Overview of Nidhi Company Registration

The government of India has established this form of business structure with the primary intention of providing funds. Individuals use this entity to lend funds to the public. Nidhi companies are predominantly popular in Southern states in India.

Any form of establishment that carries out the activities related to a Nidhi company would require complying with requirements of registration process. The process of registering a Nidhi company is iterated under section 406 of the Companies Act 2013.

There are many advantages of incorporating this form of entity when it comes to development of savings and different forms of mutual benefits. Apart from this, the members of the company can understand their needs and requirements related to finance.

Statutory Meaning of Nidhi Company

The provisions of Nidhi Entity are present under Chapter 26 of the Companies Act, 2013. Under section 406 of the Companies Act, 2013 the definition of Nidhi company is present. This form of entity is also known as a Mutual Benefit Society. Under section 406(1) an entity can be classified as a mutual benefit society if there is a specific notification regarding the same.

Any type of entity which considered as a Nidhi entity has to be incorporated as per the provisions relating to the NBFC. For compliance requirements any individual forming this type of entity would require to follow the provisions of the Companies Act, 2013.

Any applicant forming this entity will benefit from different form of mutual benefits and loans given. The main intention of forming this entity is that loans and mutual benefits are provided to the members, i.e. the shareholders of the company.

When incorporating an NBFC, then the activities carried out by a traditional NBFC are regulated by the Reserve Bank of India (RBI). This form of entity accepts deposits. However, there are specific provisions present under the RBI Act, 1934 which would not apply to this form of business. Due to this, many individual prefer starting this form of entity.

Benefits of Nidhi Company Registration

Under section 406 of the Companies Act, 2013 this form of entity is formed as a mutual benefit society. Hence, the benefits are mainly for the members of shareholders of the entity. Apart from this, loans can be easily provided to the public through this form of entity.

An applicant wanting to start a Nidhi company can select a group of members to carry out this process. Once this entity is formed, there is no involvement of external management.

-

Less Capital Requirements

To form this entity there is limited capital requirement. The primary reason for this form of registration is limited capital requirement.

The primary purpose of this form of entity is to raise funds from the public. Apart from this, the Nidhi entity is formed as an NBFC. This type of NBFC carries out activities such as accepting deposits from the public. Hence, it is simple to raise funds through this form of entity.

-

Less Compliance to Adhere

Even though the formation of this entity is based on compliances under the Companies Act, 2013 there is still less compliance when compared to other forms of entities. Even under the RBI Act, 1934 this company is exempted from carrying out different forms of compliances.

-

Benefits of Status under the Companies Act, 2013

This form of entity would have the benefits under the companies act, 2013. Just as a normal entity, this form of entity would secure the status of limited liability. Apart from this, the status of this form of entity is independent from the members and directors.

These form of entities have to comply as per the requirements of the NBFC. Hence compliance must be maintained by the Nidhi entity as per the guidelines of the RBI. However, these entities are exempted from specific provisions of the RBI Act, 1934.

-

Options for Savings and Mutual Benefits

A Nidhi entity is solely formed to increase the savings of the members. Moreover, under section 406 of the Companies Act, 2013 these companies are also known as mutual benefits companies.

-

Better option when compared to credit society

Credit societies are regulated by the provisions of the Societies Registration Act. There are more compliance requirements when forming a credit society. Hence, individuals opt for a Nidhi company as there is less compliance to adhere to.

When compared to a traditional NBFC or any other company that is engaged in finance activities; the amount of risk borne by a Nidhi entity is less. Under the provisions of the Companies Act, 2013 the members of these entities are protected by the status of limited liability.

Eligibility Criteria for Nidhi Company Registration

The following eligibility criteria must be sufficed for Nidhi Company Registration:

-

Minimum Number of Shareholders

For a company there are minimum number of shareholders. As the Nidhi entity is formed as a public company, the minimum number of shareholders must be seven.

-

Minimum Number of Directors

Minimum number of directors for a Nidhi company must be three. If this requirement is not satisfied then the company cannot be established.

When forming this entity, the minimum capital of 5 lakhs is required.

When directors are recruited for this entity, then respective DINs must be provided. DIN stands for Director Identification Number.

-

No Issuance of Preference Shares

Preference shares are specific type of shares which are issued to existing members. This company is formed with the main objective of producing savings for members. However, under this form of structure, no preference shares can be issued to members.

This form of entity has the main objective to save finance for existing members. Hence the primary objects of the business must be followed. Savings can be achieved through receiving deposits for the business.

Any equity share which is issued should not exceed Rs. 10/-. Hence the nominal value of the equity shares issued must be lesser than the above value.

-

Minimum Amount of Equity Shares

When equity shares are issued then the corresponding value of the shares must match to Rs. 100. These must be issued to each deposit holder.

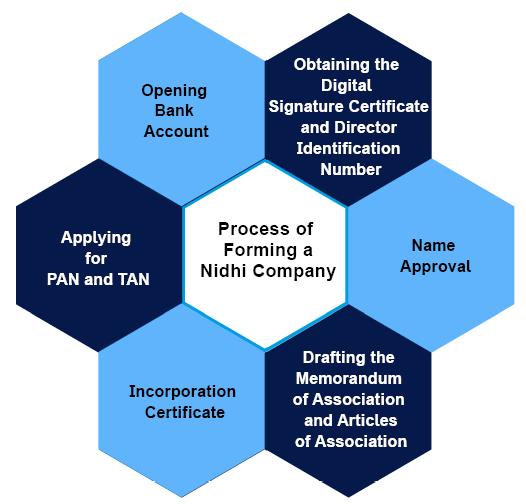

Process of Forming a Nidhi Company

The following process has to be adhered for forming a Nidhi Company:

-

Obtaining the Digital Signature Certificate and Director Identification Number

First and foremost, the applicant must apply for a digital signature certificate (DSC). Through the DSC, signatures can be provided in the digital format. After securing the DSC, the applicant has to apply for the Director Identification Number.

In the next step, the applicant has to make an application for name approval to the MCA. During this process, the applicant has to provide three unique names for the Nidhi entity. The names provided must be unique and should not be against any provisions relating to intellectual property rights in India.

-

Drafting the Memorandum of Association and Articles of Association

After the above step, the applicant must file prescribed documents to the registrar of companies. These documents must be filed through Form-INC 32. Along with this the MOA and AOA must be submitted. When submitting documents, the applicant has to intimate the main objects of forming this entity.

-

Incorporation Certificate

After reviewing the above documents, the Company will secure the certificate of incorporation. This certificate of incorporation is a testament about the company incorporation process. This will be usually be issued by the registrar within 16 to 20 business days.

After securing the certificate of incorporation, the Nidhi Company should apply for PAN and TAN. The TAN can be secured from the respective Income Tax Department.

This is the final step in incorporating the business. It is crucial to open a bank account on behalf of the business for any transactions.

Compliances for a Nidhi Company

After incorporating this form of entity, there are different compliances which have to be adhered. The following compliances have to be adhered by the applicant:

- Form NDH-2 - Requesting Extension to meet the target of 200 members.

- Form NDH-1- The list of members have to be submitted within 90 days of incorporation. All requirements have to be complied with.

- Form NDH-3 - Half Yearly requirements have to also been filed along with Form NDH-1.

- Annual Returns- Annual Returns have to be submitted as per the requirements of the Registrar of Companies.

- Profit and Loss Statement and Balance Sheet Requirements- These documents have to be submitted as per the requirements of the company on an annual basis. This must be done through Form AOC-4.

- Income Tax Returns- Every Nidhi Company is required to file income tax returns as per the requirements of the Income Tax Act.

- Net Owned Fund- A Nidhi Company must have a Net Owned Fund which is more than Rs 10 lakhs. The ratio of return on the Net Owned Fund must be in the ratio of 1: 20 basis.

- Unencumbered Deposits- Any form of unencumbered deposits must exceed the requirement of outstanding deposits.

Documents required for Nidhi Company Registration

The following documents are required for Nidhi entity registration process:

- Directors Identification Number

- PAN number of the Shareholders and Directors

- Residential proof of the shareholders and directors

- Digital Signature Certificate of the Members and Directors

- Photographs

- Identification Documents such as Aadhaar Card

- Rent Deposit or Lease Agreement for the Registered Office

- If the Office is owned then ownership information or registered office address must be provided

- No-Objection Certificate - if Required

- MOA

- AOA

- MCA Form.

TAP GLOBAL Advantage

- Our team of professionals comprising of Chartered Accountants, Company Secretaries, Lawyers, and Financial Executives.

- We have experience in registering different forms of entities.

- Constant monitoring and 24*7 customer service.

How to reach TAP GLOBAL for Nidhi Company Registration?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables