One Person Company Registration (OPC Registration) - An Overview

The Company Law Committee before enacting the Companies Act, 2013 considered several requirements of entrepreneurs and sole proprietors. The rights of sole proprietors are not protected like members of a private limited company or a Limited liability partnership.

Because of this, the Companies Act, 2013, brought out a new structure called one person company (OPC). This business entity has unique features which are enjoyed by a private limited company. At the same time, only one individual is required to run a one person company. There is no need for future expansion of a one person company. Hence this form of business structure is typically used by entrepreneurs who want to continue the business as a sole beneficiary.

Statutory Meaning of One Person Company

Before the enactment of the Companies Act, 2013, there was no meaning of One Person Company registration under the Companies Act, 1956. Therefore the Companies Act, 2013 brought out sweeping changes to the requirement of individuals wanting to go for One Person company registration. OPC is an abbreviation for One Person Company.

In a one-person company only a single individual is required to be appointed as a director. The same director will be appointed as a member or shareholder of this one person company.

Under the companies act, 2013, the OPC has the benefits of a sole proprietor business. However the status of separate legal entity and limited liability are enjoyed in an OPC. The liabilities and duties of a shareholder in an OPC can be limited to a specific extent.

The Companies Act, 2013 provides a statutory meaning to One Person Company. Under Section 2(62) of the Companies Act, 2013 - an OPC can be understood as a company or entity where the director and member is the same person. Hence a sole individual will be managing the affairs of the company. Usually in a private limited company, the directors act as agents of the company and manage the affairs of the company. The shareholders in a private limited company overlook the affairs of the company. However in an OPC, the shareholder and the director is a single individual. All affairs have to be overlooked by the single person.

Regulatory Authority for One Person Company Registration

The primary regulatory authority for one person company registration is the Ministry of Corporate Affairs (MCA). Apart from this the Registrar of Companies (ROC) handles all matters and issues dealing with one person company registration. The law dealing with one person company registration is the Companies Act 2013.

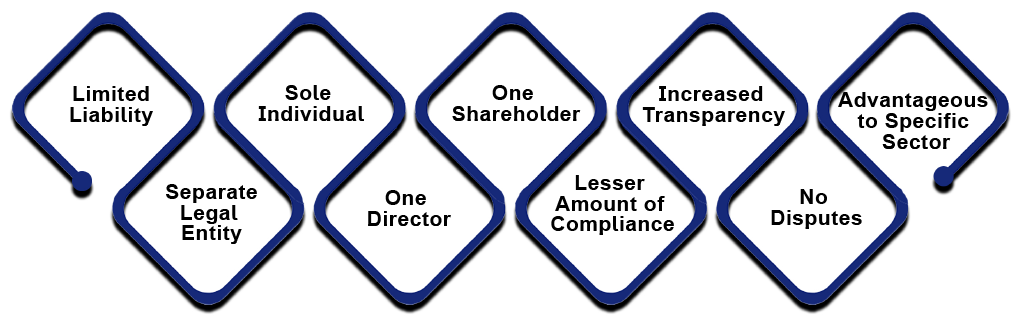

Advantages of One Person Company

One of the primary advantages of One person company registration is the principle of limited liability. Limited liability can be understood as the liability of shareholders and directors is limited to a particular extent. So if there are some disputes related to debt owed by the company, creditors cannot claim any personal assets of the shareholders and directors. However, in an OPC there is only one shareholder and director. The sole shareholder and director enjoy so limited liability.

Another advantage of using this form of entity is the concept of separate legal entity. The principle of separate legal entity would mean the independence that the shareholder and director have in the organisation. A one person company also enjoys the concept of the separate legal entity.

One feature which is enjoyed by an OPC is the concept of a single director and shareholder (member). An individual takes two hats under this form of entity. There are no additional responsibilities or added burden related to recruiting other directors to comply with the Companies Act, 2013.

As per the definition of OPC under the Companies Act, 2013 there is only one director who manages the business of a one person company. There is no requirement of any form of independent director or executive director as required for public companies.

A single member is required for a one person company. Hence the shareholder will carry out responsibilities such as overlooking the affairs of the OPC. Apart from this, the member will also act as a director. Managing the OPC is one of the responsibilities of the director and shareholder of the OPC.

-

Lesser Amount of Compliance

When compared to a private limited company or a public limited company, the amount of compliances required for a one person company is limited. It takes less time to carry out such compliances. Lesser amount of compliance means less paperwork and processes involved in the one person company registration.

Filing compliances are straightforward for a one person company when compared to other forms of business entities. Plus another added advantage of forming this entity is an increased amount of transparency when dealing with different forms of government authorities. Transparency can be achieved in both sides i.e. the applicant side and the government side.

When it comes to partnerships and private limited companies, then there are separate agreements such as the LLP agreement and the shareholders agreement. Under the one person company incorporation process, there is no requirement for any agreement as only one individual is carrying out all the operations of the business entity.

-

Advantageous to Specific Sectors such as MSME and SME

OPC registration is also advantageous to sectors such as MSME and SME. Many businesses in rural areas are the thriving cause of MSME and SMEs. By using the OPC registration process, services can be provided easily to rural areas. Apart from this, a one-person company utilizes a lot of financing from public sector undertakings and different institutions. Hence, the principle of limited liability would save the director and shareholder from any debts payable by the OPC. One person company incorporation is beneficial to increase the overall reputation of MSME and SMEs.

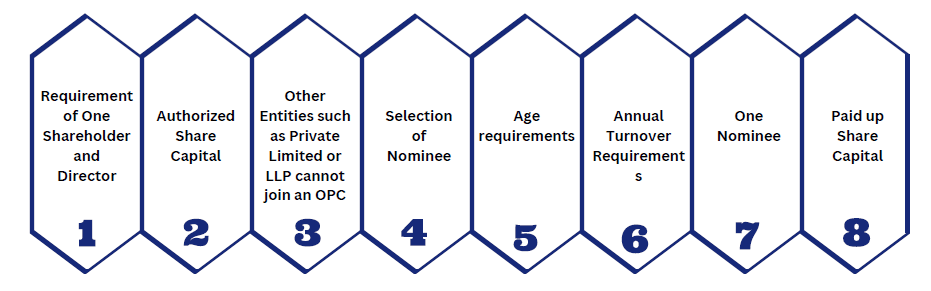

Eligibility Criteria for One Person Company Registration Process

-

Requirement of One Shareholder and Director

For a one person company incorporation process, there has to be minimum one person who acts as a shareholder and director for the OPC. Hence both the responsibilities of a shareholder and director are taken by an individual in this form of entity. An application for one person company registration will not be allowed if there are more than two people.

The minimum authorized share capital for One Person Company incorporation is Rs. 1 lakh. Hence the applicant has to ensure that the authorised share capital of the one person company is 1 lakh.

-

Other Entities such as Private Limited or LLP cannot join an OPC

Other business entities such as the private limited company or a limited liability partnership cannot become a part of the OPC.

At the time of the one person company incorporation, the director and shareholder should nominate another person.

When incorporating a one person company, it is important to consider the age of the applicant. An applicant who is lesser than 18 years or considered a minor cannot establish an OPC. Hence a minor cannot be a member of an OPC.

-

Annual Turnover Requirements

If the OPC passes a specific limit, then the same has to be converted into a private limited company. The limit for turnover is Rs.20 crores. Hence if the OPC surpasses such a limit then it has to be converted into a private limited company.

Apart from having an individual who takes two hats of a director and member, there is a requirement for an OPC to have another individual as a nominee of the OPC.

The OPC must ensure that the share capital does not go more than Rs. 2 crores. If this happens then the OPC must be immediately converted to a private limited company. This would also be the case if the annual turnover is more than Rs. 20 crores.

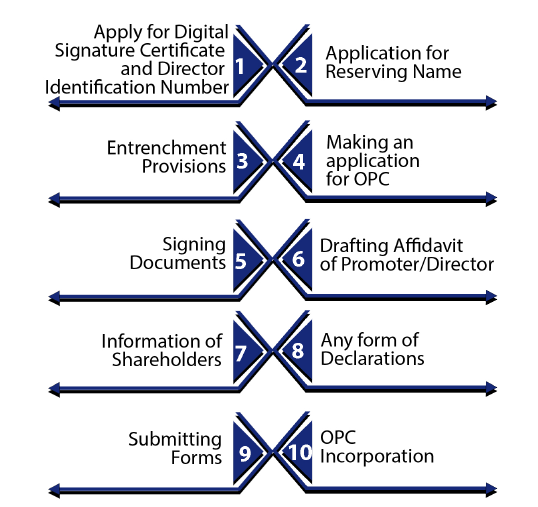

What is the OPC registration process?

The following steps are required to adhere for the OPC registration process:

-

Apply for Digital Signature Certificate and Director Identification Number

The applicant has to make an application for securing the digital signature certificate and the director identification number. This is a crucial step in the one person company incorporation process.

-

Application for Reserving Name

In the next step the applicant has to apply for the name reservation process. This can be done through the MCA portal. The applicant has to file Form INC-1 for finding a suitable name of the one person company. When forming an OPC, the words OPC private limited have to be in the end of the name of the company. The application for reserving the name of the OPC can be either made through the SPICe 32 form or the MCA portal. In the MCA web portal the RUN (Reserve Unique Name) Service must be utilised for the applicant to file a suitable name in the one person company registration process.

If there are any form of provisions relating to entrenchment, then the same must be filed through Form INC-2. Usually this process is carried out during one person company incorporation. However, if this has to be avoided, then the same can be carried out by amending the articles of association of the one person company. This will be the case for existing companies. Subsequently Form MGT-14 has to be submitted within a prescribed period.

-

Making an application for OPC

The application for OPC incorporation has to be made by the promoter in the specific jurisdiction where the OPC is situated. Form INC -2 is used in the process of making an application for OPC incorporation.

In the next step, the applicant must endorse important documents such as the memorandum of association and articles of association. This is a crucial step which has to be carried out in presence of one witness. The applicant has to provide personal details while carrying out this step. Details will include the name, age, description and address proof of the applicant.

-

Drafting Affidavit of Promoter/Director

An affidavit has to be made in the name of the promoter/ director. This affidavit has to be submitted through Form INC-9. This is a crucial step which is required in the one person company registration process.

-

Information of Shareholders

Any information regarding the sole shareholder must be submitted to the registrar of companies during the one person company registration process.

When incorporating an OPC, a formal declaration has to be made either by a Chartered Accountant or a Company Secretary or an Advocate. This declaration has to be made through Form INC-8.

All respective forms and documents have to be submitted. The documents have to be appended to SPICe Form, SPICe-MOA and SPICe-AOA. These have to file with the DSC and the DIN. All such information must be uploaded on the official website of the Ministry of Corporate Affairs. After this process is carried out Forms 49A and 49B will be generated through which PAN and TAN documentation will be generated.

On verifying all the information, the Registrar of Companies will issue the certificate of incorporation for the OPC.

Compliances carried out after OPC registration process

The following compliances have to be carried out after the OPC registration process:

- Conducting Annual Board Meetings- This requirement has to be complied in accordance with the requirements of the Companies Act, 2013.

- Filing of Income Tax Returns.

- Filing of Tax Deducted at Source.

- Filing Annual Financial Statements through Form AOC- 4.

- Filing Annual Returns through MGT-7.

- Complying with the requirement of statutory audit by appointing a practicing Chartered Accountant.

- Filing Tax at the rate of 25%.

- Dividend Distribution Tax if profits are provided to shareholders of the OPC.

- Tax Deducted at Source for the OPC- TDS returns have to be filed quarterly by the OPC.

- ESI Registration would be mandatory for an OPC if it employs more than 10 employees.

Documents and Forms required for the One Person Company Registration Process

- Declarations from the respective individuals

- Digital Signature Certificates

- MOA and AOA

- Declaration from Promoters relating to Non-Deposit rules under the Foreign Exchange Management Act

- Consent from the member and director DIR-2

- Registered Premises of the Business- In case the premises are leased, then No Objection Certificate should be taken from the landlord.

- Pan and Address Details of the Owner

- Utility Bills of the Premises

- Aadhaar Card of the Owner

- Passport Size Photographs of the Owner

- Property Proof

How to reach TAP GLOBAL for One Person Company Registration?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables