Risk and Assurance Services

Globalization has opened new gateways in the business sector both positive as well as negative as a range of risk factors for business. Teams in the Company's Board works on planning business development and also provide the information with regard to market demand, supply options and competitions, and the attached risks. Risk and Assurance service is commonly used in financial and accounting practices. The analysis, review, and management of risk creating factors and scenarios are generally termed as risk assurance. There are some corporate firms who provide Risk and Assurance Service to companies to have proper knowledge about the possibility of negative factors that can affect the growth of the company negatively. Some of the services included are:

- Analyzing all the new scenarios which can be a risk factor for companies.

- Internal Audits

- Risk Advisory Projects

- Identifying opportunities with regard to improvement

- Compliance reviews

- Provide a clear insight of all the identified risks

- Providing positive solutions or advice on the identified risk for the concerned company.

The Risk and Assurance Service provider can be employed by the company or can be a third party hired by the Company to perform the services. The primary work of the Risk and Assurance Service provider is to analyze and identify the weak points and also provide suggestions regarding the same and if needed must offer solutions too.

What is Risk Assurance?

Risk assurance is generally associated with the accounting practices. Risk assurance is similar to the assurance practices. The assurance department in a company is broader and based on accounting, while the risk assurance department is a subset and also much smaller. Auditors working in the risk assurance department have their focus set up on auditing, information technology and general controls. Risk Assurance services have become a part of the auditor's work.

Hence it can be said that risk assurance is the process that includes assessment, identification, management, and control of potential events or situations to achieve the goals of an organization in a systematic way.

Which Parties are Involved in the Risk and Assurance Services?

There are usually three parties involves in the Risk and Assurance services. They are:

- Any individual or group that is directly involved with the organization, operation, function, process or other subject matter, and also oversight functions such as compliance, finance, and risk management.

- Any person or group making the assessment-the assurance provider.

- The beneficiary of the assessment, such as the executive management and the board.

Who can Provide Risk and Assurance Service in an Organization?

Risk and assurance service providers in an organization may include the following:

- Line employees and management (the management provides assurance as a first line of defence over the risks and controls for which they will be held responsible).

- Internal and External Auditors.

- Senior Management.

- Quality Assurance.

- Environmental Auditors.

- Risk Management.

- Workplace Health and Safety Auditors.

- Review teams with regard to Financial Reporting.

- Workplace Health and Safety Auditors.

- Government Performance Auditors.

- Subcommittees of the board such as audit, credit Governance, Actuarial.

- External Assurance Providers including the survey and specialist reviews in health and safety matters etc.

What is the Framework of Risk and Assurance Services?

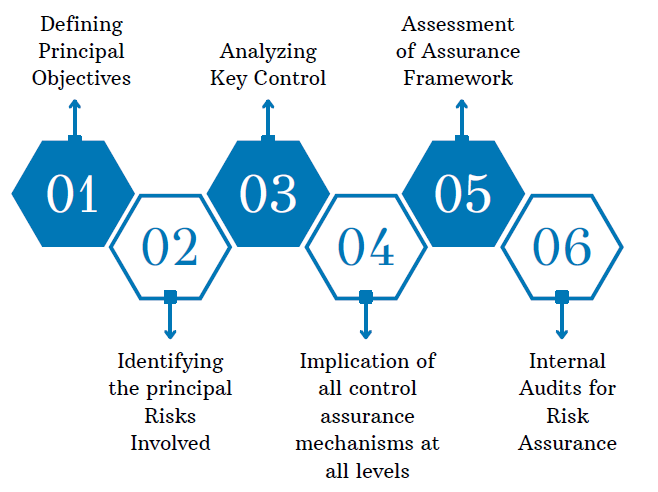

The risk and assurance service framework is like a structural plan of a company. It is a comprehended method that is specifically designed to combat the major risks attached to attaining the goal set by the company. It also provides a structure of smooth internal control. The Risk and Assurance service provider helps the Board in identifying and planning the course of action for the effective performance of the organization. The primary steps involved in the Risk and Assurance Framework are as follows:

Defining Principal Objectives

Before initiating any forms of risk and assurance services, the assessing authority must have a clear picture of the organization's financial, functional, and generic objectives. It provides clarity on all the possible risks that might be involved and also helps in the development of a better risk and assurance framework.

Identifying the principal Risks Involved

The board must be given a clear view with regard to threats in achieving the goals of the organization. This assessment must be done on a regular basis to avoid losses to risks by any well-planned management.

Analyzing Key Control

Managing principal risks in an entity needs key controls. These are used by an organization in a well designed and documented way to prevent any loss to any type of principal risk. They must be reviewed by some independent party for obtaining better results. The reviews can involve the internal audits.

Implication of all control assurance mechanisms at all levels

The integral part of a risk and assurance framework is the control assurance which involves:

- Standard Governance

- Risk Management and

- Financial Management

The boards can make a safer work action plan for the purpose of achieving the goals of the organization:

- By reviewing the Board Reports and analyzing the gaps involved in control and assurance.

- The team has to work with the board to make a risk-assessed action plan for better performance.

Assessment of Assurance Framework

The assurance framework and the strength of arrangements must be assessed and updated whenever required.

The assurance framework if used in a better way is the most effective management tool any company can get for the purpose of risk assurance as well as for the smooth functioning of the company.

Internal Audits for Risk Assurance

Internal audits are necessary to keep a clear view of the existing and emerging risk that an organization can face. It is important to perform internal audits periodically. The following listed are the reasons as to why internal audit is needed:

- Internal Audit assists in proper risk assurance.

- It performs as a line of control and defense in an organization.

- It also helps in analyzing and auditing the adequacy as well as the effectiveness of the risk management framework.

- It keeps a track of the implementation of the risk and assurance framework and also checks on the loopholes.

- It provides an independent viewpoint on the risk assurance information that is submitted by the board and also the risk assurance committee.

- It also provides an independent and non-biased review on the applicability and also suggests the required risk assurance services.

- For providing a better performance space in an organization the internal audits and the risk assurance team works together.

What are the Types of Risk and Assurance Services?

The Risk and Assurance services come in several forms and the basic purpose is to provide the firm pertinent information to ease the decision making. The Types of Risk and Assurance Service is discussed below:

In current times organizations are subjected to risks and more precipitous changes in the future. The investors and managers are more concerned regarding the company's risks and also if they are prepared to handle the risks. The risk assessment service assures that the organization's risks in the business are comprehensive and also evaluates that the entity has appropriate systems in place to effectively manage those risks.

-

Business Performance Measurement

Investors and managers require detailed information base than just a financial statement. They need a balanced scorecard. Business Performance measurement evaluates the organization's performance measurement system and also contains all the relevant and reliable measures to assess the entity's goals and objectives and also compares its performance with its competitors.

-

Information Systems Reliability

The employees in an organization as well as the managers are dependent on the information provided to them by the risk and assurance service provider. The data provided must be accurate and the focus must be on systems that rely on the design. This service assesses if an entity's internal information system provides reliable information for the purpose of operating and making financial decisions.

The growth in electronic commerce has suffered a setback because of a lack of confidence in the systems. This service assures whether the systems and tools used in electronic commerce provide appropriate data integrity, security, reliability, and privacy.

What is the Role of the Risk and Assurance service providers?

The major role of the risk and assurance service providers is to provide assurance that:

- The process-related to risk management is applied properly in the organization and that the sufficient and suitable process has been brought into action.

- The intention and strategic needs of the organization must be kept in mind while framing the risk management policy.

- The system is structured in such a way that all the identified material risks are treated in an early stage.

- There is a cost-effective treatment plans for all the prioritized intolerable risks.

- Controls are designed to check on the outputs of the risk management.

- There is a proper and timely execution of the risk treatment plans.

- Presence of adequate and effective control measures.

How can TAP GLOBAL Help You?

Fill The Form

Get a Callback

Submit Document

Track Progress

Get Deliverables