Overview of Partnership Firm Registration

Partnership structures have been utilized by a different form of organizations in the world. Even before the 1900s, this structure has proved its usefulness. With the evolution of companies, this form of business structure came out prominently with a view of creating an agreement or relationship between two or more people.

The prominent features of a partnership allow two or more individuals to share profits at the same time manage the business. The business structure related to partnership can either be done independently by one partner or by all partners acting for the common purpose of the business.

A traditional partnership is formed based on a legal agreement under the partnership act, 1932. All compliances have to adhere when forming this form of business structure. Usually, start-ups and budding businesses go for this form of business entity. Hence it is essential to consider all the factors for partnership firm registration.

Prominent organisations around the world use the essence of the partnership. For example, Hewlett Packard formed as a partnership initiative, and this is one of the prominent organisations in the world. Hence going for partnership firm registration would be beneficial for individual partners.

Statutory Meaning of Partnership Firm Registration

Before going to the process of partnership firm registration, it is important to first understand the meaning of a partnership. In layman terms, a partnership can be understood as a relationship between two or more people with a common intention to carry out some business.

Under section 4 of the Indian Partnership Act, 1932 a partnership can be understood as a relation between two or more persons to share profits of the business, either by one of the partners acting on behalf of all the individuals or for all the partners carrying out their respective duties.

Individuals who have entered into this relation or agreement are known as partners, and the business entity is known as the partnership entity of the partnership firm. The partnership firm registration occurs only legally; it cannot be formed through some form of mutual understanding between the parties of the partnership.

All the partners have to carry out their respective functions for the betterment of the business entity. They may be or may not be an agent and principal relationship as a result of the partnership.

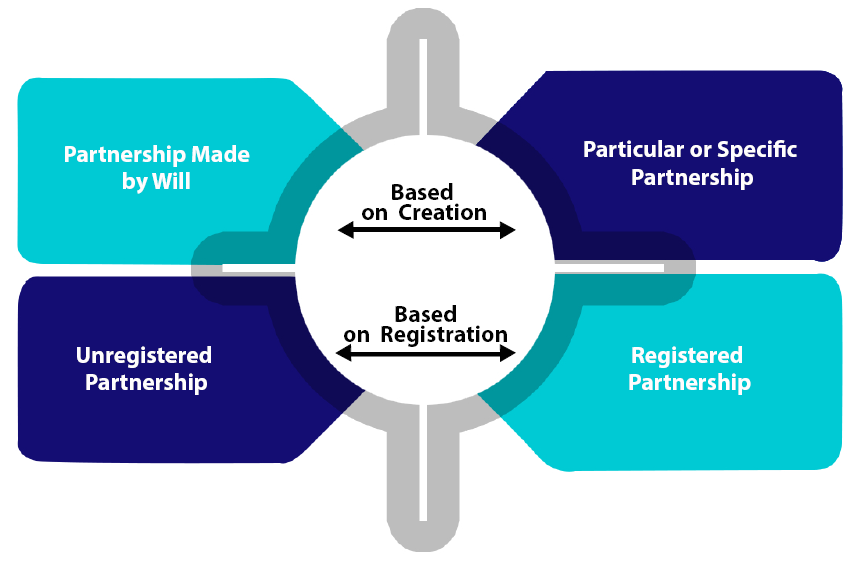

Types of Partnership Firm

Based on Creation

A partnership can be formed by the creation or for a specific purpose. Partnerships based on creation are further subdivided into:

Here, there is no formal agreement or contract between the partners related to the partnership. The mutual consent of the parties just forms this partnership. There is no specific period for the partnership. Section 7 of the Indian Partnership Act deals with partnership made by a will.

- Particular or Specific Partnership

Here, there may be a specific agreement or contract between the partners. However, this partnership is only for a specific purpose or a project. A typical example would be a joint venture (JV) agreement between two or more parties. The parties enter into a JV to earn out specific profits. Hence under the partnership firm registration process, some form of partnerships can be established through creation.

Based on Registration

Different types of partnerships can be formed through the registration process. Partnership Firm Registration process allows the applicant to form the following types of partnership based on registration:

Unregistered partnership is understood as a partnership which does not have any legal documentation pertaining to the process of partnership firm registration. Though there is mutual consent between the partners to act for the partnership, still having an agreement would reduce the issues for an unregistered partnership.

This form of partnership firm registration is carried out under the provisions of the Indian Partnership Act, 1932. Usually, individuals planning to form a partnership firm would utilise this form of partnership.

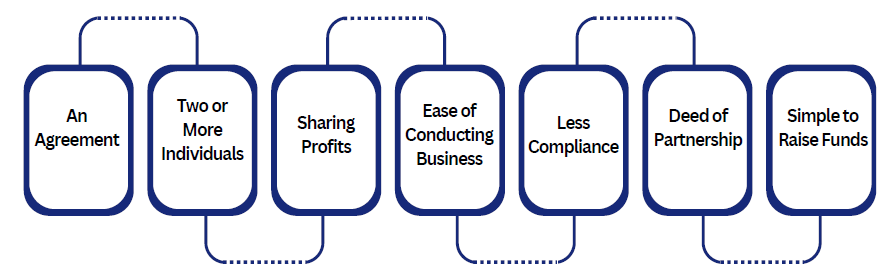

Advantages of Partnership Firm

There are different advantages of a partnership firm. The following considerations must be taken before starting a partnership business:

A partnership is a formal or informal agreement between two or more individuals. Hence, the respective liabilities and duties of this form of a partnership are determined by the terms and conditions of the agreement.

Two are more individuals are required for forming a traditional partnership. If there is only one individual, then a partnership cannot be formed. The main advantage of this is that a sole individual does not have to contribute towards the partnership. More than two or more individuals are liable to contribute to the partnership. Hence for a partnership firm registration process, a partner can utilise the above benefit to reduce their respective burdens.

Profits will include any profits received from the business. Profits would also include equity profits which are earned by the business over some time. Part of profits is always shared between the partners of the business. This would also be mentioned under the partnership agreement.

-

Ease of Conducting Business

One of the main reasons for partnership firm registration is due to ease of conducting business. This is due to the business structure, which is formed under the partnership. The rights and liabilities of all the partners in a partnership business are set out under the partnership deed.

When compared to other forms of business structures, there is less compliance for a partnership business. However, a partnership is required to file respective tax returns and submit compliances required by the MCA and Registrar.

The partnership deed is something similar to a shareholders' agreement. This deed sets out all the rights and liabilities of the parties in a partnership. The deed would maintain details of the contribution provided by each partner. Apart from this, it will also record the amount of profit-sharing ratio maintained by the partners of the partnership firm. Any dispute arising out the partnership can be sorted out by using the partnership deed. This is one of the main advantages of partnership firm registration.

Under the partnership, it is simple to secure funds from large banks and NBFC.

Hence the above factors make it beneficial for an individual to go for the partnership firm registration process.

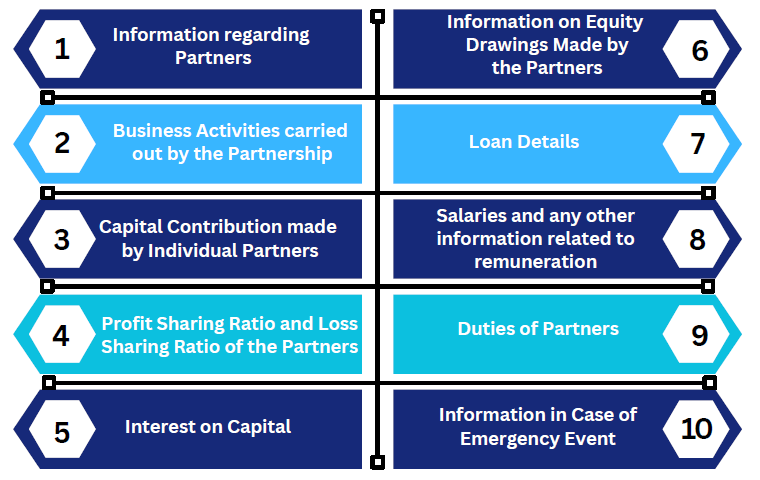

Essentials of a Partnership Deed

When an individual goes for the partnership firm registration, it is mandatory and compulsory to draft the partnership deed. First and foremost, the partnership deed sets out the rights and liabilities of the partners. Apart from this, the partnership deed would also be beneficial for the partnership when dealing with particular form of disputes.

The following are the essentials of a Partnership Deed:

-

Information regarding Partners

Under the Partnership Firm registration process, any information related to the partners must be included in this section of the partnership deed. Personal and sensitive information would be included in this section. Information such as the name, address and position of the partners would be included here.

-

Business Activities carried out by the Partnership

Here the activities carried out by the partnership should be mentioned. For example if the partnership is carrying out legal activities, then the same has to be mentioned in the partnership deed.

-

Capital Contribution made by Individual Partners

Here the contribution made by individual partners would be mentioned under the deed. Under the partnership firm registration process, an agreement is present between the partners. An agreement here would include the amount of share capital contributed for the formation of the partnership. Individual capital contribution ratio must be specified.

-

Profit Sharing Ratio and Loss Sharing Ratio of the Partners

The deed must also contain the respective profit sharing and loss sharing ratios of the partners. This format must be in the form of ratios.

Interest which is accrued on capital would be mentioned under this portion of the partnership deed.

-

Information on Equity Drawings Made by the Partners

Any information about drawings made by the partners of the partnership firm would be mentioned under this head. Drawings would include the amount of profits drawn by the partner would be mentioned here. Any form of equity drawings would also be mentioned under this head.

Contributions can come from the personal capital of the partner or any loan taken out for the partnership. If the partner has taken out a loan for the partnership then, information on the loan should be mentioned under this head.

-

Salaries and any other information related to remuneration

Under this section, any information relating to salaries and bonus must be mentioned. It is mandatory to mention such information.

Every partner is jointly and severally liable for the partnership. The joint liabilities and duties of a partnership are mentioned under the provisions of the Indian Partnership Act, 1932.

-

Information in Case of Emergency Event

If there is some form of exigency or emergency such as the death of the partner, then the next steps for post death of the partner would be mentioned in the partnership deed.

Hence it is mandatory to draft the partnership deed. After partnership firm registration is complete, it is suitable to immediately draft a deed.

Process of Partnership Firm Registration

.png)

When registering the name of the partnership business there are few points to be considered. First and foremost, the name of the partnership business must not go against moral values of the business. Apart from this, the name should not go against any provisions relating to Trademarks and Copyrights law in India. The name should not have the following words- emperor, empresses or crown. These words would require some form of approval and consent from the respective government.

-

Application for Partnership Firm Registration

In the second step, the applicants (partners) are required to make an application in Form 1. After the application is made, the same must be submitted to the respective authority. The authority will be the registrar where the firm is incorporated. So for example if the partnership is incorporated in Bangalore, then the application must be filed in Karnataka.

-

Drafting the Partnership Deed

After the above step is carried out, the partners are required to draft the partnership deed. As mentioned earlier the deed of partnership will state the mutual rights and liabilities of the partnership. Hence, it is mandatory that this is drafted as soon as possible. It is better if the deed is written, as this would strike off any future conflicts in the partnership.

Along with the partnership deed, all documents must be submitted.

After receiving the application and documents, the registrar will verify the application. If there are no issues or any objections, then the certificate of incorporation of the partnership will be granted.

-

Opening a Bank Account for the Partnership

A partner is required to open a bank account on behalf of the partnership. Through this account, the partnership can carry out transactions for the business.

Post Compliances required for the Partnership

The following post compliances are required for the partnership after the process of registration of a partnership firm is complete:

- Securing the PAN and TAN number from the Income Tax Department.

- Registering for Goods and Services Tax (GST)- If the annual turnover is more than Rs 40 Lakhs.

- Partnership firms are allowed to file Tax Deducted at Source (TDS).

- Registering for Income Tax- Such Returns are required to be filed by the Partnership.

- Tax Rate Charged for a partnership firm is 30% - Therefore any partnership firm that has an annual turnover of more than 10 Lakhs would have to make filings.

- Any partnership which has an annual turnover of 1 Crore has to get annual audit compliance.

- Employees State Insurance Corporation Registration is required for all partnership firms.

Documents for Partnership Firm Registration

- Form 1- Application for the Partnership Firm

- Affidavit for Partnership

- Copy of the Partnership Deed

- Land documents in case the property is owned

- Identity Proof of Partners- PAN Card, Aadhaar Card, Voter ID and Passport

- Utility Bill- Electricity and Water Bills.

How to reach TAP GLOBAL for Partnership Firm Registration?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables