Overview of Limited Liability Partnership Registration

Limited Liability Partnership is commonly known as LLP. This is a special form of business structure that has the features of a traditional partnership and the benefits of limited liability are enjoyed by the partners of the LLP.

This form of business entity is preferred by individuals over other forms of business structures as the amount of flexibility offered by this form of entity outweighs the other forms of entities.

This form of business structure is evolved and used in a different form of common law jurisdictions such as the United Kingdom, South Africa and New Zealand.

Usually, law firms, accounting firms, private equity, venture capitalist, architects and real estate firms go for this form of entity. Some of the benefits offered by this business structure is limitation of liability and also ease of compliance is obtained by using this form of business structure. Hence individuals and entrepreneurs prefer going in for limited liability partnership registration. Another added advantage for LLP formation is the ease of conducting business.

Statutory Meaning of Limited Liability Partnership Registration

To understand the meaning of limited liability partnership, it is first important to know the meaning of partnerships. A partnership can be understood as a form of contract or agreement between two or more individuals to carry out a different form of business activities with a common intention of sharing the profits and losses of the business. This definition is present under the Indian Partnerships Act, 1932.

Limited Liability Partnerships (LLPs) are defined under the Limited Liability Partnerships Act, 2008 (LLP Act), as special entities which have the features of a traditional partnership and also have the status of limited liability which is enjoyed by private limited companies. In India, LLPs were brought about in the year 2010. Any form of duties which come as a result of the partnership will be resolved under the respective agreement under the LLP Act.

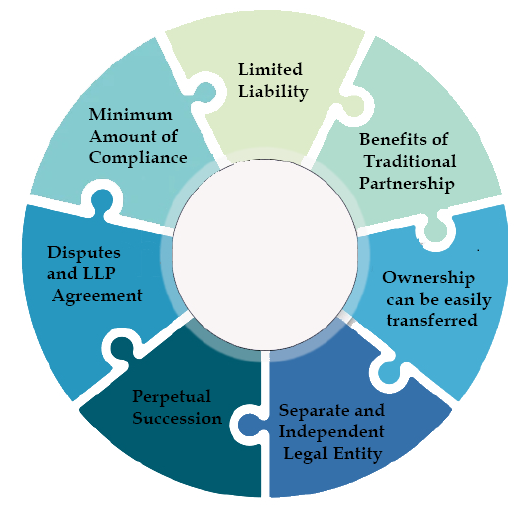

Advantages of Limited Liability Partnership Registration

The following advantages can be enjoyed by an applicant going for Limited liability partnership registration:

One of the main advantages of going for limited liability partnership registration is limited liability. Partners under this form of business structure would not have any issues when the debts are not paid. Due to the concept of limited liability, creditors cannot go for the personal assets of the partners for the debt that is owed by the LLP.

-

Benefits of Traditional Partnership

Another advantage which is enjoyed by this form of business entity is the benefits of a traditional partnership. For example, there is minimum compliance that is carried out for this form of entity.

-

Ownership can be easily transferred

Unlike other forms of business entities, transferring the ownership for an LLP can be carried out easily. Hence individuals prefer going for limited liability partnership registration.

-

Separate and Independent Legal Entity

One of the factors that make this business entity attractive is the principle of a separate and independent legal entity. The partners of the company can enjoy such benefits.

This would indicate that once the partnership is formed, the LLP will exist until and unless it is closed by an order or direction of a regulatory authority.

-

Disputes and LLP Agreement

One advantage which is enjoyed by individuals going for limited liability registration is that disputes can be handled appropriately. Like a shareholders agreement is drafted for a private limited company, an LLP agreement is drafted for a limited liability partnership entity. Through this agreement, any form of disputes that arise between partners can be resolved easily.

-

Minimum Amount of Compliance

There are limited compliances required for an LLP when compared to other forms of business entities. For example, there is no minimum amount of capital required for the Limited Liability Partnership Registration. Apart from this, there is no requirement for carrying out an audit. However, this requirement is only if the annual turnover of the LLP is lesser than 40 Lakhs and 25 Lakhs.

Regulatory Authority for Limited Liability Partnership Registration in India

The primary regulatory authority for limited liability partnership registration in India is the Ministry of Corporate Affairs (MCA). This is the main authority for all kinds of LLP registrations in India.

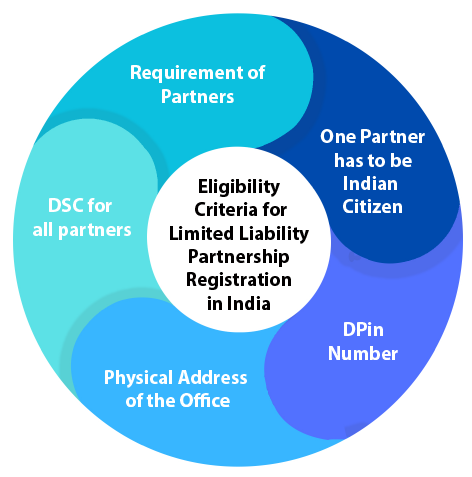

Eligibility Criteria for Limited Liability Partnership Registration in India

There have to be minimum partners for limited liability partnership registration in India. The minimum amount of partners for an LLP is two. A company can also be categorised as a partner of an LLP.

-

One Partner has to be Indian Citizen

Out of all the partners in a limited liability partnership, one of them has to be a citizen of India. This is a mandatory requirement for LLP in India.

All partners of an LLP have to secure a designated partnership identity number (DPin).

-

Physical Address of the Office

Apart from this, the office must have an actual physical place for carrying out day to day correspondence with different forms of regulatory authorities. This requirement is mandatory as per the limited liability partnerships act, 2008.

It is a mandatory requirement to secure a digital signature certificate for all the partners of the LLP. This would help to file documents and signatures in digital and electronic form.

Documents and Forms Required for Limited Liability Partnership Registration

The following documents and forms are required for limited liability partnership registration:

- Address Proof

- Identification proof -PAN, Aadhaar, Voter ID and Driving License for all the partners

- Residential Proof

- Passport and Visa if one of the partners is a foreign national

- Photographs.

- Digital Signature Certificates

- No Objection Certificate- If the office is leased out premises

- Utility Bill- such as water or electricity bill

- Address Proof where the LLP is registered

Forms

- Form 5- Change of Name of the LLP

- Form 17- Conversion of a firm to an LLP

- Form 18- Conversion of a public limited company to an LLP

- FiLLiP- This is required for incorporating an LLP

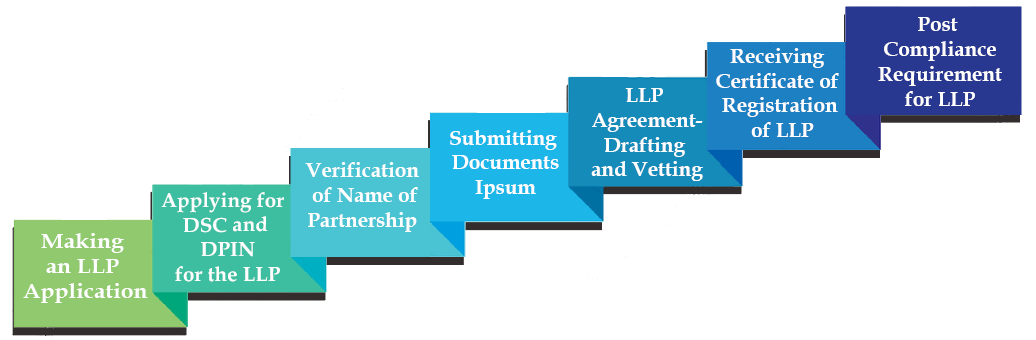

Procedure for limited liability partnership registration

The following procedure has to adhere to limited liability partnership registration in India:

Making an LLP Application

All the partners of the LLP have to apply for registering the LLP.

Applying for DSC and DPIN for the LLP

In the next step, the partners have to make an application for a digital signature certificate. This certificate will help the partners of an LLP sign documents in electronic as well as digital formats. DSC is required by at least one partner to sign documents. After this, the partners have to secure a designated partnership identification number. DPIN is required for all the partners of the partnership. This can be got through by filing form DIR-3.

Verification of Name of Partnership

Verification of the name of the partnership is done by one of the partners. This process can be carried out by using the LLP RUN form. Once the name of the partnership is reserved, the same can be used for 90 days. After this period, the name will be unreserved. The name must not be against any provisions relating to Trademark law or Copyright laws in force. Apart from this, the name must not be offensive. A minimum of two names can be reserved for the partnership.

Submitting Documents

After the name is reserved, the registrar of companies (ROC) will require all the partners to submit requisite documents for the partnership. These documents will include incorporation documents, personal identification documents such as PAN Card, Aadhar Card and Passport.

LLP Agreement- Drafting and Vetting

The LLP agreement has to be drafted with diligence. This agreement will state the liability and responsibilities of all the partners of the limited liability partnership. Any partner or individual going for Limited liability partnership registration would require special advice while drafting the agreement. It would be suitable to use skilled services such as TAP GLOBAL for drafting your LLP agreement. After the LLP agreement is drafted, the same must be filed with the ROC or in the MCA portal within 30 days. This must be carried out through Form 3.

Receiving Certificate of Registration of LLP

When all the above steps are completed the partners have to apply for the certificate of registration of LLP. Along with this the partners would have to apply for the LLPIN (Limited Liability Partnership Identification Number).

Post Compliance Requirement for LLP

Once the LLP is incorporated; there are certain post compliance requirements which have to be carried out. The following requirements have to be carried out by the LLP after incorporation:

- Opening a Bank Account on Behalf of the LLP

- Securing PAN and TAN number for the LLP

- Filing the LLP agreement with the relevant regulatory authority.

Once these steps for limited liability partnership registration are complete, the business can commence.

TAP GLOBAL Advantage

- TAP GLOBAL is a recognized management consultant in India.

- Experts at TAP GLOBAL have Limited Liability Registration Process for different sectors.

- We have multifaceted teams of professionals comprising Chartered Accountants, Lawyers and Company Secretaries

- We have extensive experience in handling matters related to transactions, taxation, and accounting matters in India.

- Our service is cost-effective.

How to reach TAP GLOBAL?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables