NBFC Software- An Overview

Nowadays all businesses consider the optimum use of technology. Technology can disrupt the traditional banking players, and the maximum of existing NBFC players in the banking sector are not friendly with technology and since they have had high operating cost. The success of the Indian banking system depends on how we are going use technology in business.

When compared to the traditional bank sector it is easier to secure loans though an NBFC. Though these institutions are heavily regulated, they are the common place for individuals and small sector enterprises to secure some form of loan.

When categorizing different companies that choose the form of loans, we have to consider, the differences between banks and NBFC. Banks also utilise software for the disbursal of loans and other forms of software. However, the rural community is more reached out by an NBFC.

NBFC have different form of laws which would be applicable for them. However, customers prefer using and utilising NBFC software and applications to carry out different processes related to sanctioning a loan.

When institutional investors consider loan then these players also utilise the services offered by a traditional NBFCs rather than banks. Banks are heavily regulated and do not have adequate facilities to address the needs of institutional investors.

Apart from this the amount of interest charged by an NBFC on the loan is less expensive when compared to that of a bank. Hence it would be useful to consider the services offered by an NBFC when going for the NBFC software.

TAP GLOBAL has multiple Loan Management Software and ERP. Our custom NBFC Software and ERP are for Non-Banking Financial Companies (NBFC) which reduce the overall workforce cost, increase customer satisfaction, and handle loan inquiry, the end to end management of the lending process.

What Makes NBFC Software productive?

Technology can change lives and solve mass appeal problems. We started TAP GLOBAL to bring innovation in traditional businesses. Disrupt Industries the way technology companies did and brought transparency in traditional business processes. The following aspects make the software productive:

- The NBFC software product would effectually help in loan management for the company. Apart from this IT management systems would also be able to be implemented.

- Through this NBFC software constant monitoring of services can be achieved.

- Instant based solutions can be provided to customers and consumers.

- NBFC software which is used by customers would have constant IT support. As we have collaborated with other fintech companies, IT support would be provided on a 24*7 basis for customers.

- Our services would primarily focus on NBFC Advisory services. Hence all the services provided to you would be at a minimum cost.

- Case management system would be present utilizing the NBFC software. The case management system would allow causes to be handled on a priority basis. Data analytics and artificial intelligence processes would be utilized to handle different processes. We utilize the system related to MIS (Management Information System) which is developed in order to provide accurate data, analysis, market reports and other factors.

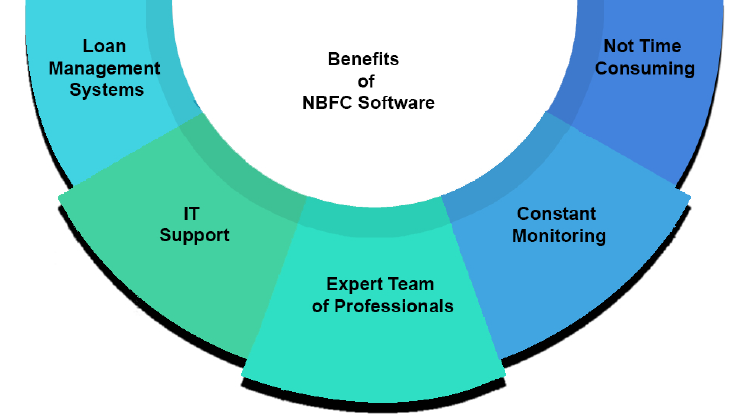

Benefits of NBFC Software

The following benefits can be secured through the NBFC software:

- Loan Management Systems

The software has enabled different capabilities related to artificial intelligence, data analytics and other predictive analysis software. Through this loan software we would be able to manage all the loan process for different companies. Apart from this, there is a separate case management system related to loans which are provided. The case management system is the part of the MIS through which loan management can be handled efficiently.

- IT Support

We have collaborated with different fintech's in order to constantly improve our NBFC software. Due to this there is constant IT support.

- Expert Team of Professionals

Our team of professionals comprise of lawyers, company secretaries and other business professionals to guide you in matters related to compliance.

- Constant Monitoring

Constant monitoring can be achieved through the systematic MIS software.

- Not Time Consuming

When information is inputted in the NBFC software every process is carried out instantly. Due to this lot of time can be saved.

Custom NBFC Software

Loan is the most demanding product for a bank and through loan scheme management system you can easily calculate ROI and create/ update schemes as per business need. The NBFC software would come with the following:

Loan Management

- 100% online Application for checking eligibility.

- EMI Calculation.

- Credit analysis.

- Document management system (Customer Master data, document, file I,e).

- CIBIL API Integration.

- Business Policies Management.

- Approval System.

- End to end disbursement management.

- Automated EMI collection (ESC, Recovery & Follow-ups).

- Due Date Alert (automatic SMS / CALL).

- Customer Dashboard to check loan status, EMI Schedule, repayment of loans.

- Defaulter List.

- PDC Detail.

- Enrollment Fee Report.

- Application Fee Report.

- Late Fee Report.

- Commission Pay Report.

- Spot Booking Expenditure.

Loan Servicing Software Activities

- Employee Management.

- Multiple Branch Management.

- EMI Collection Management.

- Adjustable Rate Mortgages.

- Escrow and Impound / Tax and Insurance Accounting.

- Investor Participation.

- Tracking, Reporting and Servicing.

- Automatic Task and Report Scheduling.

- Commercial Loan Servicing.

- Automobile Loan Servicing and Dealer Reserves and more.

Business intelligence tools

- View Agent.

- View Customer.

- Branch Collection Report.

- Branch Business Report.

- Enrollment Fee Report.

- Application Fee Report.

- Late Fee Report.

- Commission Pay Report.

- Salary Report.

- Recovery Report.

- All in one business dashboard.

Documents required for NBFC Software

The following documents have to be provided for NBFC software:

- KYC documents

- Self Identification documentation- Aadhaar Document

- In case of a company Certificate of Incorporation

- Memorandum of Association and Articles of Association

TAP GLOBAL Advantage- NBFC Software

- TAP GLOBAL main aims is to add value to you business.

- Our team of professionals comprising of Chartered Accountants, Company Secretaries, Lawyers, and Financial Executives.

- Our Forte is related to NBFC matters and registration.

- Constant monitoring and 24*7 customer service.

How to reach TAP GLOBAL for NBFC Software

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables