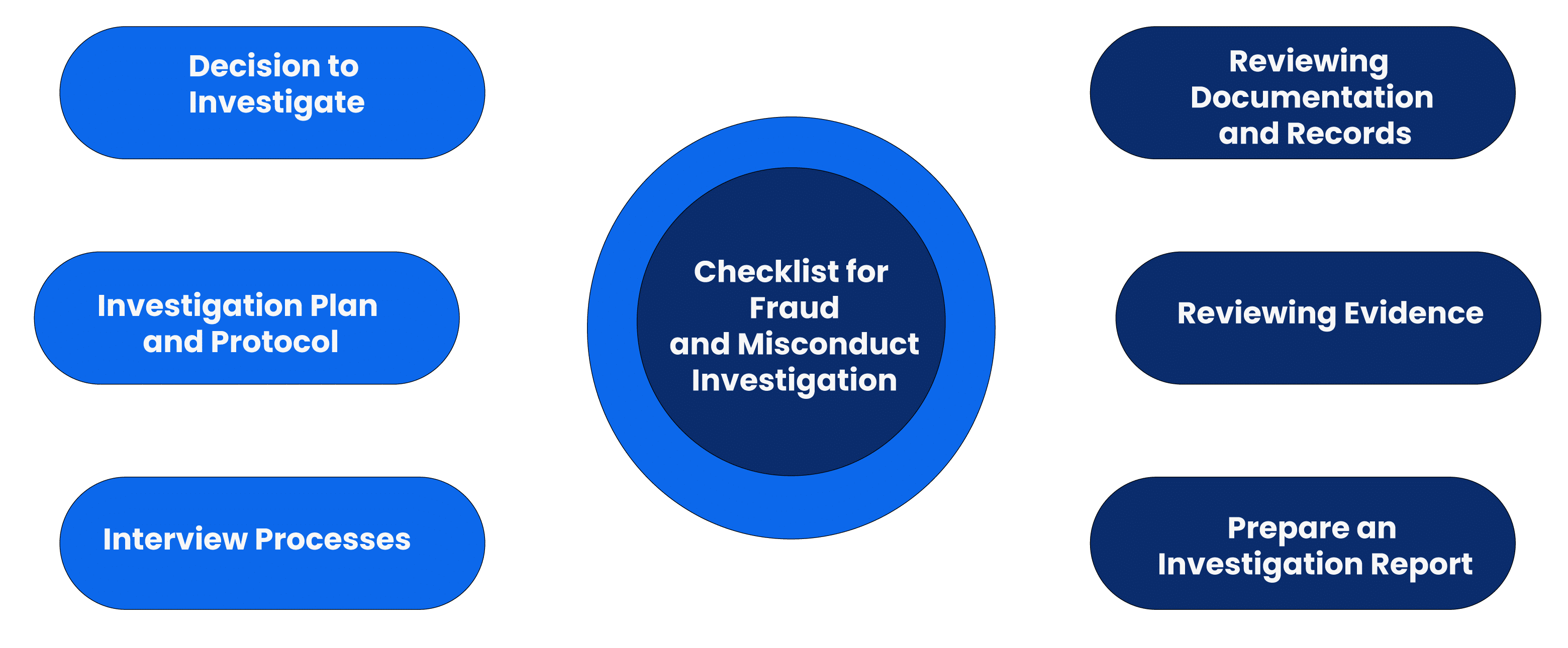

Checklist for Fraud and Misconduct Investigation

The following checklist has to be considered for fraud and misconduct investigation in an organisation:

Decision to Investigate

First and foremost the organisation would make a formal decision to investigate. The following would be considered under this:

- Analyse the Situation

The organisation or department would have to analyse the situation. Apart from this, they would have to check whether compliance has been maintained regarding local laws.

- Carry out Interviews

To find out solutions to problems, it is important to carry out formal interview processes to identify the causes and errors within the company or department.

- Check Protocol Procedures

In the next step, the firm would have to check the protocol procedures followed by the organisation. A plan would be required in advance to carry out investigation process.

- Interim Actions

Temporary Actions have to be taken against the accused. Temporary Suspension of the individual has to be carried out in compliance with the provision of local domestic laws. If the executives involved have any involvement, then consider utilising the services of investigation as carried out by the Central Government. In India, the provisions of the Companies Act, 2013. Apart from this the provisions of SEBI Act would apply to companies that deal with securities.

Investigation Plan and Protocol

Here it would be useful for the company to develop a plan for investigation. Regular follow ups must be carried out for the protocol within the organisation. The following steps would be considered under investigation plan and protocol:

- Understanding the Scope

What is the main objective of carrying out such investigation would be considered here.

- Formulate Strategy

Here it is important to define what is already known out of the investigation process under Fraud and Misconduct Investigation.

- External Interviews

This would include conducting interviews of all the external individual directors of the company. Some will include interviews of family, colleagues and members.

- Set a Timeline

The organisation must develop a timeline for the same to determine the schedule.

Interview Process

The interview process would denote that the procedure for conducting investigation is ongoing. Having this in place would ensure that the process of investigation is going smoothly. The following steps have to be included in the Interview Process:

- Explanation

The first step in the interview process would include the explanation of state of affairs of the company. Here what has to be included is to explain the current situation of the company. Apart from this, why the company has become in this situation must also be explained.

- Make Outline

It is always resourceful to make an interview outline for fraud and misconduct investigation process.

- Maintain Communication

It is important to maintain communication in a formal manner. Through this process, all information can be obtained.

- Types of Questions

The organisation must ensure that the questions asked are appropriate and suffice the requirements related to the investigation process.

Reviewing Documentation and Records

In the next step, the records have to be reviewed by the executives and the company. The following would be included in the process of review and documentation:

- Email Records

This will include all the communications carried out by the department or where the fraud is imminent.

- Personnel Files

Under fraud and misconduct investigation, the next process is to identify the personal files of the accused and find out any important information. Any indicators of fraud would bring some form of red light by reviewing the personnel files.

- Confidential and Relevant Documents

It is also important to review only important documents and confidential information which will reduce the reputation of the company or organisation must be avoided at all costs.

- Retain Important Documentation

It is important to have a docket management system to arrange documents in order. Having such systems would reduce the time in arranging documents. Through this process important documents can be received.

Reviewing Evidence

This step will include reviewing the particulars related to the evidence. The following has to be conducted during this step of reviewing evidence:

- Consider what credible evidence is

During the process of fraud and misconduct investigation, it is important to consider what important and credible evidence is. Such evidence has to be differentiated from other forms of evidence.

- Security of Evidence

Here all the evidence which is stored and located must be protected with adequate security. All the evidence must be password protected. All forms of digital data related to the investigation process must be encrypted or have a data base to manage information.

- Have Facts and opinions

It is crucial to have the facts and opinions articulated regarding the investigation.

Prepare an Investigation Report

In the final step of fraud and misconduct investigation, an investigation report has to be prepared where the organisation or company would have to present all their findings regarding the investigation. Based on the investigation, documents would be attached regarding the importance of the findings.

TAP GLOBAL Advantage- Fraud and Misconduct Investigation

- Our team of professionals comprise of Chartered Accountants, Company Secretaries, Lawyers, and Financial Executives.

- Determine and mitigate any form of fraud and misconduct investigation.

- Provide advice on reducing the amount of problems in the organisation.

- Suggest Opinions on prioritising risk.

- Constant monitoring and 24*7 customer service.

How to reach TAP GLOBAL for Fraud and Misconduct Investigation

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables